Views: 516

JP PINT 解体新書 1.b(明細行)

Nobuyuki SAMBUICHI

ISO/TC295 Audit data services/SG1 Semantic model Convener

Peppol BIS Standard Invoice JP PINT 画面の左下にある Download resources ボタンに気をとめられる方は少ないかもしれませんが、このボタンでダウンロードされる resources.zip ファイルには、パッケージやサービスのJP PINT対応開発に役立ついくつかのファイルが含まれています。

今回の『解体新書』シリーズでは、いくつかのファイルの内容を確認しながらUBL 2.1に基づくJP PINTのXMLインスタンス文書がどのように定義されているのか紹介します。

本シリーズは、システム開発者(プログラマー / システムエンジニア)を対象としており、読者がXMLスキーマを理解していることを前提として記述しています。また、XPathについても基本的な事項を理解されていると想定しています。

第1回目は、Japan PINT Invoice UBL Example.xmlです。この文書は、実例というよりは主要なビジネス用語を網羅して紹介する例として定義されています。

なお、当初の予想を超えて文章が長くなってしまいましたので、後半の明細行レベルについて、このページで記述します。文書レベルについては、JP PINT 解体新書 1.aをお読みください。

この他のファイルは、具体的な用途別に定義内容を紹介するものです。例えば、Allowance & Charge、Summarized invpice, Tax currency code, etc.といった内容です。

-

Japan PINT Invoice UBL Example.xml JP PINT 解体新書1.a 文書レベル JP PINT 解体新書1.b 明細行レベル

-

Japan PINT Invoice UBL Example1-minimum.xml JP PINT 解体新書2 適格請求書最小構成

-

Japan PINT Invoice UBL Example2-TaxAcctCur.xml

-

Japan PINT Invoice UBL Example3-SumInv1.xml

-

Japan PINT Invoice UBL Example4-SumInv2.xml

-

Japan PINT Invoice UBL Example5-AllowanceCharge.xml JP PINT 解体新書3 返金及び追加請求 (Allowance & Charge)

-

Japan PINT Invoice UBL Example6-CorrInv.xml

-

Japan PINT Invoice UBL Example7-Return.Quan.ItPr.xml

-

Japan PINT Invoice UBL Example9-SumInv1 and O.xml

-

全般

JP PINT 解体新書4 デジタル自動処理と金額の検算ルール

JP PINT V1.0 正誤表

CEF eInvoicingに基づいたJP PINT1.0ルール検証環境とテスト

Japan PINT Invoice UBL Example.xmlをHTML変換表示

『EN 16931-1 Annnex A 電子インボイスの例』 には、欧州規格で紹介されているデジタルインボイスの記載例について紹介していますので併せてご覧ください。

ご参考:

当事務所提供 JP PINT実証研究ページ

(翻訳したセマンティックモデルやUBL2.1からの構文バインディングも含んでいます)

1. 明細行の基本項目

明細行では、次のものが必須とされています。

-

ibg-25 INVOICE LINE 請求書明細行

-

ibt-126 Invoice line identifier 請求書明細行ID

-

ibt-129 Invoiced quantity 請求する数量

-

ibt-130 Invoiced quantity unit of measure code 請求する数量の数量単位コード

-

ibt-131 Invoice line net amount 値引後請求書明細行金額(税抜き)

-

ibg-31 ITEM INFORMATION 品目情報

-

ibg-30 LINE TAX INFORMATION 請求書明細行税情報

-

ibg-29 PRICE DETAILS 取引価格詳細

デジタルインボイスには必ず明細行があり、明細行には数量と金額が記載されていなければいけません。また、数量には必ず数量単位も含めなくてはいけません。数量単位コードとして特に意識したくない時は、’H87’や’EA’を指定してください。件数や個数に対応したコードです。

後述する 品目情報、請求書明細行税情報、取引価格詳細 も必須項目です。

<cac:InvoiceLine> <!-- IBG-25 INVOICE LINE --> <cbc:ID>1</cbc:ID> <!-- IBT-126 Invoice line identifier --> <cbc:Note>The equipment has 3 year warranty.</cbc:Note> <!-- IBT-127 Invoice line note --> <cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-129 Invoiced quantity, IBT-130 Invoiced quantity unit of measure code --> <cbc:LineExtensionAmount currencyID="JPY">250000</cbc:LineExtensionAmount> <!-- IBT-131 Invoice line net amount --> <cbc:AccountingCost>Cost id 654</cbc:AccountingCost> <!-- IBT-133 Invoice line Buyer accounting reference -->

Japan PINT Invoice UBL Example.xml

<cac:InvoiceLine> <!-- IBG-25 INVOICE LINE --> <cbc:ID>2</cbc:ID> <!-- IBT-126 Invoice line identifier --> <!-- cbc:Note, IBT-127 Invoice line note --> <cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-130 Invoiced quantity unit of measure code, IBT-129 Invoiced quantity --> <cbc:LineExtensionAmount currencyID="JPY">2500</cbc:LineExtensionAmount> <!-- IBT-131 Invoice line net amount --> <!-- cbc:AccountingCost, IBT-133 Invoice line Buyer accounting reference -->

Japan PINT Invoice UBL Example.xml

<cac:InvoiceLine> <!-- IBG-25 INVOICE LINE --> <cbc:ID>3</cbc:ID> <!-- IBT-126 Invoice line identifier --> <!-- cbc:Note, IBT-127 Invoice line note --> <cbc:InvoicedQuantity unitCode="H87">10</cbc:InvoicedQuantity> <!-- IBT-130 Invoiced quantity unit of measure code, IBT-129 Invoiced quantity --> <cbc:LineExtensionAmount currencyID="JPY">3490</cbc:LineExtensionAmount> <!-- IBT-131 Invoice line net amount --> <!-- cbc:AccountingCost, IBT-133 Invoice line Buyer accounting reference -->

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine |

1..n |

1..n |

ibg-25 |

• INVOICE LINE |

|

/ Invoice / cac:InvoiceLine / cbc:ID |

1..1 |

1..1 |

ibt-126 |

• • Invoice line identifier |

|

/ Invoice / cac:InvoiceLine / cbc:Note |

0..1 |

0..1 |

ibt-127 |

• • Invoice line note |

|

/ Invoice / cac:InvoiceLine / cbc:InvoicedQuantity |

1..1 |

1..1 |

ibt-129 |

• • Invoiced quantity |

|

/ Invoice / cac:InvoiceLine / cbc:InvoicedQuantity / @unitCode |

1..1 |

1..1 |

ibt-130 |

• • Invoiced quantity unit of measure code |

|

/ Invoice / cac:InvoiceLine / cbc:LineExtensionAmount |

1..1 |

1..1 |

ibt-131 |

• • Invoice line net amount |

|

/ Invoice / cac:InvoiceLine / cbc:AccountingCost |

0..1 |

0..1 |

ibt-133 |

• • Invoice line Buyer accounting reference |

|

/ Invoice / cac:InvoiceLine / cac:InvoicePeriod |

0..1 |

0..1 |

ibg-26 |

• • INVOICE LINE PERIOD |

|

/ Invoice / cac:InvoiceLine / cac:DocumentReference [ not(cbc:DocumentTypeCode = ‘130’) ] |

0..1 |

0..1 |

ibg-36 |

• • LINE DOCUMENT REFERENCE |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] |

0..n |

0..n |

ibg-27 |

• • INVOICE LINE ALLOWANCES |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] |

0..n |

0..n |

ibg-28 |

• • INVOICE LINE CHARGES |

|

/ Invoice / cac:InvoiceLine / cac:Item |

1..1 |

1..1 |

ibg-31 |

• • ITEM INFORMATION |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory |

1..n |

1..n |

ibg-30 |

• • LINE TAX INFORMATION |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:AdditionalItemProperty |

0..n |

0..n |

ibg-32 |

• • • ITEM ATTRIBUTES |

|

/ Invoice / cac:InvoiceLine / cac:Price |

1..1 |

1..1 |

ibg-29 |

• • PRICE DETAILS |

ところで、見慣れないビジネス用語 ibt-133 Invoice line Buyer accounting reference 請求書明細行買い手会計参照 とはどんな項目でしょうか。

A textual value that specifies where to book the relevant data into the Buyer’s financial accounts.

買い手の会計記録に関連データを記帳する場所を指定するテキスト値。

EN 16931-1 6.3 The semantic model Table 2 — Semantic data model of the core elements of an electronic invoiceでは、次の定義です。

BT-133 Invoice line Buyer accounting reference

Description

A textual value that specifies where to book the relevant data into the Buyer’s financial accounts.

買い手の会計記録に関連データを記帳する場所を指定するテキスト値。Usage Note

If required, this reference shall be provided by the Buyer to the Seller prior to the issuing of the Invoice.

必要であれば、この参照は買い手から売り手に請求書の発行前に提供されるものとします。Req. ID

R3 information at invoice line level that enables booking on the debit side (all processes);

借方側 (すべてのプロセス) での記帳を可能にする請求明細行レベルの情報。

UBL 2.1の定義では、The buyer’s accounting cost centre for this invoice line, expressed as a text. この明細行の原価部門の文字表現ですが、欧州規格の要求事項は、原価部門にとどまらず勘定科目や摘要なども含められそうです。会計業務のデジタル化で単純作業を軽減する上で欧州規格の要求事項 R3に関連するビジネス用語は、とても重要な項目です。

<xsd:element ref="cbc:AccountingCost" minOccurs="0" maxOccurs="1"> <xsd:annotation> <xsd:documentation> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Invoice Line. Accounting Cost. Text</ccts:DictionaryEntryName> <ccts:Definition>The buyer's accounting cost centre for this invoice line, expressed as text.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Invoice Line</ccts:ObjectClass> <ccts:PropertyTerm>Accounting Cost</ccts:PropertyTerm> <ccts:RepresentationTerm>Text</ccts:RepresentationTerm> <ccts:DataType>Text. Type</ccts:DataType> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element>

この他の会計に関連する欧州規格の要求事項については、こちらの記事 『JP PINT 解体新書 1.a EN 16931-1 5.3.2 会計』 をご確認ください。

2. 請求書明細行の期間

JP PINTでは、ibt-134 Invoice line period start date 請求書明細行の期間開始日 および ibt-135 Invoice line period end date 請求書明細行の期間終了日 のどちらも 0..1 と任意項目とされていますが、単独の日付を指定するときには、期間開始日と期間終了日に同一の日付を記載しますので、論理モデルでの繰返しは 1..1 です。

<cac:InvoicePeriod> <!-- IBG-26 INVOICE LINE PERIOD --> <cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 Invoice line period start date --> <cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 Invoice line period end date --> </cac:InvoicePeriod>

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:InvoicePeriod |

0..1 |

0..1 |

ibg-26 |

• • INVOICE LINE PERIOD |

|

/ Invoice / cac:InvoiceLine / cac:InvoicePeriod / cbc:StartDate |

0..1 |

0..1 ? 1..1 |

ibt-134 |

• • • Invoice line period start date |

|

/ Invoice / cac:InvoiceLine / cac:InvoicePeriod / cbc:EndDate |

0..1 |

0..1 ? 1..1 |

ibt-135 |

• • • Invoice line period end date |

3. 明細行からの文書参照

<cac:OrderLineReference> <cbc:LineID>1</cbc:LineID> <!-- IBT-132 Referenced purchase order line reference --> <cac:OrderReference> <cbc:ID>1</cbc:ID> <!-- IBT-183 Purchase order reference --> </cac:OrderReference> </cac:OrderLineReference> <cac:DespatchLineReference> <cbc:LineID>010</cbc:LineID> <cac:DocumentReference> <cbc:ID>789</cbc:ID> <!-- IBT-184 Despatch advice reference --> </cac:DocumentReference> </cac:DespatchLineReference> <cac:DocumentReference> <!-- IBG-36 LINE DOCUMENT REFERENCE --> <cbc:ID>D001-1</cbc:ID> <!-- IBT-188 Invoice line document identifier --> <!-- cbc:DocumentTypeCode, IBT-189 Document type code --> </cac:DocumentReference> <cac:DocumentReference> <cbc:ID schemeID="ABZ">AB-123</cbc:ID> <!-- IBT-128 Invoice line object identifier, IBT-128-1 Scheme identifier --> <cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-128, qualifier --> </cac:DocumentReference>

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ ubl:Invoice / cac:InvoiceLine / cac:OrderLineReference |

0..1 |

(ibt-132の親要素) |

||

|

/ ubl:Invoice / cac:InvoiceLine / cac:OrderLineReference / cbc:LineID |

1..1 |

0..1 |

ibt-132 |

• • Referenced purchase order line reference |

|

/ ubl:Invoice / cac:InvoiceLine / cac:OrderLineReference / cac:OrderReference |

0..1 |

(ibt-183の親要素) |

||

|

/ ubl:Invoice / cac:InvoiceLine / cac:OrderLineReference / cac:OrderReference / cbc:ID |

1..1 |

0..1 |

ibt-183 |

• • Purchase order reference |

|

/ ubl:Invoice / cac:InvoiceLine / cac:DespatchLineReference |

0..1 |

(固定値 ‘NA’他の親要素) |

||

|

/ ubl:Invoice / cac:InvoiceLine / cac:DespatchLineReference / cbc:LineID |

1..1 |

(固定値 ‘NA’ :注 1) |

||

|

/ ubl:Invoice / cac:InvoiceLine / cac:DespatchLineReference / cac:DocumentReference |

0..1 |

(ibt-184の親要素) |

||

|

/ ubl:Invoice / cac:InvoiceLine / cac:DespatchLineReference / cac:DocumentReference / cbc:ID |

1..1 |

0..1 |

ibt-184 |

• • Despatch advice reference |

|

/ Invoice / cac:InvoiceLine / cac:DocumentReference [ not(cbc:DocumentTypeCode = ‘130’) ] |

0..1 |

0..1 |

ibg-36 |

• • LINE DOCUMENT REFERENCE |

|

/ ubl:Invoice / cac:InvoiceLine / cac:DocumentReference [ not(cbc:DocumentTypeCode = ‘130’) ] / cbc:ID |

1..1 |

1..1 |

ibt-188 |

• • • Invoice line document identifier |

|

/ ubl:Invoice / cac:InvoiceLine / cac:DocumentReference [ not(cbc:DocumentTypeCode = ‘130’) ] / cbc:DocumentTypeCode |

0..1 |

0..1 |

ibt-189 |

• • • Document type code |

|

/ ubl:Invoice / cac:InvoiceLine / cac:DocumentReference [ cbc:DocumentTypeCode = ‘130’ ] |

0..1 |

(ibt-128の親要素) |

||

|

/ ubl:Invoice / cac:InvoiceLine / cac:DocumentReference [ cbc:DocumentTypeCode = ‘130’ ] / cbc:ID |

1..1 |

0..1 |

ibt-128 |

• • Invoice line object identifier |

|

/ ubl:Invoice / cac:InvoiceLine / cac:DocumentReference [ cbc:DocumentTypeCode = ‘130’ ] / cbc:ID / @schemeID |

0..1 |

0..1 |

ibt-128-1 |

• • • Invoice line object identifier Scheme identifier |

それぞれの文書参照は、次のように定義されています。

Referenced purchase order line reference

An identifier for a referenced line within a purchase order, issued by the Buyer.

買い手によって発行された、購買発注の参照された行の識別子。

Purchase order reference

An identifier for a referenced purchase order, issued by the Buyer.

買い手によって発行された、購買発注の識別子。

Despatch advice reference

An identifier for a referenced despatch advice.

買い手によって発行された、出荷案内書の識別子。

注:出荷案内書参照の XPath は、

/ ubl:Invoice / cac:InvoiceLine / cac:DespatchLineReference / cac:DocumentReference / cbc:ID

UBL 2.1での先祖要素の cac:DespatchLineReference のXMLスキーマ定義では、次のように cbc:LineID が必須要素とされているため、cbc:LineID の値に ’NA’を指定して含めている。cbc:LineID 要素を削除していると XMLスキーマ検証でエラーとなってしまうので注意してください。

<xsd:element name="DespatchLineReference" type="LineReferenceType"/>

<xsd:complexType name="LineReferenceType"> <xsd:sequence> <xsd:element ref="cbc:LineID" minOccurs="1" maxOccurs="1"/> <xsd:element ref="cbc:UUID" minOccurs="0" maxOccurs="1"/> <xsd:element ref="cbc:LineStatusCode" minOccurs="0" maxOccurs="1"/> <xsd:element ref="cac:DocumentReference" minOccurs="0" maxOccurs="1"/> </xsd:sequence> </xsd:complexType>

LINE DOCUMENT REFERENCE

An identifier for an object on which the invoice line is based, given by the Seller.

請求明細書の元となるオブジェクトの識別子で、売り手が指定します。

Invoice line document identifier

An identifiers for a document that the invoice line referes to.

請求明細行が参照する文書の識別子。

Invoice line object identifier

An identifier for an object on which the invoice line is based, given by the Seller.

請求明細書の元となるオブジェクトの識別子で、売り手が指定します。

ibt-128 • Invoice line object identifier 請求書明細行請求対象物ID

@schemeID は、請求書が参照する文書を識別するためのスキーマID。

受信者にどのスキーマを使用したか明らかにしていない場合は、UNTDID 1153 code list から選択したスキーマIDを使用しなければならない。

次の値は’130’固定

/ ubl:Invoice / cac:InvoiceLine / cac:DocumentReference [ not(cbc:DocumentTypeCode = ‘130’) ] / cbc:DocumentTypeCode

文書参照では、国連のコードリスト1001 UN/EDIFACT 1001 Document name code (Code specifying the document name.) から選択したコードを<cbc:DocumentTypeCode>の値として指定することで、どのような種類の文書を参照しているのか指定します。

EIPAから会員向けに発行されたガイドラインでは、「Document type code(IBT-189)には納品書を示す’270’を記録する。」ことが推奨されています。この値’270’が指定されていることで、ibt-188 Invoice line document identifier 明細行文書ID に記載された値が納品書番号であると判定することができます。

詳細は、次の記事 『インボイスが合算請求書か判定できますか』 をお読みください。

4. 明細行の返金

<cac:AllowanceCharge> <!-- IBG-27 INVOICE LINE ALLOWANCES --> <cbc:ChargeIndicator>false</cbc:ChargeIndicator> <cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-140 Invoice line allowance reason code --> <cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-139 Invoice line allowance reason --> <!-- cbc:MultiplierFactorNumeric, IBT-138 Invoice line allowance percentage --> <cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-136 Invoice line allowance amount --> <!-- cbc:BaseAmount, IBT-137 Invoice line allowance base amount --> </cac:AllowanceCharge>

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] |

0..n |

0..n |

ibg-27 |

• • INVOICE LINE ALLOWANCES |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:ChargeIndicator |

1..1 |

Syntax qualifier |

||

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:AllowanceChargeReasonCode |

0..1 |

0..1 |

ibt-140 |

• • • Invoice line allowance reason code |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:AllowanceChargeReason |

0..1 |

0..1 |

ibt-139 |

• • • Invoice line allowance reason |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:MultiplierFactorNumeric |

0..1 |

0..1 |

ibt-138 |

• • • Invoice line allowance percentage |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:Amount |

1..1 |

1..1 |

ibt-136 |

• • • Invoice line allowance amount |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:BaseAmount |

0..1 |

0..1 |

ibt-137 |

• • • Invoice line allowance base amount |

ここでの必須要素は、

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:AllowanceChargeReasonCode および

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:Amount

ibt-136 Invoice line allowance amount 請求書明細行の返金金額(税抜き)

消費税に関する情報は、明細行単位で ibg-30 LINE TAX INFORMATION 請求書明細行税情報 で定義するのでこのグループには含まれない。

ibt-137 Invoice line allowance base amount 請求書明細行の返金金額の基準金額 に

ibt-138 Invoice line allowance percentage 請求書明細行の返金の率 を掛けて

ibt-136 Invoice line allowance amount 請求書明細行の返金金額(税抜き) を求めても良い。

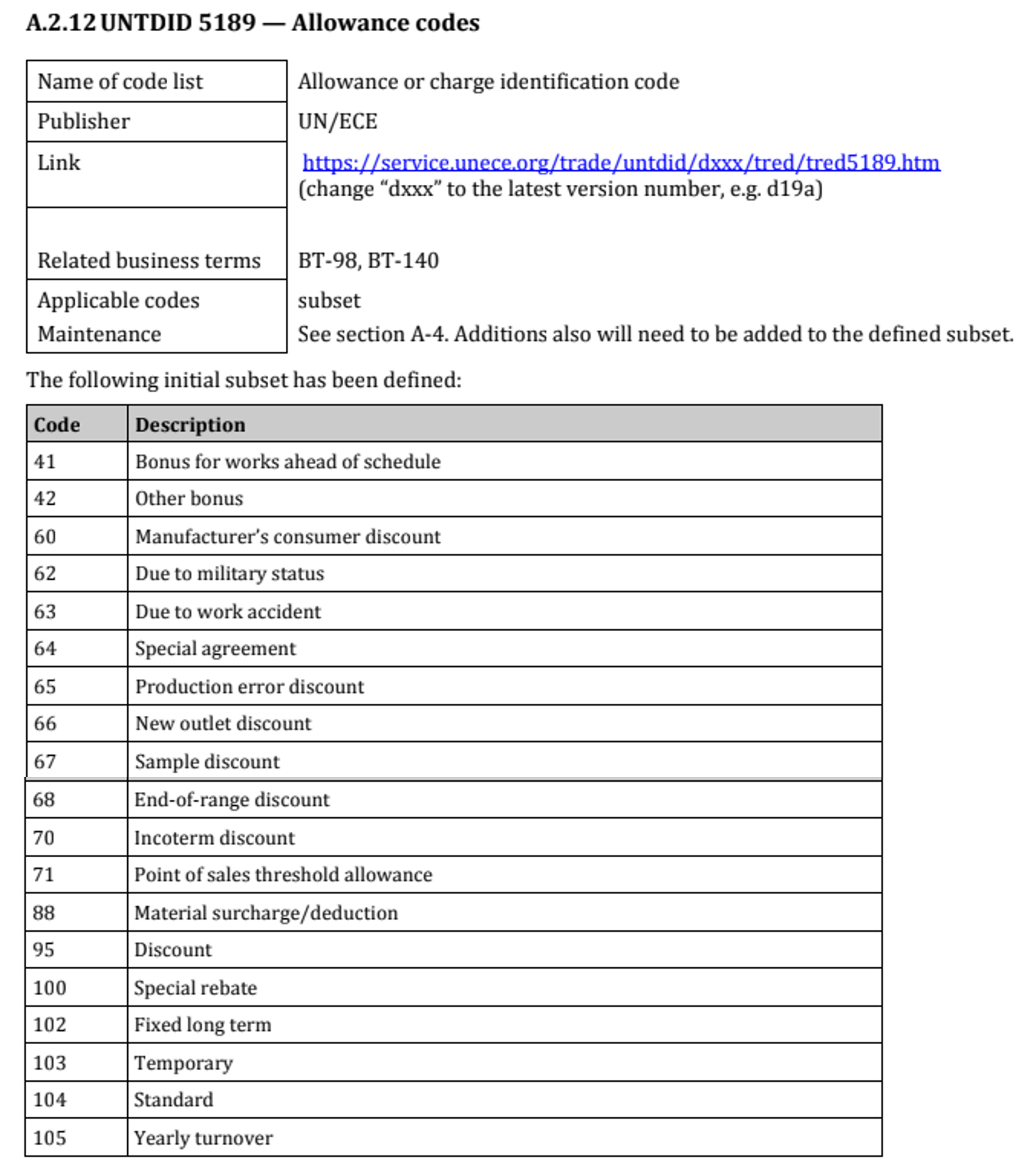

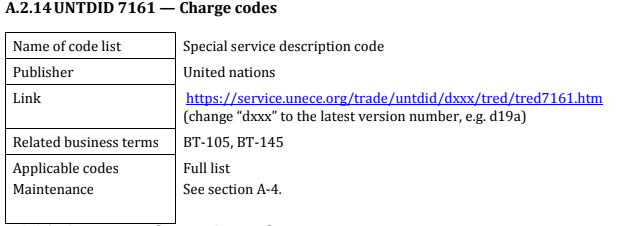

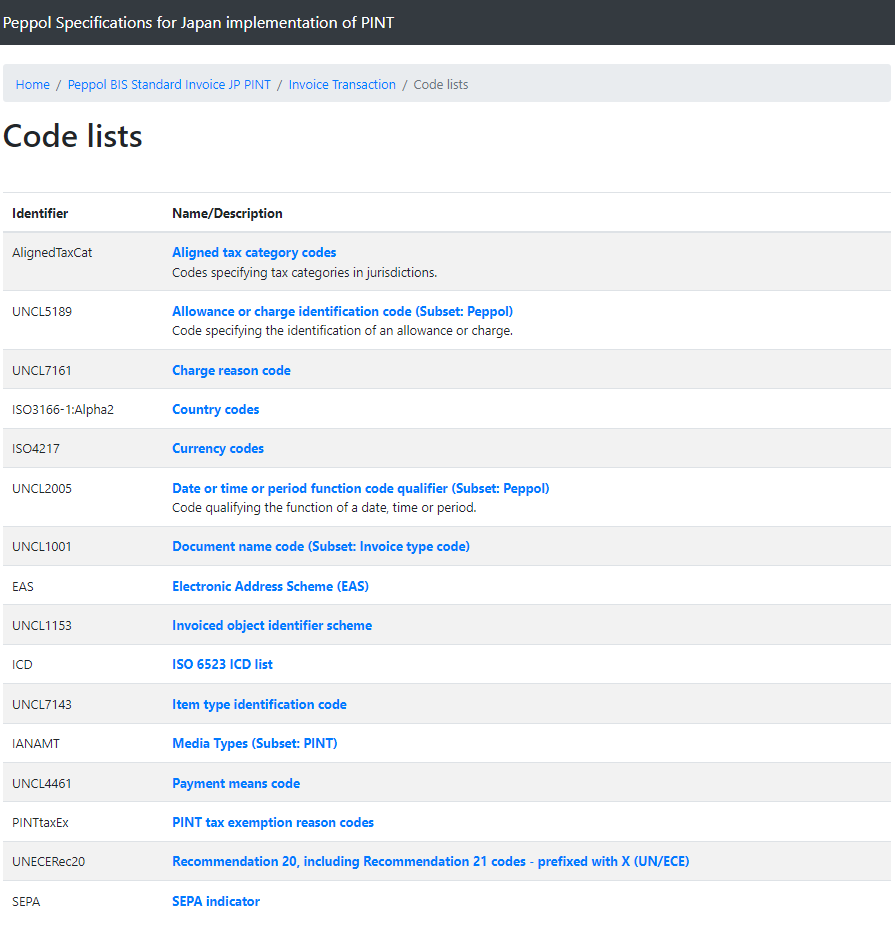

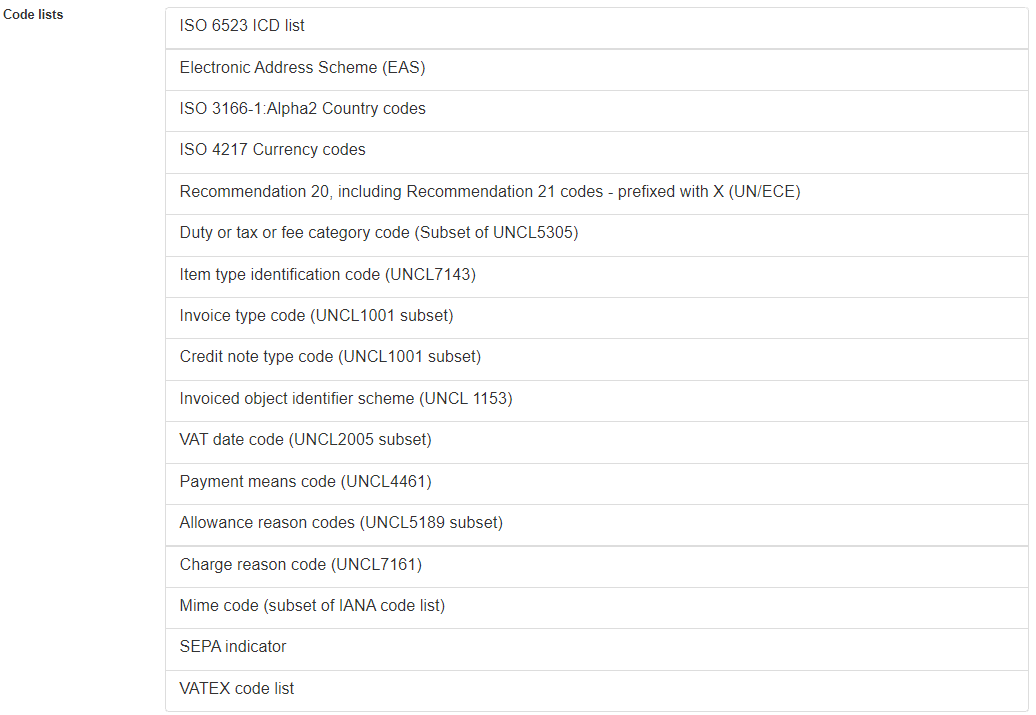

ibt-140 Invoice line allowance reason code 請求書明細行の返金理由コード を使用するときには、指定されたコードリストからの値を使用することとされている。

UNCL5189 Allowance or charge identification code (Subset: Peppol)

Code specifying the identification of an allowance or charge.

Code lists

コード一覧のページも提供されているが、これがどの組織が管理しているコードか分からないとコードの拡張が出来ない。

CEN,CEN/TS 16931-3-2 の付属書では、コードを制定している組織やコードの改定方法も解説されている。

制定母体に登録申請して追加されても、それがOpen Peppolが提供するスキーマトロンのスクリプトに反映されないとエラーがでてしまい、使用することができない。+

PINTにおけるコードの改訂手続きの文書も必要ではないでしょうか。

CEN/TS 16931-3-2 Electronic invoicing – Part 3-2: Syntax binding for ISO/IEC 19845 (UBL 2.1) invoice and credit note

5. 明細行の追加請求

<cac:AllowanceCharge> <!-- IBG-28 INVOICE LINE CHARGES --> <cbc:ChargeIndicator>true</cbc:ChargeIndicator> <cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode> <!-- IBT-145 Invoice line charge reason code --> <cbc:AllowanceChargeReason>クリーニング</cbc:AllowanceChargeReason> <!-- IBT-144 Invoice line charge reason --> <!-- cbc:MultiplierFactorNumeric, IBT-143 Invoice line charge percentage --> <cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-141 Invoice line charge amount --> <!-- cbc:BaseAmount, IBT-142 Invoice line charge base amount--> </cac:AllowanceCharge>

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] |

0..n |

0..n |

ibg-28 |

• • INVOICE LINE CHARGES |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:ChargeIndicator |

1..1 |

Syntax qualifier |

||

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:AllowanceChargeReasonCode |

0..1 |

0..1 |

ibt-145 |

• • • Invoice line charge reason code |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:AllowanceChargeReason |

0..1 |

0..1 |

ibt-144 |

• • • Invoice line charge reason |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:MultiplierFactorNumeric |

0..1 |

0..1 |

ibt-143 |

• • • Invoice line charge percentage |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:Amount |

1..1 |

1..1 |

ibt-141 |

• • • Invoice line charge amount |

|

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:BaseAmount |

0..1 |

0..1 |

ibt-142 |

• • • Invoice line charge base amount |

ここでの必須要素は、

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:AllowanceChargeReasonCode および

/ Invoice / cac:InvoiceLine / cac:AllowanceCharge [ cbc:ChargeIndicator = true() ] / cbc:Amount

ibt-141 Invoice line charge amount 請求書明細行の追加請求金額(税抜き)

消費税に関する情報は、明細行単位で ibg-30 LINE TAX INFORMATION 請求書明細行税情報 で定義するのでこのグループには含まれない。

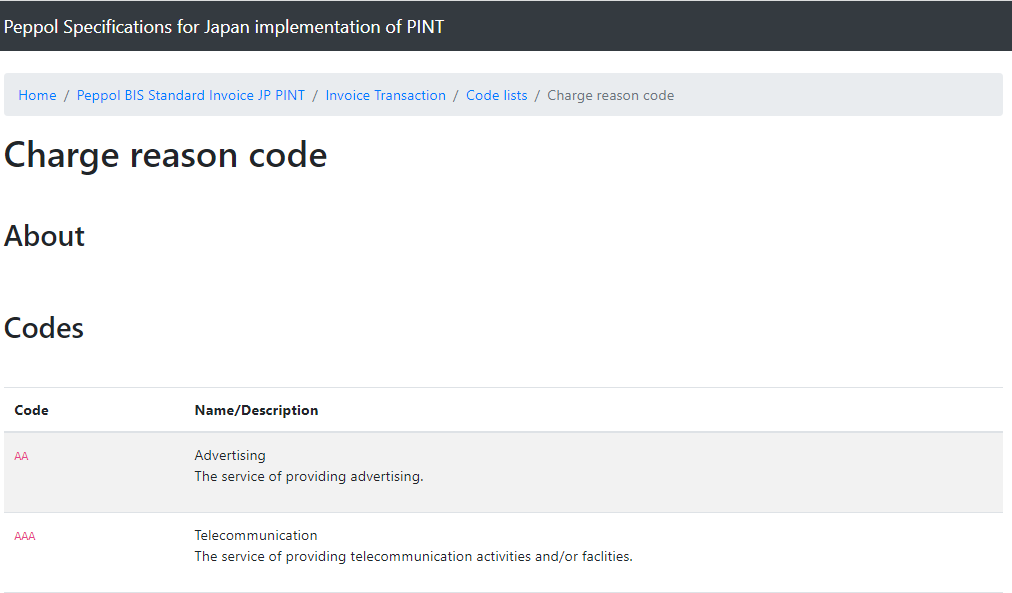

ibt-145 Invoice line charge reason code 請求書明細行の追加請求理由コード を使用するときには、指定されたコードリストからの値を使用することとされている。

例に引用した「クリーニング」の追加請求理由コード CG は、Cleaning Cleaning service.です。

Code lists

コード一覧だけがページから提供されているが、コードの説明もなく、これがどの組織が管理しているコードか分からないとコードの拡張が出来ない。

CEN,CEN/TS 16931-3-2 の付属書では、コードを制定している組織やコードの改定方法も解説されている。

制定母体に登録申請して追加されても、それがOpen Peppolが提供するスキーマトロンのスクリプトに反映されないとエラーがでてしまい、使用することができない。

PINTにおけるコードの改訂手続きの文書も必要ではないでしょうか。

CEN/TS 16931-3-2 Electronic invoicing – Part 3-2: Syntax binding for ISO/IEC 19845 (UBL 2.1) invoice and credit note

ところで、charge reason code にUNTDID 5189のコードも使用できるのでしょうか。

UNCL5189 Allowance or charge identification code (Subset: Peppol)

という表示からは、Chargeにも使えると思われるかもしれませんが、BIS Billing 3.0 では、

Allowance reason codes (UNCL5189 subset)

Charge reason code (UNCL7161)

と区別して示されていますのでUNCL5189 subsetはCharge reason codeでは使えません。

UN/ECEが制定しているコード表の名称は、Allowance or charge identification codeですから間違いではないのですが、BIS Billing 3.0 のように明確に区別して記載していただきたいと思います。

Cide lists

Code lists

6. 品目情報

<cac:Item> <!-- IBG-31 ITEM INFORMATION --> <!-- cbc:Description, IBT-154 Item description --> <cbc:Name>デスクチェア</cbc:Name> <!-- IBT-153 Item name --> <cac:BuyersItemIdentification> <cbc:ID>b-13214</cbc:ID> <!-- IBT-156 Item Buyer's identifier --> </cac:BuyersItemIdentification> <cac:SellersItemIdentification> <cbc:ID>97iugug876</cbc:ID> <!-- IBT-155 Item Seller's identifier --> </cac:SellersItemIdentification> <cac:StandardItemIdentification> <cbc:ID schemeID="0160">4503994155481</cbc:ID> <!-- IBT-157 Item standard identifier --> </cac:StandardItemIdentification> <cac:OriginCountry> <cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-159 Item country of origin --> </cac:OriginCountry>

Japan PINT Invoice UBL Example.xml

<cac:Item> <!-- IBG-31 ITEM INFORMATION --> <!-- cbc:Description, IBT-154 Item description --> <cbc:Name>コピー用紙(A4)</cbc:Name> <!-- IBT-153 Item name --> <!-- cac:BuyersItemIdentification, cbc:ID, IBT-156 Item Buyer's identifier --> <cac:SellersItemIdentification> <cbc:ID>Item3</cbc:ID> <!-- IBT-155 Item Seller's identifier --> </cac:SellersItemIdentification> <cac:StandardItemIdentification> <cbc:ID schemeID="0160">1234567890121</cbc:ID> <!-- IBT-157 Item standard identifier, IBT-157-1 Scheme identifier --> </cac:StandardItemIdentification> <!-- cac:OriginCountry, cbc:IdentificationCode, IBT-159 Item country of origin --> <cac:CommodityClassification> <cbc:ItemClassificationCode listID="MP">43211503</cbc:ItemClassificationCode> <!-- IBT-158 Item classification identifier, IBT-158-1 Scheme identifier --> </cac:CommodityClassification>

Japan PINT Invoice UBL Example.xml

<cac:Item> <!-- IBG-31 ITEM INFORMATION --> <!-- cbc:Description, IBT-154 Item description --> <cbc:Name>検定済教科書(算数)</cbc:Name> <!-- IBT-153 Item name -->

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:Item |

1..1 |

1..1 |

ibg-31 |

• • ITEM INFORMATION |

|

/ Invoice / cac:InvoiceLine / cac:Item / cbc:Description |

0..1 |

0..1 |

ibt-154 |

• • • Item description |

|

/ Invoice / cac:InvoiceLine / cac:Item / cbc:Name |

1..1 |

1..1 |

ibt-153 |

• • • Item name |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:BuyersItemIdentification |

0..1 |

(ibt-156の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:BuyersItemIdentification / cbc:ID |

1..1 |

0..1 |

ibt-156 |

• • • Item Buyer’s identifier |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:SellersItemIdentification |

0..1 |

(ibt-155の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:SellersItemIdentification / cbc:ID |

1..1 |

0..1 |

ibt-155 |

• • • Item Seller’s identifier |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:StandardItemIdentification |

0..1 |

(ibt-157の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:StandardItemIdentification / cbc:ID |

1..1 |

0..1 |

ibt-157 |

• • • Item standard identifier |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:StandardItemIdentification / cbc:ID / @schemeID |

1..1 |

1..1 |

ibt-157-1 |

• • • • Scheme identifier |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:OriginCountry |

0..1 |

(ibt-159の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:OriginCountry / cbc:IdentificationCode |

1..1 |

0..1 |

ibt-159 |

• • • Item country of origin |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:CommodityClassification |

0..n |

(ibt-158の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:CommodityClassification / cbc:ItemClassificationCode |

1..1 |

0..n |

ibt-158 |

• • • Item classification identifier |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:CommodityClassification / cbc:ItemClassificationCode / @listID |

1..1 |

1..1 |

ibt-158-1 |

• • • • Scheme identifier |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:CommodityClassification / cbc:ItemClassificationCode / @listVersionID |

0..1 |

0..1 |

ibt-158-2 |

• • • • Scheme version identifier |

ibg-31 ITEM INFORMATION 品目情報 は、必須要素であり、繰り返し回数は1回。

ibt-157 Item standard identifier 品目標準IDには、ibt-157-1 Scheme identifier スキーマIDが定義されていなければならない。

ibt-157-1

Scheme identifier

The identification scheme shall be identified from the entries of the list published by the ISO/IEC 6523 maintenance agency.

Item classification identifier Scheme identifier

品目標準IDは、ISO 6523で登録された機関が発行する識別番号でなければならない。

ibt-158-1

Scheme identifier

The identification scheme shall be chosen from the entries in UNTDID 7143 [6].ibt-158-2

Scheme version identifier

The version of the identification scheme.

Item classification identifier Scheme identifier

こちらのコードについてもJP PINT のページからは、コード名 UNTDID 7143しか分からない。

BIS Billing 3.0の該当コードのページでは次の記載があり、UN/CEFACTが発行した2019年前半版のItem type identification code (UNCL7143)であることが分かる。

Item type identification code (UNCL7143)

Identifier UNCL7143

Agency UN/CEFACT

Version D.19A

Item type identification code

United Nations Directories for Electronic Data Interchange for Administration, Commerce and Transportから公開されている 7143 Item type identification code のページは、

7143 Item type identification code

です。

担当者が見て請求内容を確認して後続処理につなげるといったこれまでの作業を、デジタル化して作業効率の向上と機械的な判断に基づく業務精度の向上に繋げるには、人が読める品名よりもコンピュータが処理できる品目IDを使用することがポイントになります。ibt-156 Item Buyer’s identifier(買い手による品目ID)並びに ibt-155 Item Seller’s identifier(売り手による品目ID)は、それぞれの事業者が独自に採番しているIDが使用できますが、それぞれの事業者でデジタル化対応するには、それぞれの品目IDを相互交換し、品目IDの変更/追加/削除を適宜に反映するといったマスターデータの交換の仕組みも同時に提供することが必要になります。

7. 請求書明細行税情報

<cac:ClassifiedTaxCategory> <!-- IBG-30 LINE TAX INFORMATION --> <cbc:ID>S</cbc:ID> <!-- IBT-151 Invoiced item TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-152 Invoiced item TAX rate --> <!-- cbc:PerUnitAmount, IBT-166 Unit TAX --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-167 Tax Scheme --> </cac:TaxScheme> </cac:ClassifiedTaxCategory>

Japan PINT Invoice UBL Example.xml

<cac:ClassifiedTaxCategory> <!-- IBG-30 LINE TAX INFORMATION --> <cbc:ID>S</cbc:ID> <!-- IBT-151 Invoiced item TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-152 Invoiced item TAX rate --> <!-- cbc:PerUnitAmount, IBT-166 Unit TAX --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-167 Tax Scheme --> </cac:TaxScheme> </cac:ClassifiedTaxCategory> <!-- IBG-32 ITEM ATTRIBUTES -->

Japan PINT Invoice UBL Example.xml

<cac:ClassifiedTaxCategory> <!-- IBG-30 LINE TAX INFORMATION --> <cbc:ID>E</cbc:ID> <!-- IBT-151 Invoiced item TAX category code --> <cbc:Percent>0</cbc:Percent> <!-- IBT-152 Invoiced item TAX rate --> <!-- cbc:PerUnitAmount, IBT-166 Unit TAX --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-167 Tax Scheme --> </cac:TaxScheme> </cac:ClassifiedTaxCategory>

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory |

1..n |

1..n |

ibg-30 |

• • LINE TAX INFORMATION |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory / cbc:ID |

1..1 |

1..1 |

ibt-151 |

• • • Invoiced item TAX category code |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory / cbc:Percent |

0..1 |

0..1 |

ibt-152 |

• • • Invoiced item TAX rate |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory / cbc:PerUnitAmount |

0..1 |

0..1 |

ibt-166 |

• • • Unit TAX (amount) |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory / cac:TaxScheme |

0..1 |

(ibt-167の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:ClassifiedTaxCategory / cac:TaxScheme / cbc:ID |

1..1 |

0..1 |

ibt-167 |

• • • Tax Scheme |

8. 品目属性

<cac:AdditionalItemProperty> <!-- IBG-32 ITEM ATTRIBUTES --> <cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 Item attribute name --> <cbc:Value>脚</cbc:Value> <!-- IBT-161 Item attribute value --> </cac:AdditionalItemProperty>

Japan PINT Invoice UBL Example.xml

<cac:AdditionalItemProperty> <cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 Item attribute name --> <cbc:Value>冊</cbc:Value> <!-- IBT-161 Item attribute value --> </cac:AdditionalItemProperty>

Japan PINT Invoice UBL Example.xml

<cac:AdditionalItemProperty> <!-- IBG-32 ITEM ATTRIBUTES --> <cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 Item attribute name --> <cbc:Value>冊</cbc:Value> <!-- IBT-161 Item attribute value -->

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:AdditionalItemProperty |

0..n |

0..n |

ibg-32 |

• • • ITEM ATTRIBUTES |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:AdditionalItemProperty / cbc:Name |

1..1 |

1..1 |

ibt-160 |

• • • • Item attribute name |

|

/ Invoice / cac:InvoiceLine / cac:Item / cac:AdditionalItemProperty / cbc:Value |

1..1 |

1..1 |

ibt-161 |

• • • • Item attribute value |

ibg-32 ITEM ATTRIBUTES 品目属性では、品目に関する追加の属性情報を定義できます。

ここでは、日本語表記するときの数量の表示単位名称を定義しています。

9. 取引価格詳細

<cac:Price> <!-- IBG-29 PRICE DETAILS --> <cbc:PriceAmount currencyID="JPY">50000</cbc:PriceAmount> <!-- IBT-146 Item net price --> <cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 Item price base quantity, IBT-150 Item price base quantity unit of measure code --> </cac:Price>

Japan PINT Invoice UBL Example.xml

<cac:Price> <!-- IBG-29 PRICE DETAILS --> <cbc:PriceAmount currencyID="JPY">500</cbc:PriceAmount> <!-- IBT-146 Item net price --> <cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 Item price base quantity, IBT-150 Item price base quantity unit of measure code --> <cac:AllowanceCharge> <cbc:ChargeIndicator>false</cbc:ChargeIndicator> <!-- Mandatory element. Value must be “false”. --> <cbc:Amount currencyID="JPY">100</cbc:Amount> <!-- IBT-147 Item price discount --> <cbc:BaseAmount currencyID="JPY">600</cbc:BaseAmount> <!-- IBT-148 Item gross price --> </cac:AllowanceCharge> </cac:Price>

Japan PINT Invoice UBL Example.xml

<cac:Price> <!-- IBG-29 PRICE DETAILS --> <cbc:PriceAmount currencyID="JPY">349</cbc:PriceAmount> <!-- IBT-146 Item net price --> <cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 Item price base quantity, IBT-150 Item price base quantity unit of measure code --> </cac:Price>

Japan PINT Invoice UBL Example.xml

| XPath | 構文での繰返し | 論理モデルでの繰返し | ID | ビジネス用語 |

|---|---|---|---|---|

|

/ Invoice / cac:InvoiceLine / cac:Price |

1..1 |

1..1 |

ibg-29 |

• • PRICE DETAILS |

|

/ Invoice / cac:InvoiceLine / cac:Price / cbc:PriceAmount |

1..1 |

1..1 |

ibt-146 |

• • • Item net price |

|

/ Invoice / cac:InvoiceLine / cac:Price / cbc:BaseQuantity |

0..1 |

0..1 |

ibt-149 |

• • • Item price base quantity |

|

/ Invoice / cac:InvoiceLine / cac:Price / cbc:BaseQuantity / @unitCode |

0..1 |

0..1 |

ibt-150 |

• • • Item price base quantity unit of measure code |

|

/ Invoice / cac:InvoiceLine / cac:Price / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] |

0..1 |

(ibt-147の親要素) |

||

|

/ Invoice / cac:InvoiceLine / cac:Price / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:ChargeIndicator |

1..1 |

Syntax qualifier |

||

|

/ Invoice / cac:InvoiceLine / cac:Price / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:Amount |

1..1 |

0..1 |

ibt-147 |

• • • Item price discount |

|

/ Invoice / cac:InvoiceLine / cac:Price / cac:AllowanceCharge [ cbc:ChargeIndicator = false() ] / cbc:BaseAmount |

0..1 |

0..1 |

ibt-148 |

• • • Item gross price |

ibt-149 Item price base quantity 品目単価基準数量 が日本ではあまりなじみのない用語なので悩まれる方も多いかと思います。

例えば、牛肉 100g 1,000円 がパック詰めされていて227gだったとします。

このとき、

| Business Term | 値 | |

|---|---|---|

|

ibt-146 |

Item net price |

1000 |

|

ibt-149 |

Item price base quantity |

100 |

|

ibt-150 |

Item price base quantity unit of measure code |

CTG |

|

ibt-129 |

Invoiced quantity |

527 |

|

ibt-130 |

Invoiced quantity unit of measure code |

CTG |

|

ibt-131 |

Invoice line net amount |

Item line net amount = |

別の例として、鉛筆 1箱 12本入りを 5箱(5ダース)購入する例を次に示します。1箱(1ダース)1000円とします。数量単位コードが違うと記載される数量が異なることとibt-149 と ibt-150 は、同じコードを使用しなければならないことに注意してください。

| Business Term | 値 | |

|---|---|---|

|

ibt-146 |

Item net price |

1000 |

|

ibt-149 |

Item price base quantity |

1 |

|

ibt-150 |

Item price base quantity unit of measure code |

DZN |

|

ibt-129 |

Invoiced quantity |

5 |

|

ibt-130 |

Invoiced quantity unit of measure code |

DZN |

|

ibt-131 |

Invoice line net amount |

Item line net amount = |

| Business Term | 値 | |

|---|---|---|

|

ibt-146 |

Item net price |

1000 |

|

ibt-149 |

Item price base quantity |

12 |

|

ibt-150 |

Item price base quantity unit of measure code |

H87 |

|

ibt-129 |

Invoiced quantity |

60 |

|

ibt-130 |

Invoiced quantity unit of measure code |

H87 |

|

ibt-131 |

Invoice line net amount |

Item line net amount = |

Japan PINT Invoice UBL Example.xml

<?xml version="1.0" encoding="UTF-8"?> <Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ccts="urn:un:unece:uncefact:documentation:2" xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDatatypes-2" xmlns:udt="urn:un:unece:uncefact:data:specification:UnqualifiedDataTypesSchemaModule:2" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance"> <!-- Japan common commercial invoice, example --> <!-- UBL Version is not defined in JP PINT --> <cbc:UBLVersionID>2.1</cbc:UBLVersionID> <cbc:CustomizationID>urn:fdc:peppol:jp:billing:3.0</cbc:CustomizationID> <!-- IBT-024 Specification identifier --> <cbc:ProfileID>urn:fdc:peppol.eu:2017:poacc:billing:01:1.0</cbc:ProfileID> <!-- IBT-023 Business process type --> <cbc:ID>156</cbc:ID> <!-- IBT-001 Invoice number --> <cbc:IssueDate>2023-10-24</cbc:IssueDate> <!-- IBT-002 Invoice issue date --> <!-- cbc:IssueTime, IBT-168 Invoice issue time --> <cbc:DueDate>2023-11-20</cbc:DueDate> <!-- IBT-009 Payment due date --> <cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <!-- IBT-003 Invoice type code --> <cbc:Note>Ordered at trade show</cbc:Note> <!-- IBT-022 Invoice note --> <!-- cbc:TaxPointDate, IBT-007 TAX point date --> <cbc:DocumentCurrencyCode>JPY</cbc:DocumentCurrencyCode> <!-- IBT-005 Invoice currency code --> <!-- cbc:TaxCurrencyCode, IBT-006 Tax accounting currency --> <cbc:AccountingCost>4217:2323:2323</cbc:AccountingCost> <!-- IBT-019 Buyer accounting reference --> <cbc:BuyerReference>0150abc</cbc:BuyerReference> <!-- IBT-010 Buyer reference --> <cac:InvoicePeriod> <!-- IBG-14 INVOICING PERIOD --> <cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-073 Invoicing period start date --> <cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-074 Invoicing period end date --> <!-- cbc:DescriptionCode, IBT-008 TAX point date code --> </cac:InvoicePeriod> <cac:OrderReference> <cbc:ID>O-998877</cbc:ID> <!-- IBT-013 Purchase order reference --> <cbc:SalesOrderID>SO-12343</cbc:SalesOrderID> <!-- IBT-014 Sales order reference --> </cac:OrderReference> <cac:BillingReference> <!-- IBG-03 PRECEDING INVOICE REFERENCE --> <cac:InvoiceDocumentReference> <cbc:ID>123</cbc:ID> <!-- IBT-025 Preceding Invoice reference --> <cbc:IssueDate>2023-10-20</cbc:IssueDate> <!-- IBT-026 Preceding Invoice issue date --> </cac:InvoiceDocumentReference> </cac:BillingReference> <cac:DespatchDocumentReference> <cbc:ID>despadv-3</cbc:ID> <!-- IBT-016 Despatch advice reference --> </cac:DespatchDocumentReference> <cac:ReceiptDocumentReference> <cbc:ID>resadv-1</cbc:ID> <!-- IBT-015 Receiving advice reference --> </cac:ReceiptDocumentReference> <cac:OriginatorDocumentReference> <cbc:ID>ppid-123</cbc:ID> <!-- IBT-017 Tender or lot reference --> </cac:OriginatorDocumentReference> <cac:ContractDocumentReference> <cbc:ID>framework no 1</cbc:ID> <!-- IBT-012 Contract reference --> </cac:ContractDocumentReference> <cac:AdditionalDocumentReference> <cbc:ID schemeID="ABT">DR35141</cbc:ID> <!-- IBT-018 Invoiced object identifier, IBT-018-1 The identification scheme identifier of the Invoiced object identifier --> <cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-018 qualifier --> </cac:AdditionalDocumentReference> <cac:AdditionalDocumentReference> <cbc:ID>doc1</cbc:ID> <!-- IBT-122 Supporting document reference --> <cbc:DocumentDescription>Usage summary</cbc:DocumentDescription> <!-- IBT-123 Supporting document description --> <cac:Attachment> <cbc:EmbeddedDocumentBinaryObject filename="report.csv" mimeCode="text/csv">aHR0cHM6Ly90ZXN0LXZlZmEuZGlmaS5uby9wZXBwb2xiaXMvcG9hY2MvYmlsbGluZy8zLjAvYmlzLw==</cbc:EmbeddedDocumentBinaryObject> <!-- IBT-125 Attached document, IBT-125-1 Attached document Mime code, IBT-125-2 Attached document Filename --> <cac:ExternalReference> <cbc:URI>http://www.salescompany.com/summary001.html</cbc:URI> <!-- IBT-124 External document location --> </cac:ExternalReference> </cac:Attachment> </cac:AdditionalDocumentReference> <cac:AdditionalDocumentReference> <cbc:ID>doc2</cbc:ID> <!-- IBT-122 Supporting document reference --> <cbc:DocumentDescription>Usage breakdown</cbc:DocumentDescription> <!-- IBT-123 Supporting document description --> <cac:Attachment> <cac:ExternalReference> <cbc:URI>http://www.salescompany.com/breakdown001.html</cbc:URI> <!-- IBT-124 External document location --> </cac:ExternalReference> </cac:Attachment> </cac:AdditionalDocumentReference> <cac:ProjectReference> <cbc:ID>project333</cbc:ID> <!-- IBT-011 Project reference --> </cac:ProjectReference> <cac:AccountingSupplierParty> <!-- IBG-04 SELLER --> <cac:Party> <cbc:EndpointID schemeID="0188">1234567890123</cbc:EndpointID> <!-- IBT-034 Seller electronic address, IBT-034-1 Scheme identifier --> <cac:PartyIdentification> <cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> <!-- IBT-029 Seller identifier, IBT-029-1 Scheme identifier --> </cac:PartyIdentification> <cac:PartyName> <cbc:Name>株式会社 〇〇商事</cbc:Name> <!-- IBT-028 Seller trading name --> </cac:PartyName> <cac:PostalAddress> <!-- IBG-05 SELLER POSTAL ADDRESS --> <cbc:StreetName>四谷4-29-X</cbc:StreetName> <!-- IBT-035 Seller address line 1 --> <cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName> <!-- IBT-036 Seller address line 2 --> <cbc:CityName>新宿区</cbc:CityName> <!-- IBT-037 Seller city --> <cbc:PostalZone>1600044</cbc:PostalZone> <!-- IBT-038 Seller post code --> <cbc:CountrySubentity>東京都</cbc:CountrySubentity> <!-- IBT-039 Seller country subdivision --> <cac:AddressLine> <cbc:Line>Third address line</cbc:Line> <!-- IBT-162 Seller address line 3 --> </cac:AddressLine> <cac:Country> <cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-040 Seller country code --> </cac:Country> </cac:PostalAddress> <cac:PartyTaxScheme> <cbc:CompanyID>T1234567890123</cbc:CompanyID> <!-- IBT-031 Seller TAX identifier --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-031, qualifier --> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:PartyLegalEntity> <cbc:RegistrationName>株式会社 〇〇商事</cbc:RegistrationName> <!-- IBT-027 Seller name --> <cbc:CompanyID schemeID="0188">1234567890123</cbc:CompanyID> <!-- IBT-030 Seller legal registration identifier, IBT-030-1 Scheme identifier --> <cbc:CompanyLegalForm>Private Limited Company</cbc:CompanyLegalForm> <!-- IBT-033 Seller additional legal information --> </cac:PartyLegalEntity> <cac:Contact> <!-- IBG-06 SELLER CONTACT --> <cbc:Name>青木 志郎</cbc:Name> <!-- IBT-041 Seller contact point --> <cbc:Telephone>03-3xxx-0001</cbc:Telephone> <!-- IBT-042 Seller contact telephone number --> <cbc:ElectronicMail>shirou_aoki@〇〇co.jp</cbc:ElectronicMail> <!-- IBT-043 Seller contact email address --> </cac:Contact> </cac:Party> </cac:AccountingSupplierParty> <cac:AccountingCustomerParty> <!-- IBG-07 BUYER --> <cac:Party> <cbc:EndpointID schemeID="0188">3210987654321</cbc:EndpointID> <!-- IBT-049 Buyer electronic address, IBT-049-1 Scheme identifier --> <cac:PartyIdentification> <cbc:ID schemeID="0147">654321:000321:0147:1</cbc:ID> <!-- IBT-046 Buyer identifier, IBT-046-1 Scheme identifier --> </cac:PartyIdentification> <cac:PartyName> <cbc:Name>株式会社 〇〇物産</cbc:Name> <!-- IBT-045 Buyer trading name --> </cac:PartyName> <cac:PostalAddress> <!-- IBG-08 BUYER POSTAL ADDRESS --> <cbc:StreetName>北区</cbc:StreetName> <!-- IBT-050 Buyer address line 1 --> <cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName> <!-- IBT-051 Buyer address line 2 --> <cbc:CityName>札幌市</cbc:CityName> <!-- IBT-052 Buyer city --> <cbc:PostalZone>0010012</cbc:PostalZone> <!-- IBT-053 Buyer post code --> <cbc:CountrySubentity>北海道</cbc:CountrySubentity> <!-- IBT-054 Buyer country subdivision --> <cac:AddressLine> <cbc:Line>Third line</cbc:Line> <!-- IBT-163 Buyer address line 3 --> </cac:AddressLine> <cac:Country> <cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-055 Buyer country code --> </cac:Country> </cac:PostalAddress> <cac:PartyTaxScheme> <cbc:CompanyID>T3210987654321</cbc:CompanyID> <!-- IBT-048 Buyer TAX identifier --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-048, qualifier --> </cac:TaxScheme> </cac:PartyTaxScheme> <cac:PartyLegalEntity> <cbc:RegistrationName>株式会社 〇〇物産</cbc:RegistrationName> <!-- IBT-044 Buyer name --> <cbc:CompanyID schemeID="0147">654321:000321:0147:1</cbc:CompanyID> <!-- IBT-047 Buyer legal registration identifier, IBT-047-1 Scheme identifier --> </cac:PartyLegalEntity> <cac:Contact> <!-- IBG-09 BUYER CONTACT --> <cbc:Name>株式会社 〇〇物産</cbc:Name> <!-- IBT-056 Buyer contact point --> <cbc:Telephone>011-757-1xxx</cbc:Telephone> <!-- IBT-057 Buyer contact telephone number --> <cbc:ElectronicMail>purchaser@oobussan.co.jp</cbc:ElectronicMail> <!-- IBT-058 Buyer contact email address --> </cac:Contact> </cac:Party> </cac:AccountingCustomerParty> <cac:PayeeParty> <!-- IBG-10 PAYEE --> <cac:PartyIdentification> <cbc:ID schemeID="0147">123456:000124:0147:1</cbc:ID> <!-- IBT-060 Payee identifier, IBT-060-1 Scheme identifier, must not be same as ibt-029 --> </cac:PartyIdentification> <cac:PartyName> <cbc:Name>Payee party</cbc:Name> <!-- IBT-059 Payee name, must not be same as ibt-028 --> </cac:PartyName> <cac:PartyLegalEntity> <cbc:CompanyID schemeID="0147">123456:000124:0147:1</cbc:CompanyID> <!-- IBT-061 Payee legal registration identifier, IBT-061-1 Scheme identifier --> </cac:PartyLegalEntity> </cac:PayeeParty> <cac:TaxRepresentativeParty> <!-- IBG-11 SELLER TAX REPRESENTATIVE PARTY --> <cac:PartyName> <cbc:Name>TaxRepresentative Name</cbc:Name> <!-- IBT-062 Seller tax representative name --> </cac:PartyName> <cac:PostalAddress> <!-- IBG-12 SELLER TAX REPRESENTATIVE POSTAL ADDRESS --> <cbc:StreetName>四谷4-32-X</cbc:StreetName> <!-- IBT-064 Tax representative address line 1 --> <cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName> <!-- IBT-065 Tax representative address line 2 --> <cbc:CityName>新宿区</cbc:CityName> <!-- IBT-066 Tax representative city --> <cbc:PostalZone>1600044</cbc:PostalZone> <!-- IBT-067 Tax representative post code --> <cbc:CountrySubentity>東京都</cbc:CountrySubentity> <!-- IBT-068 Tax representative country subdivision --> <cac:AddressLine> <cbc:Line>Third line</cbc:Line> <!-- IBT-164 Tax representative address line 3 --> </cac:AddressLine> <cac:Country> <cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-069 Tax representative country code --> </cac:Country> </cac:PostalAddress> <cac:PartyTaxScheme> <cbc:CompanyID>T7654321098765</cbc:CompanyID> <!-- IBT-063 Seller tax representative TAX identifier --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-063, qualifier --> </cac:TaxScheme> </cac:PartyTaxScheme> </cac:TaxRepresentativeParty> <cac:Delivery> <!-- IBG-13 DELIVERY INFORMATION --> <cbc:ActualDeliveryDate>2023-10-18</cbc:ActualDeliveryDate> <!-- IBT-072 Actual delivery date --> <cac:DeliveryLocation> <cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> <!-- IBT-071 Deliver to location identifier, IBT-071-1 Scheme identifier --> <cac:Address> <!-- IBG-15 DELIVER TO ADDRESS --> <cbc:StreetName>北区</cbc:StreetName> <!-- IBT-075 Deliver to address line 1 --> <cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName> <!-- IBT-076 Deliver to address line 2 --> <cbc:CityName>札幌市</cbc:CityName> <!-- IBT-077 Deliver to city --> <cbc:PostalZone>0010012</cbc:PostalZone> <!-- IBT-078 Deliver to post code --> <cbc:CountrySubentity>北海道</cbc:CountrySubentity> <!-- IBT-079 Deliver to country subdivision --> <cac:AddressLine> <cbc:Line>Gate 15</cbc:Line> <!-- IBT-165 Deliver to address line 3 --> </cac:AddressLine> <cac:Country> <cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-080 Deliver to country code --> </cac:Country> </cac:Address> </cac:DeliveryLocation> <cac:DeliveryParty> <cac:PartyName> <cbc:Name>株式会社 〇〇物産 札幌支社</cbc:Name> <!-- IBT-070 Deliver to party name --> </cac:PartyName> </cac:DeliveryParty> </cac:Delivery> <cac:PaymentMeans> <!-- IBG-16 PAYMENT INSTRUCTIONS --> <!-- cbc:ID, IBT-178 Payment Instructions ID --> <cbc:PaymentMeansCode name="Credit transfer">30</cbc:PaymentMeansCode> <!-- IBT-081 Payment means type code, IBT-082 Payment means text --> <!-- cbc:PaymentID, IBT-083 Remittance information --> <!-- cac:CardAccount, IBG-18 PAYMENT CARD INFORMATION --> <cac:PayeeFinancialAccount> <!-- IBG-17 CREDIT TRANSFER --> <cbc:ID>1234:567:1:3242394</cbc:ID> <!-- IBT-084 Payment account identifier, IBT-084-1 Scheme identifier --> <cbc:Name>カ)マルマルシヨウジ</cbc:Name> <!-- IBT-085 Payment account name --> <!-- cac:FinancialInstitutionBranch, cbc:ID, IBT-086 Payment service provider identifier --> <!-- cac:FinancialInstitutionBranch, cac:PostalAddress, IBG-34 FINANCIAL INSTITUTION ADDRESS --> </cac:PayeeFinancialAccount> <!-- cac:PaymentMandate, IBG-19 DIRECT DEBIT --> </cac:PaymentMeans> <cac:PaymentTerms> <!-- IBG-33 INVOICE TERMS --> <!-- cbc:PaymentMeansID, IBT-187 Terms payment instructions ID --> <cbc:Note>月末締め翌月20日払い, 銀行手数料振込人負担</cbc:Note> <!-- IBT-020 Payment terms --> <!-- cbc:Amount, IBT-176 Terms amount--> <!-- cbc:InstallmentDueDate, IBT-177 Terms installment due date --> </cac:PaymentTerms> <!-- cac:PrepaidPayment, IBG-35 Paid amounts --> <cac:AllowanceCharge> <!-- IBG-20 DOCUMENT LEVEL ALLOWANCES --> <cbc:ChargeIndicator>false</cbc:ChargeIndicator> <cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-098 Document level allowance reason code --> <cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-097 Document level allowance reason --> <!-- cbc:MultiplierFactorNumeric, IBT-094 Document level allowance percentage --> <cbc:Amount currencyID="JPY">179</cbc:Amount> <!-- IBT-092 Document level allowance amount --> <!-- cbc:BaseAmount, IBT-093 Document level allowance base amount --> <cac:TaxCategory> <cbc:ID>S</cbc:ID> <!-- IBT-095 Document level allowance TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-096 Document level allowance TAX rate --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-095, qualifier --> </cac:TaxScheme> </cac:TaxCategory> </cac:AllowanceCharge> <cac:AllowanceCharge> <!-- IBG-21 DOCUMENT LEVEL CHARGES --> <cbc:ChargeIndicator>true</cbc:ChargeIndicator> <cbc:AllowanceChargeReasonCode>FC</cbc:AllowanceChargeReasonCode> <!-- IBT-105 Document level charge reason code --> <cbc:AllowanceChargeReason>配送サービス</cbc:AllowanceChargeReason> <!-- IBT-104 Document level charge reason --> <!-- cbc:MultiplierFactorNumeric, IBT-101 Document level charge percentage --> <cbc:Amount currencyID="JPY">7679</cbc:Amount> <!-- IBT-099 Document level charge amount --> <!-- cbc:BaseAmount, IBT-100 Document level charge base amount --> <cac:TaxCategory> <cbc:ID>S</cbc:ID> <!-- IBT-102 Document level charge TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-103 Document level charge TAX rate --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-102, qualifier --> </cac:TaxScheme> </cac:TaxCategory> </cac:AllowanceCharge> <cac:TaxTotal> <cbc:TaxAmount currencyID="JPY">26000</cbc:TaxAmount> <!-- IBT-110 Invoice total TAX amount --> <cac:TaxSubtotal> <!-- IBG-23 TAX BREAKDOWN --> <cbc:TaxableAmount currencyID="JPY">260000</cbc:TaxableAmount> <!-- IBT-116 TAX category taxable amount --> <cbc:TaxAmount currencyID="JPY">26000</cbc:TaxAmount> <!-- IBT-117 TAX category tax amount --> <cac:TaxCategory> <cbc:ID>S</cbc:ID> <!-- IBT-118 TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-119 TAX category rate --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-118, qualifier --> </cac:TaxScheme> </cac:TaxCategory> </cac:TaxSubtotal> <cac:TaxSubtotal> <!-- IBG-23 TAX BREAKDOWN --> <cbc:TaxableAmount currencyID="JPY">3490</cbc:TaxableAmount> <!-- IBT-116 TAX category taxable amount --> <cbc:TaxAmount currencyID="JPY">0</cbc:TaxAmount> <!-- IBT-117 TAX category tax amount --> <cac:TaxCategory> <cbc:ID>E</cbc:ID> <!-- IBT-118 TAX category code --> <cbc:Percent>0</cbc:Percent> <!-- IBT-119 TAX category rate --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-118, qualifier --> </cac:TaxScheme> </cac:TaxCategory> </cac:TaxSubtotal> </cac:TaxTotal> <cac:LegalMonetaryTotal> <!-- IBG-22 DOCUMENT TOTALS --> <cbc:LineExtensionAmount currencyID="JPY">255990</cbc:LineExtensionAmount> <!-- IBT-106 Sum of Invoice line net amount --> <cbc:TaxExclusiveAmount currencyID="JPY">263490</cbc:TaxExclusiveAmount> <!-- IBT-109 Invoice total amount without TAX --> <cbc:TaxInclusiveAmount currencyID="JPY">289490</cbc:TaxInclusiveAmount> <!-- IBT-112 Invoice total amount with TAX --> <cbc:AllowanceTotalAmount currencyID="JPY">179</cbc:AllowanceTotalAmount> <!-- IBT-107 Sum of allowances on document level --> <cbc:ChargeTotalAmount currencyID="JPY">7679</cbc:ChargeTotalAmount> <!-- IBT-108 Sum of charges on document level --> <cbc:PrepaidAmount currencyID="JPY">0</cbc:PrepaidAmount> <!-- IBT-113 Paid amount --> <cbc:PayableRoundingAmount currencyID="JPY">0</cbc:PayableRoundingAmount> <!-- IBT-114 Rounding amount --> <cbc:PayableAmount currencyID="JPY">289490</cbc:PayableAmount> <!-- IBT-115 Amount due for payment --> </cac:LegalMonetaryTotal> <cac:InvoiceLine> <!-- IBG-25 INVOICE LINE --> <cbc:ID>1</cbc:ID> <!-- IBT-126 Invoice line identifier --> <cbc:Note>The equipment has 3 year warranty.</cbc:Note> <!-- IBT-127 Invoice line note --> <cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-129 Invoiced quantity, IBT-130 Invoiced quantity unit of measure code --> <cbc:LineExtensionAmount currencyID="JPY">250000</cbc:LineExtensionAmount> <!-- IBT-131 Invoice line net amount --> <cbc:AccountingCost>Cost id 654</cbc:AccountingCost> <!-- IBT-133 Invoice line Buyer accounting reference --> <cac:InvoicePeriod> <!-- IBG-26 INVOICE LINE PERIOD --> <cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 Invoice line period start date --> <cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 Invoice line period end date --> </cac:InvoicePeriod> <cac:OrderLineReference> <cbc:LineID>1</cbc:LineID> <!-- IBT-132 Referenced purchase order line reference --> <cac:OrderReference> <cbc:ID>1</cbc:ID> <!-- IBT-183 Purchase order reference --> </cac:OrderReference> </cac:OrderLineReference> <cac:DespatchLineReference> <cbc:LineID>010</cbc:LineID> <cac:DocumentReference> <cbc:ID>789</cbc:ID> <!-- IBT-184 Despatch advice reference --> </cac:DocumentReference> </cac:DespatchLineReference> <cac:DocumentReference> <!-- IBG-36 LINE DOCUMENT REFERENCE --> <cbc:ID>D001-1</cbc:ID> <!-- IBT-188 Invoice line document identifier --> <!-- cbc:DocumentTypeCode, IBT-189 Document type code --> </cac:DocumentReference> <cac:DocumentReference> <cbc:ID schemeID="ABZ">AB-123</cbc:ID> <!-- IBT-128 Invoice line object identifier, IBT-128-1 Scheme identifier --> <cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-128, qualifier --> </cac:DocumentReference> <cac:AllowanceCharge> <!-- IBG-27 INVOICE LINE ALLOWANCES --> <cbc:ChargeIndicator>false</cbc:ChargeIndicator> <cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-140 Invoice line allowance reason code --> <cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-139 Invoice line allowance reason --> <!-- cbc:MultiplierFactorNumeric, IBT-138 Invoice line allowance percentage --> <cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-136 Invoice line allowance amount --> <!-- cbc:BaseAmount, IBT-137 Invoice line allowance base amount --> </cac:AllowanceCharge> <cac:AllowanceCharge> <!-- IBG-28 INVOICE LINE CHARGES --> <cbc:ChargeIndicator>true</cbc:ChargeIndicator> <cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode> <!-- IBT-145 Invoice line charge reason code --> <cbc:AllowanceChargeReason>クリーニング</cbc:AllowanceChargeReason> <!-- IBT-144 Invoice line charge reason --> <!-- cbc:MultiplierFactorNumeric, IBT-143 Invoice line charge percentage --> <cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-141 Invoice line charge amount --> <!-- cbc:BaseAmount, IBT-142 Invoice line charge base amount--> </cac:AllowanceCharge> <cac:Item> <!-- IBG-31 ITEM INFORMATION --> <!-- cbc:Description, IBT-154 Item description --> <cbc:Name>デスクチェア</cbc:Name> <!-- IBT-153 Item name --> <cac:BuyersItemIdentification> <cbc:ID>b-13214</cbc:ID> <!-- IBT-156 Item Buyer's identifier --> </cac:BuyersItemIdentification> <cac:SellersItemIdentification> <cbc:ID>97iugug876</cbc:ID> <!-- IBT-155 Item Seller's identifier --> </cac:SellersItemIdentification> <cac:StandardItemIdentification> <cbc:ID schemeID="0160">4503994155481</cbc:ID> <!-- IBT-157 Item standard identifier --> </cac:StandardItemIdentification> <cac:OriginCountry> <cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-159 Item country of origin --> </cac:OriginCountry> <cac:CommodityClassification> <cbc:ItemClassificationCode listID="TST" listVersionID="19.05.01">86776</cbc:ItemClassificationCode> <!-- IBT-158 Item classification identifier, IBT-158-1 Scheme identifier, IBT-158-2 Scheme version identifier --> </cac:CommodityClassification> <cac:ClassifiedTaxCategory> <!-- IBG-30 LINE TAX INFORMATION --> <cbc:ID>S</cbc:ID> <!-- IBT-151 Invoiced item TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-152 Invoiced item TAX rate --> <!-- cbc:PerUnitAmount, IBT-166 Unit TAX --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-167 Tax Scheme --> </cac:TaxScheme> </cac:ClassifiedTaxCategory> <cac:AdditionalItemProperty> <!-- IBG-32 ITEM ATTRIBUTES --> <cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 Item attribute name --> <cbc:Value>脚</cbc:Value> <!-- IBT-161 Item attribute value --> </cac:AdditionalItemProperty> </cac:Item> <cac:Price> <!-- IBG-29 PRICE DETAILS --> <cbc:PriceAmount currencyID="JPY">50000</cbc:PriceAmount> <!-- IBT-146 Item net price --> <cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 Item price base quantity, IBT-150 Item price base quantity unit of measure code --> </cac:Price> </cac:InvoiceLine> <cac:InvoiceLine> <!-- IBG-25 INVOICE LINE --> <cbc:ID>2</cbc:ID> <!-- IBT-126 Invoice line identifier --> <!-- cbc:Note, IBT-127 Invoice line note --> <cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-130 Invoiced quantity unit of measure code, IBT-129 Invoiced quantity --> <cbc:LineExtensionAmount currencyID="JPY">2500</cbc:LineExtensionAmount> <!-- IBT-131 Invoice line net amount --> <!-- cbc:AccountingCost, IBT-133 Invoice line Buyer accounting reference --> <cac:InvoicePeriod> <!-- IBG-26 INVOICE LINE PERIOD --> <cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 Invoice line period start date --> <cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 Invoice line period end date --> </cac:InvoicePeriod> <cac:DocumentReference> <!-- IBG-36 LINE DOCUMENT REFERENCE --> <cbc:ID>D001-2</cbc:ID> <!-- IBT-188 Invoice line document identifier --> <!-- cbc:DocumentTypeCode, IBT-189 Document type code --> </cac:DocumentReference> <cac:Item> <!-- IBG-31 ITEM INFORMATION --> <!-- cbc:Description, IBT-154 Item description --> <cbc:Name>コピー用紙(A4)</cbc:Name> <!-- IBT-153 Item name --> <!-- cac:BuyersItemIdentification, cbc:ID, IBT-156 Item Buyer's identifier --> <cac:SellersItemIdentification> <cbc:ID>Item3</cbc:ID> <!-- IBT-155 Item Seller's identifier --> </cac:SellersItemIdentification> <cac:StandardItemIdentification> <cbc:ID schemeID="0160">1234567890121</cbc:ID> <!-- IBT-157 Item standard identifier, IBT-157-1 Scheme identifier --> </cac:StandardItemIdentification> <!-- cac:OriginCountry, cbc:IdentificationCode, IBT-159 Item country of origin --> <cac:CommodityClassification> <cbc:ItemClassificationCode listID="MP">43211503</cbc:ItemClassificationCode> <!-- IBT-158 Item classification identifier, IBT-158-1 Scheme identifier --> </cac:CommodityClassification> <cac:ClassifiedTaxCategory> <!-- IBG-30 LINE TAX INFORMATION --> <cbc:ID>S</cbc:ID> <!-- IBT-151 Invoiced item TAX category code --> <cbc:Percent>10</cbc:Percent> <!-- IBT-152 Invoiced item TAX rate --> <!-- cbc:PerUnitAmount, IBT-166 Unit TAX --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-167 Tax Scheme --> </cac:TaxScheme> </cac:ClassifiedTaxCategory> <!-- IBG-32 ITEM ATTRIBUTES --> <cac:AdditionalItemProperty> <cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 Item attribute name --> <cbc:Value>冊</cbc:Value> <!-- IBT-161 Item attribute value --> </cac:AdditionalItemProperty> </cac:Item> <cac:Price> <!-- IBG-29 PRICE DETAILS --> <cbc:PriceAmount currencyID="JPY">500</cbc:PriceAmount> <!-- IBT-146 Item net price --> <cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 Item price base quantity, IBT-150 Item price base quantity unit of measure code --> <cac:AllowanceCharge> <cbc:ChargeIndicator>false</cbc:ChargeIndicator> <!-- Mandatory element. Value must be “false”. --> <cbc:Amount currencyID="JPY">100</cbc:Amount> <!-- IBT-147 Item price discount --> <cbc:BaseAmount currencyID="JPY">600</cbc:BaseAmount> <!-- IBT-148 Item gross price --> </cac:AllowanceCharge> </cac:Price> </cac:InvoiceLine> <cac:InvoiceLine> <!-- IBG-25 INVOICE LINE --> <cbc:ID>3</cbc:ID> <!-- IBT-126 Invoice line identifier --> <!-- cbc:Note, IBT-127 Invoice line note --> <cbc:InvoicedQuantity unitCode="H87">10</cbc:InvoicedQuantity> <!-- IBT-130 Invoiced quantity unit of measure code, IBT-129 Invoiced quantity --> <cbc:LineExtensionAmount currencyID="JPY">3490</cbc:LineExtensionAmount> <!-- IBT-131 Invoice line net amount --> <!-- cbc:AccountingCost, IBT-133 Invoice line Buyer accounting reference --> <cac:InvoicePeriod> <!-- IBG-26 INVOICE LINE PERIOD --> <cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 Invoice line period start date --> <cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 Invoice line period end date --> </cac:InvoicePeriod> <cac:DocumentReference> <!-- IBG-36 LINE DOCUMENT REFERENCE --> <cbc:ID>D001-3</cbc:ID> <!-- IBT-188 Invoice line document identifier --> </cac:DocumentReference> <cac:Item> <!-- IBG-31 ITEM INFORMATION --> <!-- cbc:Description, IBT-154 Item description --> <cbc:Name>検定済教科書(算数)</cbc:Name> <!-- IBT-153 Item name --> <cac:ClassifiedTaxCategory> <!-- IBG-30 LINE TAX INFORMATION --> <cbc:ID>E</cbc:ID> <!-- IBT-151 Invoiced item TAX category code --> <cbc:Percent>0</cbc:Percent> <!-- IBT-152 Invoiced item TAX rate --> <!-- cbc:PerUnitAmount, IBT-166 Unit TAX --> <cac:TaxScheme> <cbc:ID>VAT</cbc:ID> <!-- IBT-167 Tax Scheme --> </cac:TaxScheme> </cac:ClassifiedTaxCategory> <cac:AdditionalItemProperty> <!-- IBG-32 ITEM ATTRIBUTES --> <cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 Item attribute name --> <cbc:Value>冊</cbc:Value> <!-- IBT-161 Item attribute value --> </cac:AdditionalItemProperty> </cac:Item> <cac:Price> <!-- IBG-29 PRICE DETAILS --> <cbc:PriceAmount currencyID="JPY">349</cbc:PriceAmount> <!-- IBT-146 Item net price --> <cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 Item price base quantity, IBT-150 Item price base quantity unit of measure code --> </cac:Price> </cac:InvoiceLine> </Invoice>

Japan PINT Invoice UBL Example.xml