Views: 119

[2022-11-02追記] このテスト方法では、XML文書中のどこに問題があるか分かりません。スタイルシート(XSLT)ファイルの使用方法に問題がありましたので、こちら の記事をお読みください。

前回の記事 で紹介したように今回の公開では、スタイルシート(XSLT)ファイルが追加提供されました。

提供されたスタイルシート(XSLT)ファイルを使用したスキーマトロン検証の方法を紹介します。

実行には、Java環境とXML解析のためのライブラリSaxonが必要です。

1. 実行環境の準備

Javaの実行環境がすでにあることが前提ですが、SOURCEFORGEからオープンソースソフトSaxon XSLT and XQuery Processor Filesをダウンロードしてください。Saxon のライセンス条件については、こちら 。ここで使用しているのは、SaxonJ-HEです。Saxon-HE includes support for published W3C recommendations at the minimum conformance level;

次に、そのファイルを展開して、JP PINT 1.0のサイトからhttps://docs.peppol.eu/poac/jp/pint-jp/resources.zip からダウンロードして展開したpint-jp-resources-devディレクトリを含むディレクトリに配置してください。

$tree > tree.txtで確認すると次のようになっています。

. ├── SaxonHE11-4J │ ├── doc │ │ ├── img │ │ │ ├── logo_crop-mid-blue-background.gif │ │ │ └── saxonica_logo.gif │ │ ├── index.html │ │ └── saxondocs.css │ ├── lib │ │ ├── jline-2.14.6.jar │ │ ├── xmlresolver-4.4.3-data.jar │ │ └── xmlresolver-4.4.3.jar │ ├── notices │ │ ├── JAMESCLARK.txt │ │ ├── JLINE2.txt │ │ └── LICENSE.txt │ ├── saxon-he-11.4.jar │ ├── saxon-he-test-11.4.jar │ └── saxon-he-xqj-11.4.jar ├── pint-jp-resources-dev │ ├── PINT-UBL-validation-shared.html │ ├── common │ │ ├── PINT-UBL-validation-aligned-japan.xslt │ │ ├── PINT-UBL-validation-shared.xslt │ │ └── docs │ │ ├── bis.pdf │ │ ├── compliance.pdf │ │ └── release-notes.pdf │ ├── homepage │ │ ├── bis.html │ │ ├── semantic.html │ │ └── syntax.html │ └── trn-invoice │ ├── codelist │ │ ├── Aligned-TaxCategoryCodes.gc │ │ ├── Aligned-TaxCategoryCodes.yaml │ │ ├── Aligned-TaxExemptionCodes.gc │ │ ├── Aligned-TaxExemptionCodes.yaml │ │ ├── ICD.gc │ │ ├── ICD.yaml │ │ ├── ISO3166.gc │ │ ├── ISO3166.yaml │ │ ├── ISO4217.gc │ │ ├── ISO4217.yaml │ │ ├── MimeCode.gc │ │ ├── MimeCode.yaml │ │ ├── SEPA.gc │ │ ├── SEPA.yaml │ │ ├── UNCL1001-inv.gc │ │ ├── UNCL1001-inv.yaml │ │ ├── UNCL1153.gc │ │ ├── UNCL1153.yaml │ │ ├── UNCL2005.gc │ │ ├── UNCL2005.yaml │ │ ├── UNCL4461.gc │ │ ├── UNCL4461.yaml │ │ ├── UNCL5189.gc │ │ ├── UNCL5189.yaml │ │ ├── UNCL7143.gc │ │ ├── UNCL7143.yaml │ │ ├── UNCL7161.gc │ │ ├── UNCL7161.yaml │ │ ├── UNECERec20.gc │ │ ├── UNECERec20.yaml │ │ ├── eas.gc │ │ └── eas.yaml │ ├── example │ │ ├── Japan PINT Invoice UBL Error.xml │ │ ├── Japan PINT Invoice UBL Example.xml │ │ ├── Japan PINT Invoice UBL Example1-minimum.xml │ │ ├── Japan PINT Invoice UBL Example2-TaxAcctCur.xml │ │ ├── Japan PINT Invoice UBL Example3-SumInv1.xml │ │ ├── Japan PINT Invoice UBL Example4-SumInv2.xml │ │ ├── Japan PINT Invoice UBL Example5-AllowanceCharge.xml │ │ ├── Japan PINT Invoice UBL Example6-CorrInv.xml │ │ ├── Japan PINT Invoice UBL Example7-Return.Quan.ItPr.xml │ │ └── Japan PINT Invoice UBL Example9-SumInv1 and O.xml │ ├── schematron │ │ ├── PINT-UBL-validation-preprocessed.sch │ │ └── PINT-jurisdiction-aligned-rules.sch │ ├── semantic-model.yaml │ └── syntax-binding.yaml └── tree.txt

2. Saxonでスキーマトロン検証

ダウンロードしたファイルの中から次のファイルを対象に検証を行います。

Sharedルールの検証には、次のコマンドを実行します。

java -jar SaxonHE11-4J/saxon-he-11.4.jar "pint-jp-resources-dev/trn-invoice/example/Japan PINT Invoice UBL Example.xml" pint-jp-resources-dev/common/PINT-UBL-validation-shared.xslt > Example.html

コマンド引数は、最初の -jar パラメタで実行ライブラリ saxon-he-11.4.jar を指定し、検証対象のXMLファイルと検証に使用するスタイルシート(XSLT)ファイルを順に指定します。スタイルシート(XSLT)処理結果はHTMLで出力されるので、> Example.htmlで指定します。

検証結果は、Example.htmlにHTMLファイルとして出力されます。Webブラウザで確認すると何も表示されず、異常がないことが確認できます。

pint-jp-resources-dev/trn-invoice/example/Japan PINT Invoice UBL Example.xml

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ccts="urn:un:unece:uncefact:documentation:2" xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDatatypes-2" xmlns:udt="urn:un:unece:uncefact:data:specification:UnqualifiedDataTypesSchemaModule:2" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<!--

Japan common commercial invoice, example

-->

<cbc:UBLVersionID>2.1</cbc:UBLVersionID>

<cbc:CustomizationID>urn:fdc:peppol:jp:billing:3.0</cbc:CustomizationID> <!-- IBT-024 - Specification identifier -->

<cbc:ProfileID>urn:fdc:peppol.eu:2017:poacc:billing:01:1.0</cbc:ProfileID> <!-- IBT-023 - Business process type -->

<cbc:ID>156</cbc:ID> <!-- IBT-001 - Invoice number -->

<cbc:IssueDate>2023-10-24</cbc:IssueDate> <!-- IBT-002 - Invoice issue date -->

<!-- cbc:IssueTime, IBT-168 - Invoice issue time -->

<cbc:DueDate>2023-11-20</cbc:DueDate> <!-- IBT-009 - Payment due date -->

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <!-- IBT-003 - Invoice type code -->

<cbc:Note>Ordered at trade show</cbc:Note> <!-- IBT-022 - Invoice note -->

<!-- cbc:TaxPointDate, IBT-007 - TAX point date -->

<cbc:DocumentCurrencyCode>JPY</cbc:DocumentCurrencyCode> <!-- IBT-005 - Invoice currency code -->

<!-- cbc:TaxCurrencyCode, IBT-006 - Tax accounting currency -->

<cbc:AccountingCost>4217:2323:2323</cbc:AccountingCost> <!-- IBT-019 - Buyer accounting reference -->

<cbc:BuyerReference>0150abc</cbc:BuyerReference> <!-- IBT-010 - Buyer reference -->

<cac:InvoicePeriod> <!-- IBG-14 - INVOICING PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-073 - Invoicing period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-074 - Invoicing period end date -->

<!-- cbc:DescriptionCode, IBT-008 - TAX point date code -->

</cac:InvoicePeriod>

<cac:OrderReference>

<cbc:ID>O-998877</cbc:ID> <!-- IBT-013 - Purchase order reference -->

<cbc:SalesOrderID>SO-12343</cbc:SalesOrderID> <!-- IBT-014 - Sales order reference -->

</cac:OrderReference>

<cac:BillingReference> <!-- IBG-03 - PRECEDING INVOICE REFERENCE -->

<cac:InvoiceDocumentReference>

<cbc:ID>123</cbc:ID> <!-- IBT-025 - Preceding Invoice reference -->

<cbc:IssueDate>2023-10-20</cbc:IssueDate> <!-- IBT-026 - Preceding Invoice issue date -->

</cac:InvoiceDocumentReference>

</cac:BillingReference>

<cac:DespatchDocumentReference>

<cbc:ID>despadv-3</cbc:ID> <!-- IBT-016 - Despatch advice reference -->

</cac:DespatchDocumentReference>

<cac:ReceiptDocumentReference>

<cbc:ID>resadv-1</cbc:ID> <!-- IBT-015 - Receiving advice reference -->

</cac:ReceiptDocumentReference>

<cac:OriginatorDocumentReference>

<cbc:ID>ppid-123</cbc:ID> <!-- IBT-017 - Tender or lot reference -->

</cac:OriginatorDocumentReference>

<cac:ContractDocumentReference>

<cbc:ID>framework no 1</cbc:ID> <!-- IBT-012 - Contract reference -->

</cac:ContractDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID schemeID="ABT">DR35141</cbc:ID> <!-- IBT-018 - Invoiced object identifier, IBT-018-1 - The identification scheme identifier of the Invoiced object identifier -->

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-018 qualifier -->

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>doc1</cbc:ID> <!-- IBT-122 - Supporting document reference -->

<cbc:DocumentDescription>Usage summary</cbc:DocumentDescription> <!-- IBT-123 - Supporting document description -->

<cac:Attachment>

<cbc:EmbeddedDocumentBinaryObject filename="report.csv" mimeCode="text/csv">aHR0cHM6Ly90ZXN0LXZlZmEuZGlmaS5uby9wZXBwb2xiaXMvcG9hY2MvYmlsbGluZy8zLjAvYmlzLw==</cbc:EmbeddedDocumentBinaryObject>

<!-- IBT-125 - Attached document, IBT-125-1 - Attached document Mime code, IBT-125-2 - Attached document Filename -->

<cac:ExternalReference>

<cbc:URI>http://www.salescompany.com/summary001.html</cbc:URI> <!-- IBT-124 - External document location -->

</cac:ExternalReference>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>doc2</cbc:ID> <!-- IBT-122 - Supporting document reference -->

<cbc:DocumentDescription>Usage breakdown</cbc:DocumentDescription> <!-- IBT-123 - Supporting document description -->

<cac:Attachment>

<cac:ExternalReference>

<cbc:URI>http://www.salescompany.com/breakdown001.html</cbc:URI> <!-- IBT-124 - External document location -->

</cac:ExternalReference>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:ProjectReference>

<cbc:ID>project333</cbc:ID> <!-- IBT-011 - Project reference -->

</cac:ProjectReference>

<cac:AccountingSupplierParty> <!-- IBG-04 - SELLER -->

<cac:Party>

<cbc:EndpointID schemeID="0188">1234567890123</cbc:EndpointID> <!-- IBT-034 - Seller electronic address, IBT-034-1 - Scheme identifier -->

<cac:PartyIdentification>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> <!-- IBT-029 Seller identifier, IBT-029-1 Scheme identifier -->

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>株式会社 〇〇商事</cbc:Name> <!-- IBT-028 - Seller trading name -->

</cac:PartyName>

<cac:PostalAddress> <!-- IBG-05 - SELLER POSTAL ADDRESS -->

<cbc:StreetName>四谷4-29-X</cbc:StreetName> <!-- IBT-035 - Seller address line 1 -->

<cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName> <!-- IBT-036 - Seller address line 2 -->

<cbc:CityName>新宿区</cbc:CityName> <!-- IBT-037 - Seller city -->

<cbc:PostalZone>1600044</cbc:PostalZone> <!-- IBT-038 - Seller post code -->

<cbc:CountrySubentity>東京都</cbc:CountrySubentity> <!-- IBT-039 - Seller country subdivision -->

<cac:AddressLine>

<cbc:Line>Third address line</cbc:Line> <!-- IBT-162 - Seller address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-040 - Seller country code -->

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>T1234567890123</cbc:CompanyID> <!-- IBT-031 - Seller TAX identifier -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-031, qualifier -->

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>株式会社 〇〇商事</cbc:RegistrationName> <!-- IBT-027 - Seller name -->

<cbc:CompanyID schemeID="0188">1234567890123</cbc:CompanyID> <!-- IBT-030 - Seller legal registration identifier, IBT-030-1 - Scheme identifier -->

<cbc:CompanyLegalForm>Private Limited Company</cbc:CompanyLegalForm> <!-- IBT-033 - Seller additional legal information -->

</cac:PartyLegalEntity>

<cac:Contact> <!-- IBG-06 - SELLER CONTACT -->

<cbc:Name>青木 志郎</cbc:Name> <!-- IBT-041 - Seller contact point -->

<cbc:Telephone>03-3xxx-0001</cbc:Telephone> <!-- IBT-042 - Seller contact telephone number -->

<cbc:ElectronicMail>shirou_aoki@〇〇co.jp</cbc:ElectronicMail> <!-- IBT-043 - Seller contact email address -->

</cac:Contact>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty> <!-- IBG-07 - BUYER -->

<cac:Party>

<cbc:EndpointID schemeID="0188">3210987654321</cbc:EndpointID> <!-- IBT-049 - Buyer electronic address, IBT-049-1 - Scheme identifier -->

<cac:PartyIdentification>

<cbc:ID schemeID="0147">654321:000321:0147:1</cbc:ID> <!-- IBT-046 - Buyer identifier, IBT-046-1 - Scheme identifier -->

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>株式会社 〇〇物産</cbc:Name> <!-- IBT-045 - Buyer trading name -->

</cac:PartyName>

<cac:PostalAddress> <!-- IBG-08 - BUYER POSTAL ADDRESS -->

<cbc:StreetName>北区</cbc:StreetName> <!-- IBT-050 - Buyer address line 1 -->

<cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName> <!-- IBT-051 - Buyer address line 2 -->

<cbc:CityName>札幌市</cbc:CityName> <!-- IBT-052 - Buyer city -->

<cbc:PostalZone>0010012</cbc:PostalZone> <!-- IBT-053 - Buyer post code -->

<cbc:CountrySubentity>北海道</cbc:CountrySubentity> <!-- IBT-054 - Buyer country subdivision -->

<cac:AddressLine>

<cbc:Line>Third line</cbc:Line> <!-- IBT-163 - Buyer address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-055 - Buyer country code -->

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>>T3210987654321</cbc:CompanyID> <!-- IBT-048 - Buyer TAX identifier -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-048, qualifier -->

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>株式会社 〇〇物産</cbc:RegistrationName> <!-- IBT-044 - Buyer name -->

<cbc:CompanyID schemeID="0147">654321:000321:0147:1</cbc:CompanyID> <!-- IBT-047 - Buyer legal registration identifier, IBT-047-1 - Scheme identifier -->

</cac:PartyLegalEntity>

<cac:Contact> <!-- IBG-09 - BUYER CONTACT -->

<cbc:Name>株式会社 〇〇物産</cbc:Name> <!-- IBT-056 - Buyer contact point -->

<cbc:Telephone>011-757-1xxx</cbc:Telephone> <!-- IBT-057 - Buyer contact telephone number -->

<cbc:ElectronicMail>purchaser@oobussan.co.jp</cbc:ElectronicMail> <!-- IBT-058 - Buyer contact email address -->

</cac:Contact>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PayeeParty> <!-- IBG-10 - PAYEE -->

<cac:PartyIdentification>

<cbc:ID schemeID="0147">123456:000124:0147:1</cbc:ID> <!-- IBT-060 - Payee identifier, IBT-060-1 - Scheme identifier, must not be same as ibt-029 -->

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>Payee party</cbc:Name> <!-- IBT-059 - Payee name, must not be same as ibt-028 -->

</cac:PartyName>

<cac:PartyLegalEntity>

<cbc:CompanyID schemeID="0147">123456:000124:0147:1</cbc:CompanyID> <!-- IBT-061 - Payee legal registration identifier, IBT-061-1 - Scheme identifier -->

</cac:PartyLegalEntity>

</cac:PayeeParty>

<cac:TaxRepresentativeParty> <!-- IBG-11 - SELLER TAX REPRESENTATIVE PARTY -->

<cac:PartyName>

<cbc:Name>TaxRepresentative Name</cbc:Name> <!-- IBT-062 - Seller tax representative name -->

</cac:PartyName>

<cac:PostalAddress> <!-- IBG-12 - SELLER TAX REPRESENTATIVE POSTAL ADDRESS -->

<cbc:StreetName>四谷4-32-X</cbc:StreetName> <!-- IBT-064 - Tax representative address line 1 -->

<cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName> <!-- IBT-065 - Tax representative address line 2 -->

<cbc:CityName>新宿区</cbc:CityName> <!-- IBT-066 - Tax representative city -->

<cbc:PostalZone>1600044</cbc:PostalZone> <!-- IBT-067 - Tax representative post code -->

<cbc:CountrySubentity>東京都</cbc:CountrySubentity> <!-- IBT-068 - Tax representative country subdivision -->

<cac:AddressLine>

<cbc:Line>Third line</cbc:Line> <!-- IBT-164 - Tax representative address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-069 - Tax representative country code -->

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>T7654321098765</cbc:CompanyID> <!-- IBT-063 - Seller tax representative TAX identifier -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-063, qualifier -->

</cac:TaxScheme>

</cac:PartyTaxScheme>

</cac:TaxRepresentativeParty>

<cac:Delivery> <!-- IBG-13 - DELIVERY INFORMATION -->

<cbc:ActualDeliveryDate>2023-10-18</cbc:ActualDeliveryDate> <!-- IBT-072 - Actual delivery date -->

<cac:DeliveryLocation>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> <!-- IBT-071 - Deliver to location identifier, IBT-071-1 - Scheme identifier -->

<cac:Address> <!-- IBG-15 - DELIVER TO ADDRESS -->

<cbc:StreetName>北区</cbc:StreetName> <!-- IBT-075 - Deliver to address line 1 -->

<cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName> <!-- IBT-076 - Deliver to address line 2 -->

<cbc:CityName>札幌市</cbc:CityName> <!-- IBT-077 - Deliver to city -->

<cbc:PostalZone>0010012</cbc:PostalZone> <!-- IBT-078 - Deliver to post code -->

<cbc:CountrySubentity>北海道</cbc:CountrySubentity> <!-- IBT-079 - Deliver to country subdivision -->

<cac:AddressLine>

<cbc:Line>Gate 15</cbc:Line> <!-- IBT-165 - Deliver to address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-080 - Deliver to country code -->

</cac:Country>

</cac:Address>

</cac:DeliveryLocation>

<cac:DeliveryParty>

<cac:PartyName>

<cbc:Name>株式会社 〇〇物産 札幌支社</cbc:Name> <!-- IBT-070 - Deliver to party name -->

</cac:PartyName>

</cac:DeliveryParty>

</cac:Delivery>

<cac:PaymentMeans> <!-- IBG-16 - PAYMENT INSTRUCTIONS -->

<!-- cbc:ID, IBT-178 - Payment Instructions ID -->

<cbc:PaymentMeansCode name="Credit transfer">30</cbc:PaymentMeansCode> <!-- IBT-081 - Payment means type code, IBT-082 - Payment means text -->

<!-- cbc:PaymentID, IBT-083 - Remittance information -->

<!-- cac:CardAccount, IBG-18 - PAYMENT CARD INFORMATION -->

<cac:PayeeFinancialAccount> <!-- IBG-17 - CREDIT TRANSFER -->

<cbc:ID>1234:567:1:3242394</cbc:ID> <!-- IBT-084 - Payment account identifier, IBT-084-1 - Scheme identifier -->

<cbc:Name>カ)マルマルシヨウジ</cbc:Name> <!-- IBT-085 - Payment account name -->

<!-- cac:FinancialInstitutionBranch, cbc:ID, IBT-086 - Payment service provider identifier -->

<!-- cac:FinancialInstitutionBranch, cac:PostalAddress, IBG-34 - FINANCIAL INSTITUTION ADDRESS -->

</cac:PayeeFinancialAccount>

<!-- cac:PaymentMandate, IBG-19 - DIRECT DEBIT -->

</cac:PaymentMeans>

<cac:PaymentTerms> <!-- IBG-33 - INVOICE TERMS -->

<!-- cbc:PaymentMeansID, IBT-187 - Terms payment instructions ID -->

<cbc:Note>月末締め翌月20日払い, 銀行手数料振込人負担</cbc:Note> <!-- IBT-020 - Payment terms -->

<!-- cbc:Amount, IBT-176 - Terms amount-->

<!-- cbc:InstallmentDueDate, IBT-177 - Terms installment due date -->

</cac:PaymentTerms>

<!-- cac:PrepaidPayment, IBG-35 - Paid amounts -->

<cac:AllowanceCharge> <!-- IBG-20 - DOCUMENT LEVEL ALLOWANCES -->

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-098 - Document level allowance reason code -->

<cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-097 - Document level allowance reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-094 - Document level allowance percentage -->

<cbc:Amount currencyID="JPY">179</cbc:Amount> <!-- IBT-092 - Document level allowance amount -->

<!-- cbc:BaseAmount, IBT-093 - Document level allowance base amount -->

<cac:TaxCategory>

<cbc:ID>S</cbc:ID> <!-- IBT-095 - Document level allowance TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-096 - Document level allowance TAX rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-095, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:AllowanceCharge> <!-- IBG-21 - DOCUMENT LEVEL CHARGES -->

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>FC</cbc:AllowanceChargeReasonCode> <!-- IBT-105 - Document level charge reason code -->

<cbc:AllowanceChargeReason>配送サービス</cbc:AllowanceChargeReason> <!-- IBT-104 - Document level charge reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-101 - Document level charge percentage -->

<cbc:Amount currencyID="JPY">7679</cbc:Amount> <!-- IBT-099 - Document level charge amount -->

<!-- cbc:BaseAmount, IBT-100 - Document level charge base amount -->

<cac:TaxCategory>

<cbc:ID>S</cbc:ID> <!-- IBT-102 - Document level charge TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-103 - Document level charge TAX rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-102, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="JPY">26000</cbc:TaxAmount> <!-- IBT-110 - Invoice total TAX amount -->

<cac:TaxSubtotal> <!-- IBG-23 - TAX BREAKDOWN -->

<cbc:TaxableAmount currencyID="JPY">260000</cbc:TaxableAmount> <!-- IBT-116 - TAX category taxable amount -->

<cbc:TaxAmount currencyID="JPY">26000</cbc:TaxAmount> <!-- IBT-117 - TAX category tax amount -->

<cac:TaxCategory>

<cbc:ID>S</cbc:ID> <!-- IBT-118 - TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-119 - TAX category rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-118, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

<cac:TaxSubtotal> <!-- IBG-23 - TAX BREAKDOWN -->

<cbc:TaxableAmount currencyID="JPY">3490</cbc:TaxableAmount> <!-- IBT-116 - TAX category taxable amount -->

<cbc:TaxAmount currencyID="JPY">0</cbc:TaxAmount> <!-- IBT-117 - TAX category tax amount -->

<cac:TaxCategory>

<cbc:ID>E</cbc:ID> <!-- IBT-118 - TAX category code -->

<cbc:Percent>0</cbc:Percent> <!-- IBT-119 - TAX category rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-118, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal> <!-- IBG-22 - DOCUMENT TOTALS -->

<cbc:LineExtensionAmount currencyID="JPY">255990</cbc:LineExtensionAmount> <!-- IBT-106 - Sum of Invoice line net amount -->

<cbc:TaxExclusiveAmount currencyID="JPY">263490</cbc:TaxExclusiveAmount> <!-- IBT-109 - Invoice total amount without TAX -->

<cbc:TaxInclusiveAmount currencyID="JPY">289490</cbc:TaxInclusiveAmount> <!-- IBT-112 - Invoice total amount with TAX -->

<cbc:AllowanceTotalAmount currencyID="JPY">179</cbc:AllowanceTotalAmount> <!-- IBT-107 - Sum of allowances on document level -->

<cbc:ChargeTotalAmount currencyID="JPY">7679</cbc:ChargeTotalAmount> <!-- IBT-108 - Sum of charges on document level -->

<cbc:PrepaidAmount currencyID="JPY">0</cbc:PrepaidAmount> <!-- IBT-113 - Paid amount -->

<cbc:PayableRoundingAmount currencyID="JPY">0</cbc:PayableRoundingAmount> <!-- IBT-114 - Rounding amount -->

<cbc:PayableAmount currencyID="JPY">289490</cbc:PayableAmount> <!-- IBT-115 - Amount due for payment -->

</cac:LegalMonetaryTotal>

<cac:InvoiceLine> <!-- IBG-25 - INVOICE LINE -->

<cbc:ID>1</cbc:ID> <!-- IBT-126 - Invoice line identifier -->

<cbc:Note>The equipment has 3 year warranty.</cbc:Note> <!-- IBT-127 - Invoice line note -->

<cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-129 - Invoiced quantity, IBT-130 - Invoiced quantity unit of measure code -->

<cbc:LineExtensionAmount currencyID="JPY">250000</cbc:LineExtensionAmount> <!-- IBT-131 - Invoice line net amount -->

<cbc:AccountingCost>Cost id 654</cbc:AccountingCost> <!-- IBT-133 - Invoice line Buyer accounting reference -->

<cac:InvoicePeriod> <!-- IBG-26 - INVOICE LINE PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 - Invoice line period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 - Invoice line period end date -->

</cac:InvoicePeriod>

<cac:OrderLineReference>

<cbc:LineID>1</cbc:LineID> <!-- IBT-132 - Referenced purchase order line reference -->

<cac:OrderReference>

<cbc:ID>1</cbc:ID> <!-- IBT-183 - Purchase order reference -->

</cac:OrderReference>

</cac:OrderLineReference>

<cac:DespatchLineReference>

<cbc:LineID>010</cbc:LineID>

<cac:DocumentReference>

<cbc:ID>789</cbc:ID> <!-- IBT-184 - Despatch advice reference -->

</cac:DocumentReference>

</cac:DespatchLineReference>

<cac:DocumentReference> <!-- IBG-36 - LINE DOCUMENT REFERENCE -->

<cbc:ID>D001-1</cbc:ID> <!-- IBT-188 - Invoice line document identifier -->

<!-- cbc:DocumentTypeCode, IBT-189 - Document type code -->

</cac:DocumentReference>

<cac:DocumentReference>

<cbc:ID schemeID="ABZ">AB-123</cbc:ID> <!-- IBT-128 - Invoice line object identifier, IBT-128-1 - Scheme identifier -->

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-128, qualifier -->

</cac:DocumentReference>

<cac:AllowanceCharge> <!-- IBG-27 - INVOICE LINE ALLOWANCES -->

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-140 - Invoice line allowance reason code -->

<cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-139 - Invoice line allowance reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-138 - Invoice line allowance percentage -->

<cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-136 - Invoice line allowance amount -->

<!-- cbc:BaseAmount, IBT-137 - Invoice line allowance base amount -->

</cac:AllowanceCharge>

<cac:AllowanceCharge> <!-- IBG-28 - INVOICE LINE CHARGES -->

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode> <!-- IBT-145 - Invoice line charge reason code -->

<cbc:AllowanceChargeReason>クリーニング</cbc:AllowanceChargeReason> <!-- IBT-144 - Invoice line charge reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-143 - Invoice line charge percentage -->

<cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-141 - Invoice line charge amount -->

<!-- cbc:BaseAmount, IBT-142 - Invoice line charge base amount-->

</cac:AllowanceCharge>

<cac:Item> <!-- IBG-31 - ITEM INFORMATION -->

<!-- cbc:Description, IBT-154 - Item description -->

<cbc:Name>デスクチェア</cbc:Name> <!-- IBT-153 - Item name -->

<cac:BuyersItemIdentification>

<cbc:ID>b-13214</cbc:ID> <!-- IBT-156 - Item Buyer's identifier -->

</cac:BuyersItemIdentification>

<cac:SellersItemIdentification>

<cbc:ID>97iugug876</cbc:ID> <!-- IBT-155 - Item Seller's identifier -->

</cac:SellersItemIdentification>

<cac:StandardItemIdentification>

<cbc:ID schemeID="0160">4503994155481</cbc:ID> <!-- IBT-157 - Item standard identifier -->

</cac:StandardItemIdentification>

<cac:OriginCountry>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-159 - Item country of origin -->

</cac:OriginCountry>

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="TST" listVersionID="19.05.01">86776</cbc:ItemClassificationCode>

<!-- IBT-158 - Item classification identifier, IBT-158-1 - Scheme identifier, IBT-158-2 - Scheme version identifier -->

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory> <!-- IBG-30 - LINE TAX INFORMATION -->

<cbc:ID>S</cbc:ID> <!-- IBT-151 - Invoiced item TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-152 - Invoiced item TAX rate -->

<!-- cbc:PerUnitAmount, IBT-166 - Unit TAX -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-167 - Tax Scheme -->

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:AdditionalItemProperty> <!-- IBG-32 - ITEM ATTRIBUTES -->

<cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 - Item attribute name -->

<cbc:Value>脚</cbc:Value> <!-- IBT-161 - Item attribute value -->

</cac:AdditionalItemProperty>

</cac:Item>

<cac:Price> <!-- IBG-29 - PRICE DETAILS -->

<cbc:PriceAmount currencyID="JPY">50000</cbc:PriceAmount> <!-- IBT-146 - Item net price -->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 - Item price base quantity, IBT-150 - Item price base quantity unit of measure code -->

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine> <!-- IBG-25 - INVOICE LINE -->

<cbc:ID>2</cbc:ID> <!-- IBT-126 - Invoice line identifier -->

<!-- cbc:Note, IBT-127 - Invoice line note -->

<cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-130 - Invoiced quantity unit of measure code, IBT-129 - Invoiced quantity -->

<cbc:LineExtensionAmount currencyID="JPY">2500</cbc:LineExtensionAmount> <!-- IBT-131 - Invoice line net amount -->

<!-- cbc:AccountingCost, IBT-133 - Invoice line Buyer accounting reference -->

<cac:InvoicePeriod> <!-- IBG-26 - INVOICE LINE PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 - Invoice line period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 - Invoice line period end date -->

</cac:InvoicePeriod>

<cac:DocumentReference> <!-- IBG-36 - LINE DOCUMENT REFERENCE -->

<cbc:ID>D001-2</cbc:ID> <!-- IBT-188 - Invoice line document identifier -->

<!-- cbc:DocumentTypeCode, IBT-189 - Document type code -->

</cac:DocumentReference>

<cac:Item> <!-- IBG-31 - ITEM INFORMATION -->

<!-- cbc:Description, IBT-154 - Item description -->

<cbc:Name>コピー用紙(A4)</cbc:Name> <!-- IBT-153 - Item name -->

<!-- cac:BuyersItemIdentification, cbc:ID, IBT-156 - Item Buyer's identifier -->

<cac:SellersItemIdentification>

<cbc:ID>Item3</cbc:ID> <!-- IBT-155 - Item Seller's identifier -->

</cac:SellersItemIdentification>

<cac:StandardItemIdentification>

<cbc:ID schemeID="0160">1234567890121</cbc:ID> <!-- IBT-157 - Item standard identifier, IBT-157-1 Scheme identifier -->

</cac:StandardItemIdentification>

<!-- cac:OriginCountry, cbc:IdentificationCode, IBT-159 - Item country of origin -->

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="MP">43211503</cbc:ItemClassificationCode> <!-- IBT-158 - Item classification identifier, IBT-158-1 - Scheme identifier -->

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory> <!-- IBG-30 - LINE TAX INFORMATION -->

<cbc:ID>S</cbc:ID> <!-- IBT-151 - Invoiced item TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-152 - Invoiced item TAX rate -->

<!-- cbc:PerUnitAmount, IBT-166 - Unit TAX -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-167 - Tax Scheme -->

</cac:TaxScheme>

</cac:ClassifiedTaxCategory> <!-- IBG-32 - ITEM ATTRIBUTES -->

<cac:AdditionalItemProperty>

<cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 - Item attribute name -->

<cbc:Value>冊</cbc:Value> <!-- IBT-161 - Item attribute value -->

</cac:AdditionalItemProperty>

</cac:Item>

<cac:Price> <!-- IBG-29 - PRICE DETAILS -->

<cbc:PriceAmount currencyID="JPY">500</cbc:PriceAmount> <!-- IBT-146 - Item net price -->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 - Item price base quantity, IBT-150 - Item price base quantity unit of measure code -->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator> <!-- Mandatory element. Value must be “false”. -->

<cbc:Amount currencyID="JPY">100</cbc:Amount> <!-- IBT-147 - Item price discount -->

<cbc:BaseAmount currencyID="JPY">600</cbc:BaseAmount> <!-- IBT-148 - Item gross price -->

</cac:AllowanceCharge>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine> <!-- IBG-25 - INVOICE LINE -->

<cbc:ID>3</cbc:ID> <!-- IBT-126 - Invoice line identifier -->

<!-- cbc:Note, IBT-127 - Invoice line note -->

<cbc:InvoicedQuantity unitCode="H87">10</cbc:InvoicedQuantity> <!-- IBT-130 - Invoiced quantity unit of measure code, IBT-129 - Invoiced quantity -->

<cbc:LineExtensionAmount currencyID="JPY">3490</cbc:LineExtensionAmount> <!-- IBT-131 - Invoice line net amount -->

<!-- cbc:AccountingCost, IBT-133 - Invoice line Buyer accounting reference -->

<cac:InvoicePeriod> <!-- IBG-26 - INVOICE LINE PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 - Invoice line period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 - Invoice line period end date -->

</cac:InvoicePeriod>

<cac:DocumentReference> <!-- IBG-36 - LINE DOCUMENT REFERENCE -->

<cbc:ID>D001-3</cbc:ID> <!-- IBT-188 - Invoice line document identifier -->

</cac:DocumentReference>

<cac:Item> <!-- IBG-31 - ITEM INFORMATION -->

<!-- cbc:Description, IBT-154 - Item description -->

<cbc:Name>検定済教科書(算数)</cbc:Name> <!-- IBT-153 - Item name -->

<cac:ClassifiedTaxCategory> <!-- IBG-30 - LINE TAX INFORMATION -->

<cbc:ID>E</cbc:ID> <!-- IBT-151 - Invoiced item TAX category code -->

<cbc:Percent>0</cbc:Percent> <!-- IBT-152 - Invoiced item TAX rate -->

<!-- cbc:PerUnitAmount, IBT-166 - Unit TAX -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-167 - Tax Scheme -->

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:AdditionalItemProperty> <!-- IBG-32 - ITEM ATTRIBUTES -->

<cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 - Item attribute name -->

<cbc:Value>冊</cbc:Value> <!-- IBT-161 - Item attribute value -->

</cac:AdditionalItemProperty>

</cac:Item>

<cac:Price> <!-- IBG-29 - PRICE DETAILS -->

<cbc:PriceAmount currencyID="JPY">349</cbc:PriceAmount> <!-- IBT-146 - Item net price -->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 - Item price base quantity, IBT-150 - Item price base quantity unit of measure code -->

</cac:Price>

</cac:InvoiceLine>

</Invoice>ダウンロードしたファイルに含まれている次のデジタルインボイスにエラーが発生するよう改変した次のファイルを対象として検証します。

java -jar SaxonHE11-4J/saxon-he-11.4.jar "pint-jp-resources-dev/trn-invoice/example/Japan PINT Invoice UBL Error.xml" pint-jp-resources-dev/common/PINT-UBL-validation-shared.xslt > Error.html

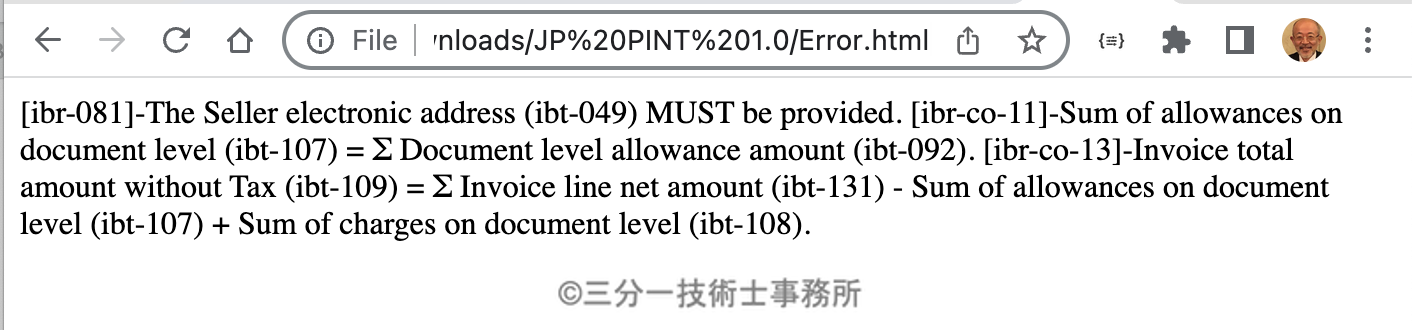

検証結果は、Error.htmlにHTMLファイルとして出力されます。Webブラウザで確認するとエラーメッセージが表示さていますので、異常があることが確認できます。

pint-jp-resources-dev/trn-invoice/example/Japan PINT Invoice UBL Error.xml

<?xml version="1.0" encoding="UTF-8"?>

<Invoice xmlns="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" xmlns:cac="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" xmlns:cbc="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" xmlns:ccts="urn:un:unece:uncefact:documentation:2" xmlns:ext="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2" xmlns:qdt="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDatatypes-2" xmlns:udt="urn:un:unece:uncefact:data:specification:UnqualifiedDataTypesSchemaModule:2" xmlns:xsd="http://www.w3.org/2001/XMLSchema" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance">

<!--

Japan common commercial invoice, example

-->

<cbc:UBLVersionID>2.1</cbc:UBLVersionID>

<cbc:CustomizationID>urn:fdc:peppol:jp:billing:3</cbc:CustomizationID> <!-- IBT-024 - Specification identifier -->

<cbc:ProfileID>urn:fdc:peppol.eu:2017:poacc:billing:01:1.0</cbc:ProfileID> <!-- IBT-023 - Business process type -->

<cbc:ID>156</cbc:ID> <!-- IBT-001 - Invoice number -->

<cbc:IssueDate>2023-10-24</cbc:IssueDate> <!-- IBT-002 - Invoice issue date -->

<!-- cbc:IssueTime, IBT-168 - Invoice issue time -->

<cbc:DueDate>2023-11-20</cbc:DueDate> <!-- IBT-009 - Payment due date -->

<cbc:InvoiceTypeCode>380</cbc:InvoiceTypeCode> <!-- IBT-003 - Invoice type code -->

<cbc:Note>Ordered at trade show</cbc:Note> <!-- IBT-022 - Invoice note -->

<!-- cbc:TaxPointDate, IBT-007 - TAX point date -->

<cbc:DocumentCurrencyCode>JPY</cbc:DocumentCurrencyCode> <!-- IBT-005 - Invoice currency code -->

<!-- cbc:TaxCurrencyCode, IBT-006 - Tax accounting currency -->

<cbc:AccountingCost>4217:2323:2323</cbc:AccountingCost> <!-- IBT-019 - Buyer accounting reference -->

<cbc:BuyerReference>0150abc</cbc:BuyerReference> <!-- IBT-010 - Buyer reference -->

<cac:InvoicePeriod> <!-- IBG-14 - INVOICING PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-073 - Invoicing period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-074 - Invoicing period end date -->

<!-- cbc:DescriptionCode, IBT-008 - TAX point date code -->

</cac:InvoicePeriod>

<cac:OrderReference>

<cbc:ID>O-998877</cbc:ID> <!-- IBT-013 - Purchase order reference -->

<cbc:SalesOrderID>SO-12343</cbc:SalesOrderID> <!-- IBT-014 - Sales order reference -->

</cac:OrderReference>

<cac:BillingReference> <!-- IBG-03 - PRECEDING INVOICE REFERENCE -->

<cac:InvoiceDocumentReference>

<cbc:ID>123</cbc:ID> <!-- IBT-025 - Preceding Invoice reference -->

<cbc:IssueDate>2023-10-20</cbc:IssueDate> <!-- IBT-026 - Preceding Invoice issue date -->

</cac:InvoiceDocumentReference>

</cac:BillingReference>

<cac:DespatchDocumentReference>

<cbc:ID>despadv-3</cbc:ID> <!-- IBT-016 - Despatch advice reference -->

</cac:DespatchDocumentReference>

<cac:ReceiptDocumentReference>

<cbc:ID>resadv-1</cbc:ID> <!-- IBT-015 - Receiving advice reference -->

</cac:ReceiptDocumentReference>

<cac:OriginatorDocumentReference>

<cbc:ID>ppid-123</cbc:ID> <!-- IBT-017 - Tender or lot reference -->

</cac:OriginatorDocumentReference>

<cac:ContractDocumentReference>

<cbc:ID>framework no 1</cbc:ID> <!-- IBT-012 - Contract reference -->

</cac:ContractDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID schemeID="ABT">DR35141</cbc:ID> <!-- IBT-018 - Invoiced object identifier, IBT-018-1 - The identification scheme identifier of the Invoiced object identifier -->

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-018 qualifier -->

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>doc1</cbc:ID> <!-- IBT-122 - Supporting document reference -->

<cbc:DocumentDescription>Usage summary</cbc:DocumentDescription> <!-- IBT-123 - Supporting document description -->

<cac:Attachment>

<cbc:EmbeddedDocumentBinaryObject filename="report.csv" mimeCode="text/csv">aHR0cHM6Ly90ZXN0LXZlZmEuZGlmaS5uby9wZXBwb2xiaXMvcG9hY2MvYmlsbGluZy8zLjAvYmlzLw==</cbc:EmbeddedDocumentBinaryObject>

<!-- IBT-125 - Attached document, IBT-125-1 - Attached document Mime code, IBT-125-2 - Attached document Filename -->

<cac:ExternalReference>

<cbc:URI>http://www.salescompany.com/summary001.html</cbc:URI> <!-- IBT-124 - External document location -->

</cac:ExternalReference>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:AdditionalDocumentReference>

<cbc:ID>doc2</cbc:ID> <!-- IBT-122 - Supporting document reference -->

<cbc:DocumentDescription>Usage breakdown</cbc:DocumentDescription> <!-- IBT-123 - Supporting document description -->

<cac:Attachment>

<cac:ExternalReference>

<cbc:URI>http://www.salescompany.com/breakdown001.html</cbc:URI> <!-- IBT-124 - External document location -->

</cac:ExternalReference>

</cac:Attachment>

</cac:AdditionalDocumentReference>

<cac:ProjectReference>

<cbc:ID>project333</cbc:ID> <!-- IBT-011 - Project reference -->

</cac:ProjectReference>

<cac:AccountingSupplierParty> <!-- IBG-04 - SELLER -->

<cac:Party>

<!-- cbc:EndpointID schemeID="0188">1234567890123</cbc:EndpointID> IBT-034 - Seller electronic address, IBT-034-1 - Scheme identifier -->

<cac:PartyIdentification>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> <!-- IBT-029 Seller identifier, IBT-029-1 Scheme identifier -->

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>株式会社 〇〇商事</cbc:Name> <!-- IBT-028 - Seller trading name -->

</cac:PartyName>

<cac:PostalAddress> <!-- IBG-05 - SELLER POSTAL ADDRESS -->

<cbc:StreetName>四谷4-29-X</cbc:StreetName> <!-- IBT-035 - Seller address line 1 -->

<cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName> <!-- IBT-036 - Seller address line 2 -->

<cbc:CityName>新宿区</cbc:CityName> <!-- IBT-037 - Seller city -->

<cbc:PostalZone>1600044</cbc:PostalZone> <!-- IBT-038 - Seller post code -->

<cbc:CountrySubentity>東京都</cbc:CountrySubentity> <!-- IBT-039 - Seller country subdivision -->

<cac:AddressLine>

<cbc:Line>Third address line</cbc:Line> <!-- IBT-162 - Seller address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-040 - Seller country code -->

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>T1234567890123</cbc:CompanyID> <!-- IBT-031 - Seller TAX identifier -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-031, qualifier -->

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>株式会社 〇〇商事</cbc:RegistrationName> <!-- IBT-027 - Seller name -->

<cbc:CompanyID schemeID="0188">1234567890123</cbc:CompanyID> <!-- IBT-030 - Seller legal registration identifier, IBT-030-1 - Scheme identifier -->

<cbc:CompanyLegalForm>Private Limited Company</cbc:CompanyLegalForm> <!-- IBT-033 - Seller additional legal information -->

</cac:PartyLegalEntity>

<cac:Contact> <!-- IBG-06 - SELLER CONTACT -->

<cbc:Name>青木 志郎</cbc:Name> <!-- IBT-041 - Seller contact point -->

<cbc:Telephone>03-3xxx-0001</cbc:Telephone> <!-- IBT-042 - Seller contact telephone number -->

<cbc:ElectronicMail>shirou_aoki@〇〇co.jp</cbc:ElectronicMail> <!-- IBT-043 - Seller contact email address -->

</cac:Contact>

</cac:Party>

</cac:AccountingSupplierParty>

<cac:AccountingCustomerParty> <!-- IBG-07 - BUYER -->

<cac:Party>

<cbc:EndpointID schemeID="0188">3210987654321</cbc:EndpointID> <!-- IBT-049 - Buyer electronic address, IBT-049-1 - Scheme identifier -->

<cac:PartyIdentification>

<cbc:ID schemeID="0147">654321:000321:0147:1</cbc:ID> <!-- IBT-046 - Buyer identifier, IBT-046-1 - Scheme identifier -->

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>株式会社 〇〇物産</cbc:Name> <!-- IBT-045 - Buyer trading name -->

</cac:PartyName>

<cac:PostalAddress> <!-- IBG-08 - BUYER POSTAL ADDRESS -->

<cbc:StreetName>北区</cbc:StreetName> <!-- IBT-050 - Buyer address line 1 -->

<cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName> <!-- IBT-051 - Buyer address line 2 -->

<cbc:CityName>札幌市</cbc:CityName> <!-- IBT-052 - Buyer city -->

<cbc:PostalZone>0010012</cbc:PostalZone> <!-- IBT-053 - Buyer post code -->

<cbc:CountrySubentity>北海道</cbc:CountrySubentity> <!-- IBT-054 - Buyer country subdivision -->

<cac:AddressLine>

<cbc:Line>Third line</cbc:Line> <!-- IBT-163 - Buyer address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-055 - Buyer country code -->

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>>T3210987654321</cbc:CompanyID> <!-- IBT-048 - Buyer TAX identifier -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-048, qualifier -->

</cac:TaxScheme>

</cac:PartyTaxScheme>

<cac:PartyLegalEntity>

<cbc:RegistrationName>株式会社 〇〇物産</cbc:RegistrationName> <!-- IBT-044 - Buyer name -->

<cbc:CompanyID schemeID="0147">654321:000321:0147:1</cbc:CompanyID> <!-- IBT-047 - Buyer legal registration identifier, IBT-047-1 - Scheme identifier -->

</cac:PartyLegalEntity>

<cac:Contact> <!-- IBG-09 - BUYER CONTACT -->

<cbc:Name>株式会社 〇〇物産</cbc:Name> <!-- IBT-056 - Buyer contact point -->

<cbc:Telephone>011-757-1xxx</cbc:Telephone> <!-- IBT-057 - Buyer contact telephone number -->

<cbc:ElectronicMail>purchaser@oobussan.co.jp</cbc:ElectronicMail> <!-- IBT-058 - Buyer contact email address -->

</cac:Contact>

</cac:Party>

</cac:AccountingCustomerParty>

<cac:PayeeParty> <!-- IBG-10 - PAYEE -->

<cac:PartyIdentification>

<cbc:ID schemeID="0147">123456:000124:0147:1</cbc:ID> <!-- IBT-060 - Payee identifier, IBT-060-1 - Scheme identifier, must not be same as ibt-029 -->

</cac:PartyIdentification>

<cac:PartyName>

<cbc:Name>Payee party</cbc:Name> <!-- IBT-059 - Payee name, must not be same as ibt-028 -->

</cac:PartyName>

<cac:PartyLegalEntity>

<cbc:CompanyID schemeID="0147">123456:000124:0147:1</cbc:CompanyID> <!-- IBT-061 - Payee legal registration identifier, IBT-061-1 - Scheme identifier -->

</cac:PartyLegalEntity>

</cac:PayeeParty>

<cac:TaxRepresentativeParty> <!-- IBG-11 - SELLER TAX REPRESENTATIVE PARTY -->

<cac:PartyName>

<cbc:Name>TaxRepresentative Name</cbc:Name> <!-- IBT-062 - Seller tax representative name -->

</cac:PartyName>

<cac:PostalAddress> <!-- IBG-12 - SELLER TAX REPRESENTATIVE POSTAL ADDRESS -->

<cbc:StreetName>四谷4-32-X</cbc:StreetName> <!-- IBT-064 - Tax representative address line 1 -->

<cbc:AdditionalStreetName>〇〇商事ビル</cbc:AdditionalStreetName> <!-- IBT-065 - Tax representative address line 2 -->

<cbc:CityName>新宿区</cbc:CityName> <!-- IBT-066 - Tax representative city -->

<cbc:PostalZone>1600044</cbc:PostalZone> <!-- IBT-067 - Tax representative post code -->

<cbc:CountrySubentity>東京都</cbc:CountrySubentity> <!-- IBT-068 - Tax representative country subdivision -->

<cac:AddressLine>

<cbc:Line>Third line</cbc:Line> <!-- IBT-164 - Tax representative address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-069 - Tax representative country code -->

</cac:Country>

</cac:PostalAddress>

<cac:PartyTaxScheme>

<cbc:CompanyID>T7654321098765</cbc:CompanyID> <!-- IBT-063 - Seller tax representative TAX identifier -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-063, qualifier -->

</cac:TaxScheme>

</cac:PartyTaxScheme>

</cac:TaxRepresentativeParty>

<cac:Delivery> <!-- IBG-13 - DELIVERY INFORMATION -->

<cbc:ActualDeliveryDate>2023-10-18</cbc:ActualDeliveryDate> <!-- IBT-072 - Actual delivery date -->

<cac:DeliveryLocation>

<cbc:ID schemeID="0147">123456:000123:0147:1</cbc:ID> <!-- IBT-071 - Deliver to location identifier, IBT-071-1 - Scheme identifier -->

<cac:Address> <!-- IBG-15 - DELIVER TO ADDRESS -->

<cbc:StreetName>北区</cbc:StreetName> <!-- IBT-075 - Deliver to address line 1 -->

<cbc:AdditionalStreetName>北十二条西76-X</cbc:AdditionalStreetName> <!-- IBT-076 - Deliver to address line 2 -->

<cbc:CityName>札幌市</cbc:CityName> <!-- IBT-077 - Deliver to city -->

<cbc:PostalZone>0010012</cbc:PostalZone> <!-- IBT-078 - Deliver to post code -->

<cbc:CountrySubentity>北海道</cbc:CountrySubentity> <!-- IBT-079 - Deliver to country subdivision -->

<cac:AddressLine>

<cbc:Line>Gate 15</cbc:Line> <!-- IBT-165 - Deliver to address line 3 -->

</cac:AddressLine>

<cac:Country>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-080 - Deliver to country code -->

</cac:Country>

</cac:Address>

</cac:DeliveryLocation>

<cac:DeliveryParty>

<cac:PartyName>

<cbc:Name>株式会社 〇〇物産 札幌支社</cbc:Name> <!-- IBT-070 - Deliver to party name -->

</cac:PartyName>

</cac:DeliveryParty>

</cac:Delivery>

<cac:PaymentMeans> <!-- IBG-16 - PAYMENT INSTRUCTIONS -->

<!-- cbc:ID, IBT-178 - Payment Instructions ID -->

<cbc:PaymentMeansCode name="Credit transfer">30</cbc:PaymentMeansCode> <!-- IBT-081 - Payment means type code, IBT-082 - Payment means text -->

<!-- cbc:PaymentID, IBT-083 - Remittance information -->

<!-- cac:CardAccount, IBG-18 - PAYMENT CARD INFORMATION -->

<cac:PayeeFinancialAccount> <!-- IBG-17 - CREDIT TRANSFER -->

<cbc:ID>1234:567:1:3242394</cbc:ID> <!-- IBT-084 - Payment account identifier, IBT-084-1 - Scheme identifier -->

<cbc:Name>カ)マルマルシヨウジ</cbc:Name> <!-- IBT-085 - Payment account name -->

<!-- cac:FinancialInstitutionBranch, cbc:ID, IBT-086 - Payment service provider identifier -->

<!-- cac:FinancialInstitutionBranch, cac:PostalAddress, IBG-34 - FINANCIAL INSTITUTION ADDRESS -->

</cac:PayeeFinancialAccount>

<!-- cac:PaymentMandate, IBG-19 - DIRECT DEBIT -->

</cac:PaymentMeans>

<cac:PaymentTerms> <!-- IBG-33 - INVOICE TERMS -->

<!-- cbc:PaymentMeansID, IBT-187 - Terms payment instructions ID -->

<cbc:Note>月末締め翌月20日払い, 銀行手数料振込人負担</cbc:Note> <!-- IBT-020 - Payment terms -->

<!-- cbc:Amount, IBT-176 - Terms amount-->

<!-- cbc:InstallmentDueDate, IBT-177 - Terms installment due date -->

</cac:PaymentTerms>

<!-- cac:PrepaidPayment, IBG-35 - Paid amounts -->

<cac:AllowanceCharge> <!-- IBG-20 - DOCUMENT LEVEL ALLOWANCES -->

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-098 - Document level allowance reason code -->

<cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-097 - Document level allowance reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-094 - Document level allowance percentage -->

<cbc:Amount currencyID="JPY">179</cbc:Amount> <!-- IBT-092 - Document level allowance amount -->

<!-- cbc:BaseAmount, IBT-093 - Document level allowance base amount -->

<cac:TaxCategory>

<cbc:ID>S</cbc:ID> <!-- IBT-095 - Document level allowance TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-096 - Document level allowance TAX rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-095, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:AllowanceCharge> <!-- IBG-21 - DOCUMENT LEVEL CHARGES -->

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>FC</cbc:AllowanceChargeReasonCode> <!-- IBT-105 - Document level charge reason code -->

<cbc:AllowanceChargeReason>配送サービス</cbc:AllowanceChargeReason> <!-- IBT-104 - Document level charge reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-101 - Document level charge percentage -->

<cbc:Amount currencyID="JPY">7679</cbc:Amount> <!-- IBT-099 - Document level charge amount -->

<!-- cbc:BaseAmount, IBT-100 - Document level charge base amount -->

<cac:TaxCategory>

<cbc:ID>S</cbc:ID> <!-- IBT-102 - Document level charge TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-103 - Document level charge TAX rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-102, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:AllowanceCharge>

<cac:TaxTotal>

<cbc:TaxAmount currencyID="JPY">26000</cbc:TaxAmount> <!-- IBT-110 - Invoice total TAX amount -->

<cac:TaxSubtotal> <!-- IBG-23 - TAX BREAKDOWN -->

<cbc:TaxableAmount currencyID="JPY">260000</cbc:TaxableAmount> <!-- IBT-116 - TAX category taxable amount -->

<cbc:TaxAmount currencyID="JPY">26000</cbc:TaxAmount> <!-- IBT-117 - TAX category tax amount -->

<cac:TaxCategory>

<cbc:ID>S</cbc:ID> <!-- IBT-118 - TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-119 - TAX category rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-118, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

<cac:TaxSubtotal> <!-- IBG-23 - TAX BREAKDOWN -->

<cbc:TaxableAmount currencyID="JPY">3490</cbc:TaxableAmount> <!-- IBT-116 - TAX category taxable amount -->

<cbc:TaxAmount currencyID="JPY">0</cbc:TaxAmount> <!-- IBT-117 - TAX category tax amount -->

<cac:TaxCategory>

<cbc:ID>E</cbc:ID> <!-- IBT-118 - TAX category code -->

<cbc:Percent>0</cbc:Percent> <!-- IBT-119 - TAX category rate -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-118, qualifier -->

</cac:TaxScheme>

</cac:TaxCategory>

</cac:TaxSubtotal>

</cac:TaxTotal>

<cac:LegalMonetaryTotal> <!-- IBG-22 - DOCUMENT TOTALS -->

<cbc:LineExtensionAmount currencyID="JPY">255990</cbc:LineExtensionAmount> <!-- IBT-106 - Sum of Invoice line net amount -->

<cbc:TaxExclusiveAmount currencyID="JPY">263490</cbc:TaxExclusiveAmount> <!-- IBT-109 - Invoice total amount without TAX -->

<cbc:TaxInclusiveAmount currencyID="JPY">289490</cbc:TaxInclusiveAmount> <!-- IBT-112 - Invoice total amount with TAX -->

<cbc:AllowanceTotalAmount currencyID="JPY">1</cbc:AllowanceTotalAmount> <!-- IBT-107 - Sum of allowances on document level -->

<cbc:ChargeTotalAmount currencyID="JPY">7679</cbc:ChargeTotalAmount> <!-- IBT-108 - Sum of charges on document level -->

<cbc:PrepaidAmount currencyID="JPY">0</cbc:PrepaidAmount> <!-- IBT-113 - Paid amount -->

<cbc:PayableRoundingAmount currencyID="JPY">0</cbc:PayableRoundingAmount> <!-- IBT-114 - Rounding amount -->

<cbc:PayableAmount currencyID="JPY">289490</cbc:PayableAmount> <!-- IBT-115 - Amount due for payment -->

</cac:LegalMonetaryTotal>

<cac:InvoiceLine> <!-- IBG-25 - INVOICE LINE -->

<cbc:ID>1</cbc:ID> <!-- IBT-126 - Invoice line identifier -->

<cbc:Note>The equipment has 3 year warranty.</cbc:Note> <!-- IBT-127 - Invoice line note -->

<cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-129 - Invoiced quantity, IBT-130 - Invoiced quantity unit of measure code -->

<cbc:LineExtensionAmount currencyID="JPY">250000</cbc:LineExtensionAmount> <!-- IBT-131 - Invoice line net amount -->

<cbc:AccountingCost>Cost id 654</cbc:AccountingCost> <!-- IBT-133 - Invoice line Buyer accounting reference -->

<cac:InvoicePeriod> <!-- IBG-26 - INVOICE LINE PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 - Invoice line period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 - Invoice line period end date -->

</cac:InvoicePeriod>

<cac:OrderLineReference>

<cbc:LineID>1</cbc:LineID> <!-- IBT-132 - Referenced purchase order line reference -->

<cac:OrderReference>

<cbc:ID>1</cbc:ID> <!-- IBT-183 - Purchase order reference -->

</cac:OrderReference>

</cac:OrderLineReference>

<cac:DespatchLineReference>

<cbc:LineID>010</cbc:LineID>

<cac:DocumentReference>

<cbc:ID>789</cbc:ID> <!-- IBT-184 - Despatch advice reference -->

</cac:DocumentReference>

</cac:DespatchLineReference>

<cac:DocumentReference> <!-- IBG-36 - LINE DOCUMENT REFERENCE -->

<cbc:ID>D001-1</cbc:ID> <!-- IBT-188 - Invoice line document identifier -->

<!-- cbc:DocumentTypeCode, IBT-189 - Document type code -->

</cac:DocumentReference>

<cac:DocumentReference>

<cbc:ID schemeID="ABZ">AB-123</cbc:ID> <!-- IBT-128 - Invoice line object identifier, IBT-128-1 - Scheme identifier -->

<cbc:DocumentTypeCode>130</cbc:DocumentTypeCode> <!-- IBT-128, qualifier -->

</cac:DocumentReference>

<cac:AllowanceCharge> <!-- IBG-27 - INVOICE LINE ALLOWANCES -->

<cbc:ChargeIndicator>false</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>95</cbc:AllowanceChargeReasonCode> <!-- IBT-140 - Invoice line allowance reason code -->

<cbc:AllowanceChargeReason>値引</cbc:AllowanceChargeReason> <!-- IBT-139 - Invoice line allowance reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-138 - Invoice line allowance percentage -->

<cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-136 - Invoice line allowance amount -->

<!-- cbc:BaseAmount, IBT-137 - Invoice line allowance base amount -->

</cac:AllowanceCharge>

<cac:AllowanceCharge> <!-- IBG-28 - INVOICE LINE CHARGES -->

<cbc:ChargeIndicator>true</cbc:ChargeIndicator>

<cbc:AllowanceChargeReasonCode>CG</cbc:AllowanceChargeReasonCode> <!-- IBT-145 - Invoice line charge reason code -->

<cbc:AllowanceChargeReason>クリーニング</cbc:AllowanceChargeReason> <!-- IBT-144 - Invoice line charge reason -->

<!-- cbc:MultiplierFactorNumeric, IBT-143 - Invoice line charge percentage -->

<cbc:Amount currencyID="JPY">1500</cbc:Amount> <!-- IBT-141 - Invoice line charge amount -->

<!-- cbc:BaseAmount, IBT-142 - Invoice line charge base amount-->

</cac:AllowanceCharge>

<cac:Item> <!-- IBG-31 - ITEM INFORMATION -->

<!-- cbc:Description, IBT-154 - Item description -->

<cbc:Name>デスクチェア</cbc:Name> <!-- IBT-153 - Item name -->

<cac:BuyersItemIdentification>

<cbc:ID>b-13214</cbc:ID> <!-- IBT-156 - Item Buyer's identifier -->

</cac:BuyersItemIdentification>

<cac:SellersItemIdentification>

<cbc:ID>97iugug876</cbc:ID> <!-- IBT-155 - Item Seller's identifier -->

</cac:SellersItemIdentification>

<cac:StandardItemIdentification>

<cbc:ID schemeID="0160">4503994155481</cbc:ID> <!-- IBT-157 - Item standard identifier -->

</cac:StandardItemIdentification>

<cac:OriginCountry>

<cbc:IdentificationCode>JP</cbc:IdentificationCode> <!-- IBT-159 - Item country of origin -->

</cac:OriginCountry>

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="TST" listVersionID="19.05.01">86776</cbc:ItemClassificationCode>

<!-- IBT-158 - Item classification identifier, IBT-158-1 - Scheme identifier, IBT-158-2 - Scheme version identifier -->

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory> <!-- IBG-30 - LINE TAX INFORMATION -->

<cbc:ID>S</cbc:ID> <!-- IBT-151 - Invoiced item TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-152 - Invoiced item TAX rate -->

<!-- cbc:PerUnitAmount, IBT-166 - Unit TAX -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-167 - Tax Scheme -->

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:AdditionalItemProperty> <!-- IBG-32 - ITEM ATTRIBUTES -->

<cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 - Item attribute name -->

<cbc:Value>脚</cbc:Value> <!-- IBT-161 - Item attribute value -->

</cac:AdditionalItemProperty>

</cac:Item>

<cac:Price> <!-- IBG-29 - PRICE DETAILS -->

<cbc:PriceAmount currencyID="JPY">50000</cbc:PriceAmount> <!-- IBT-146 - Item net price -->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 - Item price base quantity, IBT-150 - Item price base quantity unit of measure code -->

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine> <!-- IBG-25 - INVOICE LINE -->

<cbc:ID>2</cbc:ID> <!-- IBT-126 - Invoice line identifier -->

<!-- cbc:Note, IBT-127 - Invoice line note -->

<cbc:InvoicedQuantity unitCode="H87">5</cbc:InvoicedQuantity> <!-- IBT-130 - Invoiced quantity unit of measure code, IBT-129 - Invoiced quantity -->

<cbc:LineExtensionAmount currencyID="JPY">2500</cbc:LineExtensionAmount> <!-- IBT-131 - Invoice line net amount -->

<!-- cbc:AccountingCost, IBT-133 - Invoice line Buyer accounting reference -->

<cac:InvoicePeriod> <!-- IBG-26 - INVOICE LINE PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 - Invoice line period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 - Invoice line period end date -->

</cac:InvoicePeriod>

<cac:DocumentReference> <!-- IBG-36 - LINE DOCUMENT REFERENCE -->

<cbc:ID>D001-2</cbc:ID> <!-- IBT-188 - Invoice line document identifier -->

<!-- cbc:DocumentTypeCode, IBT-189 - Document type code -->

</cac:DocumentReference>

<cac:Item> <!-- IBG-31 - ITEM INFORMATION -->

<!-- cbc:Description, IBT-154 - Item description -->

<cbc:Name>コピー用紙(A4)</cbc:Name> <!-- IBT-153 - Item name -->

<!-- cac:BuyersItemIdentification, cbc:ID, IBT-156 - Item Buyer's identifier -->

<cac:SellersItemIdentification>

<cbc:ID>Item3</cbc:ID> <!-- IBT-155 - Item Seller's identifier -->

</cac:SellersItemIdentification>

<cac:StandardItemIdentification>

<cbc:ID schemeID="0160">1234567890121</cbc:ID> <!-- IBT-157 - Item standard identifier, IBT-157-1 Scheme identifier -->

</cac:StandardItemIdentification>

<!-- cac:OriginCountry, cbc:IdentificationCode, IBT-159 - Item country of origin -->

<cac:CommodityClassification>

<cbc:ItemClassificationCode listID="MP">43211503</cbc:ItemClassificationCode> <!-- IBT-158 - Item classification identifier, IBT-158-1 - Scheme identifier -->

</cac:CommodityClassification>

<cac:ClassifiedTaxCategory> <!-- IBG-30 - LINE TAX INFORMATION -->

<cbc:ID>S</cbc:ID> <!-- IBT-151 - Invoiced item TAX category code -->

<cbc:Percent>10</cbc:Percent> <!-- IBT-152 - Invoiced item TAX rate -->

<!-- cbc:PerUnitAmount, IBT-166 - Unit TAX -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-167 - Tax Scheme -->

</cac:TaxScheme>

</cac:ClassifiedTaxCategory> <!-- IBG-32 - ITEM ATTRIBUTES -->

<cac:AdditionalItemProperty>

<cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 - Item attribute name -->

<cbc:Value>冊</cbc:Value> <!-- IBT-161 - Item attribute value -->

</cac:AdditionalItemProperty>

</cac:Item>

<cac:Price> <!-- IBG-29 - PRICE DETAILS -->

<cbc:PriceAmount currencyID="JPY">500</cbc:PriceAmount> <!-- IBT-146 - Item net price -->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 - Item price base quantity, IBT-150 - Item price base quantity unit of measure code -->

<cac:AllowanceCharge>

<cbc:ChargeIndicator>false</cbc:ChargeIndicator> <!-- Mandatory element. Value must be “false”. -->

<cbc:Amount currencyID="JPY">100</cbc:Amount> <!-- IBT-147 - Item price discount -->

<cbc:BaseAmount currencyID="JPY">600</cbc:BaseAmount> <!-- IBT-148 - Item gross price -->

</cac:AllowanceCharge>

</cac:Price>

</cac:InvoiceLine>

<cac:InvoiceLine> <!-- IBG-25 - INVOICE LINE -->

<cbc:ID>3</cbc:ID> <!-- IBT-126 - Invoice line identifier -->

<!-- cbc:Note, IBT-127 - Invoice line note -->

<cbc:InvoicedQuantity unitCode="H87">10</cbc:InvoicedQuantity> <!-- IBT-130 - Invoiced quantity unit of measure code, IBT-129 - Invoiced quantity -->

<cbc:LineExtensionAmount currencyID="JPY">3490</cbc:LineExtensionAmount> <!-- IBT-131 - Invoice line net amount -->

<!-- cbc:AccountingCost, IBT-133 - Invoice line Buyer accounting reference -->

<cac:InvoicePeriod> <!-- IBG-26 - INVOICE LINE PERIOD -->

<cbc:StartDate>2023-10-18</cbc:StartDate> <!-- IBT-134 - Invoice line period start date -->

<cbc:EndDate>2023-10-18</cbc:EndDate> <!-- IBT-135 - Invoice line period end date -->

</cac:InvoicePeriod>

<cac:DocumentReference> <!-- IBG-36 - LINE DOCUMENT REFERENCE -->

<cbc:ID>D001-3</cbc:ID> <!-- IBT-188 - Invoice line document identifier -->

</cac:DocumentReference>

<cac:Item> <!-- IBG-31 - ITEM INFORMATION -->

<!-- cbc:Description, IBT-154 - Item description -->

<cbc:Name>検定済教科書(算数)</cbc:Name> <!-- IBT-153 - Item name -->

<cac:ClassifiedTaxCategory> <!-- IBG-30 - LINE TAX INFORMATION -->

<cbc:ID>E</cbc:ID> <!-- IBT-151 - Invoiced item TAX category code -->

<cbc:Percent>0</cbc:Percent> <!-- IBT-152 - Invoiced item TAX rate -->

<!-- cbc:PerUnitAmount, IBT-166 - Unit TAX -->

<cac:TaxScheme>

<cbc:ID>VAT</cbc:ID> <!-- IBT-167 - Tax Scheme -->

</cac:TaxScheme>

</cac:ClassifiedTaxCategory>

<cac:AdditionalItemProperty> <!-- IBG-32 - ITEM ATTRIBUTES -->

<cbc:Name>表示単位名称</cbc:Name> <!-- IBT-160 - Item attribute name -->

<cbc:Value>冊</cbc:Value> <!-- IBT-161 - Item attribute value -->

</cac:AdditionalItemProperty>

</cac:Item>

<cac:Price> <!-- IBG-29 - PRICE DETAILS -->

<cbc:PriceAmount currencyID="JPY">349</cbc:PriceAmount> <!-- IBT-146 - Item net price -->

<cbc:BaseQuantity unitCode="H87">1</cbc:BaseQuantity> <!-- IBT-149 - Item price base quantity, IBT-150 - Item price base quantity unit of measure code -->

</cac:Price>

</cac:InvoiceLine>

</Invoice>エラーメッセージが連続して1行で出力されているので見難いですが、確かに改変した箇所をエラーとして報告しています。

3. エラー表示

alignedルールで検証すると、

java -jar SaxonHE11-4J/saxon-he-11.4.jar "pint-jp-resources-dev/trn-invoice/example/Japan PINT Invoice UBL Error.xml" pint-jp-resources-dev/common/PINT-UBL-validation-aligned-japan.xslt > Error-aligned.html

変更した箇所がエラーとして報告されました。

[aligned-ibrp-001-jp]-Specification identifier MUST start with the value 'urn:fdc:peppol:jp:billing:3.0'.

エラーがあるかどうかは分かりますが、どこが問題かまではこれだけの情報では分かりませんね。