Views: 96

Peppol BIS Billing 3.0におけるプロバイダの責務 – 追補:スキーマトロンによる検証ルールとJP PINTの課題 –

2025-07-29

- 1. C2(送信側アクセスポイント)の責務

- 2. BIS Billing 3.0 における スキーマトロン検証ルールの構造と運用上の注意点

- 3. C3(受信側アクセスポイント)の責務

- 4. Peppol Transaction Statistics Reporting Process

- 5. ログとして記録すべき情報(ペポルオーソリティやオープンペポルへの報告に備えて)

- 6. ログの保持と管理

- 7. 通信処理と応答:TLSおよびメッセージ応答に関する整理(訂正版)

- 8. 結論

- 9. まとめ

- 10. 追補 1:スキーマトロンによる検証ルールとJP PINTの課題

- 11. 追補 2:スキーマトロンの検証ルール

- 12. 参考:スキーマトロンファイル

TLS関連の記載に誤りがありましたので訂正しました。

7. 通信処理と応答:TLSおよびメッセージ応答に関する整理(訂正版)をご確認ください(2025-07-29)。

なお、TLSについての記事 『SMPソリューションのHTTPS運用準備ガイド』ならびにNAPTR移行についての記事 『Peppol NAPTR移行とAPプロバイダーの対応』も併せてご確認ください。

ペポル ネットワークにおいて、BIS Billing 3.0文書を送受信する際のアクセスポイント(C2, C3)のプロバイダが担うべき責務と、OpenPeppolやPeppol Authority(PA)に報告するために保持しておくべきログ情報について整理します。

また、 10. 追補 1:スキーマトロンによる検証ルールとJP PINTの課題ではPINT EUと比較してJP PINTの課題を紹介します。

1. C2(送信側アクセスポイント)の責務

送信側APであるC2は、メッセージ送信時に以下の処理と検証を行う必要があります。

| 項目 | 内容 |

|---|---|

|

宛先の特定 |

メッセージ中の |

|

スキーマ検証(XSD) |

文書がUBL 2.1仕様に準拠しているか、XML Schemaで検証 |

|

スキーマトロン検証 |

CustomizationIDに基づいて対応するCIUS(国別利用仕様)のスキーマトロンを適用し、ビジネスルールに適合していることを確認 |

|

エラーなしを確認して送信 |

すべての検証に成功した場合のみ、C3へメッセージを中継 |

C2は、以上の検証に合格したメッセージのみを中継する責務を持ち、それ以外の業務的な意味づけや処理には関与しません。これは、JP PINTを含むすべてのBIS Billing 3.0仕様で共通です。

2. BIS Billing 3.0 における スキーマトロン検証ルールの構造と運用上の注意点

EN 16931[1] に準拠した BIS Billing 3.0 では、XML スキーマによる構造検証に加えて、スキーマトロンによるビジネスルール検証が定義されており、ペポル ネットワークでの適合性を機械的に判定できるようになっている。

2.1. スキーマトロンの二重構成とその役割

Peppol BIS Billing 3.0 では以下の 2 種類の スキーマトロン検証スクリプトが用意されている。

-

EN16931 model bound to UBL (CEN-EN16931-UBL.sch):

EN 16931のCEN標準に準拠した基本-Basic-ルールを提供し、特にCIUS未定義要素の使用を警告または禁止するルールが含まれる。

EN 16931のCEN標準に準拠した基本-Basic-ルールを提供し、特にCIUS未定義要素の使用を警告または禁止するルールが含まれる。 -

Rules for Peppol BIS 3.0 Billing (PEPPOL-EN16931-UBL.sch):

Peppol仕様に基づいた国/地域別の拡張(例:税制・記述表現等)を含む詳細なペポルBISルール。

この 2 種は補完的な関係にあり、それぞれ以下のような役割を持つ。

2.1.1. CEN-EN16931-UBL.sch の特徴

-

EN 16931の Core Invoice Usage Specification (CIUS[2]) に準拠した基礎的な基本-Basic-ルールを定義。

-

XML スキーマ検証では検出できないコンテキスト依存の条件(たとえば

cbc:TaxCategoryCodeに応じたcbc:Percentの存在)を検証。 -

加えて、CIUS で許可されていない XML 要素が文書内に存在した場合に警告を出すルールを含んでおり、非互換拡張や誤記入の防止に役立つ。

2.1.2. PEPPOL-EN16931-UBL.sch の特徴

-

CEN 準拠の基本-Basic-ルールを継承しつつ、ペポル ネットワークでの実運用に必要な追加ルールを定義。

-

加盟国ごとの税制やビジネス慣習に対応するため、より詳細なビジネスルール(例:支払手段コードの制限、必須項目の条件付き強化)を含むペポルBISルール。

-

各国の拡張 CIUS を吸収し、相互運用性を担保することを目的とする。

2.2. CIUSで定義されていない要素の扱いとプロバイダの責務

CEN スキーマトロンによって、CIUS で明示的に定義されていない要素が含まれている場合は検出されるが、これはあくまで共通仕様への準拠性確保のためである。

ただし、Peppol BIS Billing の利用者が仕様に準拠しない独自要素を XML に含めた場合、スキーマトロンによって警告される可能性がある。

このような検証ルールの定義・管理は、一般にプロバイダの責務ではなく、仕様策定者またはネットワーク運用主体の責務である。

プロバイダは提供された CIUS および スキーマトロンに基づいてバリデーションを実施すべきであり、独自判断で検証ルールを追加することは推奨されない。

3. C3(受信側アクセスポイント)の責務

受信側APであるC3は、次のような処理を担当します。

| 項目 | 内容 |

|---|---|

|

メッセージの受信 |

C2からメッセージを受信 |

|

SMPに基づくルーティング |

SMPで特定されたエンドポイント情報に基づいて、C4に中継 |

|

構文的異常がないかの確認(実装依存) |

破損ファイルなど明らかな構文エラーがある場合、中継を止める判断は可能だが、ビジネスルール検証などは責務外 |

4. Peppol Transaction Statistics Reporting Process

4.1. なぜ(目的)

ペポル ネットワークにおける利用状況・取引量のモニタリングと透明性の確保のため、各Access Point(AP)およびService Metadata Publisher(SMP)から取引統計を報告し、OpenPeppolがネットワークの健全性と成長傾向を把握・分析するために用いる。

4.2. 何を(報告対象)

以下の取引に関する統計情報を定期的に集計・報告する:

-

送信成功メッセージ数

-

受信成功メッセージ数

-

エラーメッセージ数

-

文書種別(Invoice、Orderなど)

-

プロセスID(BISなど)

-

SMPで管理されているエンドポイント数(SMPプロバイダーの場合)

4.3. どうやって(報告方法)

-

OpenPeppolが定める統一フォーマットに従ったレポート(例: CSVまたはJSON)

-

月次もしくは四半期ごとに提出

-

セキュアなアップロードチャネル(例: HTTPS経由のAPIやポータル)

-

各AP/SMPは自組織のログから統計を抽出し、自動化された処理でレポートを生成することが推奨される

4.4. 誰から誰に(報告経路)

-

送信者:

-

Peppol Access Point プロバイダー(AP)

-

SMP プロバイダー

-

-

受信者:

-

OpenPeppol

-

4.5. 参考(補足)

-

報告された統計はペポル ネットワーク全体のパフォーマンス・普及度を分析するための集計に用いられ、個別APの業績を直接評価する目的では使用されない。

-

一部の統計情報は、年次報告書や理事会報告資料として活用される。

-

将来的にAPIベースの自動報告インターフェースが整備される予定。

4.6. 結論

Peppol取引統計報告プロセスは、ネットワーク全体の可視化と継続的改善のために不可欠な手段である。APおよびSMPプロバイダーは、定期的かつ正確な報告を通じて、OpenPeppolのエコシステム維持に貢献することが求められる。

5. ログとして記録すべき情報(ペポルオーソリティやオープンペポルへの報告に備えて)

C2/C3プロバイダは、メッセージ送受信の証跡として、最低限以下の情報を記録しておくことが推奨されます。

| 項目 | 記録内容 |

|---|---|

|

送信者ID(C1) |

Sender Participant ID(例:0088:123456789) |

|

受信者ID(C4) |

Recipient Participant ID(SMP情報と一致) |

|

CustomizationID / ProfileID |

バリデーションとSMP解決に使用。 |

|

Document Type ID |

CustomizationIDとProfileIDを含む完全識別子。SMPでのルーティング解決、およびバリデーション対象文書の一意識別に使用される。 |

|

送受信日時 |

協定世界時(UTC)または現地時刻(ローカル時刻)での送信・受信の時刻(ISO 8601) |

|

メッセージファイルサイズ |

通信障害・遅延分析に使用 |

|

メッセージ識別子 |

SBDHやASiCのUUIDなど、一意なID |

|

SMPルックアップ結果(推奨) |

適用SMPエントリ(ドキュメントタイプ、エンドポイントURLなど) |

|

送信結果 |

成功/失敗 |

OpenPeppolで使用される識別子の仕様は、次の文書で規定されています。

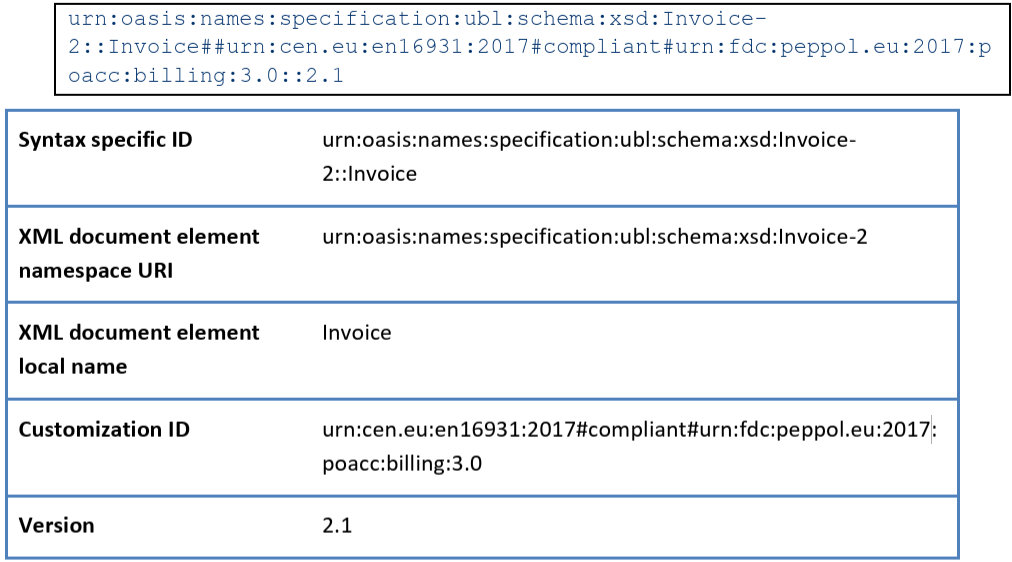

Document Type ID の構造は次のようになります:

{UBL名前空間}::{ルート要素名}##{CustomizationID}::{UBLバージョン}

例えば、Peppol BIS Billing 3.0文書では、次のような Document Type ID が使用されます:

urn:oasis:names:specification:ubl:schema:xsd:Invoice-2::Invoice##urn:cen.eu:en16931:2017#compliant#urn:fdc:peppol.eu:2017:poacc:billing:3.0::2.1

このように、EN 16931に準拠しつつ、国別のプロファイルに対応するCustomizationIDが指定されます。

例1 (from Billing BIS v3):

次の例は、Peppol Billing BIS v3 に準拠した UBL 2.1 請求書に対応するドキュメントタイプを示しています。

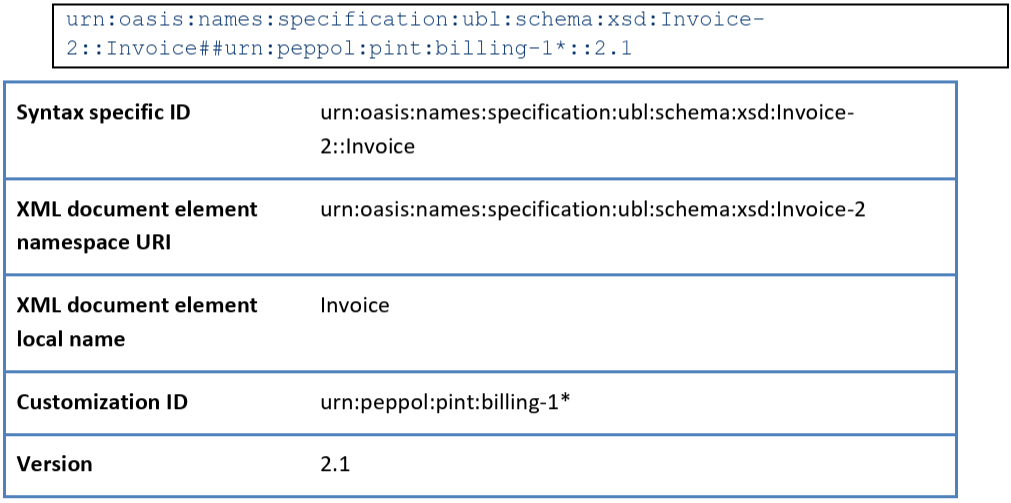

例2 (using a Wildcard Customization ID):

次の例は、SMP登録で使用されるドキュメントタイプを示しており、例示のカスタマイズIDに準拠したUBL 2.1インボイスです。

6. ログの保持と管理

| 項目 | 内容 |

|---|---|

|

保持期間 |

最低でも3〜6ヶ月。国や契約によっては2年間以上の長期保持 |

|

記録形式 |

CSV, JSON, テキストログ, データベースなど形式は自由。ただし再検索可能性を確保 |

|

個人情報保護 |

GDPRなどのデータ保護規制に準拠した保管・管理が必要(特にEUとの通信) |

7. 通信処理と応答:TLSおよびメッセージ応答に関する整理(訂正版)

7.1. Peppol AS4 Profile v2.0.3(概要)

PeppolネットワークにおけるAS4メッセージングの通信仕様。

欧州委員会の CEF eDelivery AS4 v1.14 をベースに、Peppol特有の制約や運用ルールを追加。

7.1.1. 用途と概要

AS4は、Peppolの4コーナーモデルにおける Corner 2(送信AP)と Corner 3(受信AP)間のメッセージ転送に使用されます。

以下の要素が重要です:

-

非同期メッセージ通信(AS4 One-Way/Push)

-

署名と暗号化には PeppolのPKI(Public Key Infrastructure)を使用

-

SMP/SML による受信者(C3)AP情報の発見

7.1.2. 主な仕様の要点(修正版)

| 項目 | 内容 |

|---|---|

|

交換パターン |

One-Way Push のみを使用(PullおよびTwo-Wayは非対応) |

|

TLS要件 |

TLS 1.2以上での暗号化通信が必須。ポート443を使用し、TLS証明書はWebサーバ用証明書を利用(Peppol証明書とは別)。 |

|

TLS証明書 |

通信に使用するTLS証明書は、Peppol AP証明書ではない。一般的な事業者向けの証明書を発行する認証局のサーバ証明書を使用。 |

|

Party識別 |

送信者・受信者の識別には、Peppol Participant ID(例:0088:123456789)を使用。AP証明書のSubject CNAMEはTLSとは関係しない。 |

|

MPC(Message Partition Channel) |

デフォルトMPC ( |

|

SBDHの使用 |

すべてのAS4ペイロードにSBDH(Standard Business Document Header)を付加することが必須。順序も |

|

署名方式 |

Binary Security Token(BST)を使った X.509v3 証明書によるメッセージ署名を必須とする。 |

TLS証明書は、通信暗号化用であり、メッセージ署名やPeppolへの登録とは別の役割を持ちます。SMP/SMLで登録されるのはPeppol AP証明書であり、これをTLSに流用することはできません。7.2. 追加の注意事項:CNAMEからNAPTRへの移行

2025年4月より、PeppolネットワークにおけるSML(Service Metadata Locator)のドメイン解決方式が、従来の CNAME ベースから NAPTR レコードを使用する方式へと段階的に移行しています。

-

目的:DNSベースのドメイン解決の柔軟性と拡張性を高めるため

-

影響範囲:

-

新たにSMPを登録する場合、NAPTR対応が必須となります

-

既存のSMPも、将来的にCNAMEレコード方式が廃止される予定であるため、早期の対応が推奨されます

-

APプロバイダやSMP運用者は、DNS設定やSML登録情報の更新が必要です

-

NAPTRレコードには、

SMP`のサービス名(`Service: "SMP+http")とプロトコル(例:D2T)を明記する必要があります

詳細は以下の公式資料及び解説記事をご参照ください:

7.2.1. 適合要件

本仕様へ準拠するには:

-

CEF eDelivery AS4 v1.14 のコア要件(6.1〜6.6)への準拠

-

本文書の 第3章(基本仕様)および 第5章(P-Mode定義)の遵守

7.2.2. 関連リンク

-

Peppol AS4仕様: https://docs.peppol.eu/edelivery/as4-profile/

-

CEF AS4: https://ec.europa.eu/digital-building-blocks/wikis/display/DIGITAL/eDelivery+AS4+-+1.14

-

Identifier Policy: https://docs.peppol.eu/edelivery/policies/PEPPOL-EDN-Policy-for-use-of-identifiers-4.2.0-2023-06-19.pdf

-

Transport Security Policy: https://docs.peppol.eu/edelivery/policies/PEPPOL-EDN-Policy-for-Transport-Security-1.1.0-2020-04-20.pdf

7.3. トランスポートレベルの応答(必須)

AP間通信は、AS4(Peppol AS4 Profile)やSTART/Tプロファイルに基づいて構成されており、HTTPレベルでの応答(200 OK / Fault)は必須です。これは通信層(Transport Layer)での確認応答であり、メッセージ本文の内容に応じた意味的な応答ではありません。

POST /as4 HTTP/1.1

Host: receiver.ap.peppol.net

Content-Type: application/soap+xml

→ HTTP/1.1 200 OK7.4. メッセージレベルの応答(任意・要件なし)

Peppol BIS Billing 3.0のメッセージ仕様(Invoice, CreditNote)では、応答用メッセージの送信は定義されていません。したがって以下のような応答をC2やC3が送信する必要はありません。

-

ApplicationResponse(応答メッセージ文書)

-

メッセージ受領確認(Delivery Receipt)

-

処理完了通知(Business Acknowledgement)

7.4.1. 応答メッセージを送る場合の留意点

| CustomizationID | 応答文書にも適切なCustomizationIDが必要 |

|---|---|

|

SMP登録 |

応答文書種別がSMPに登録されていないと、Peppol経由でルーティングできない |

|

通信上の義務 |

トランスポートレイヤでの200 OKは必要だが、メッセージ応答自体は仕様上の要件ではない |

8. 結論

|

C2(送信AP) |

UBLスキーマ検証とCIUS スキーマトロンバリデーションの実施。送信前にエラーがないことを確認し、中継先(C3)をSML/SMPで特定。 |

|

C3(受信AP) |

メッセージを中継するのみ。業務的な意味解釈や再バリデーションは行わず、そのままC4に配送。 |

|

TLS通信 |

すべての通信はTLSで行い、HTTPレベルでの応答(200 OKなど)は必須。 |

|

メッセージ応答 |

仕様として義務ではなく、SMPで受信側が受け入れる設定になっていれば送信可能。事前合意が望ましい。 |

|

ログ保持 |

送受信日時、宛先ID、CustomizationID、スキーマ・スキーマトロンの検証有無、ファイルサイズ等の記録が望ましい。 |

ペポル ネットワークの運用においては、仕様の範囲を超えた過剰な検証や処理を避ける一方、通信・ルーティングの証跡とセキュリティを確保することが、プロバイダに求められる最も重要な責務です。

9. まとめ

Peppol BIS Billing 3.0において、C2およびC3のプロバイダが担う責務は以下のように整理されます。

|

C2(送信AP) |

UBLスキーマ検証とCIUS スキーマトロンバリデーションの実施。送信前にエラーがないことを確認し、中継先(C3)をSML/SMPで特定 |

|

C3(受信AP) |

メッセージを中継するのみ。業務的な意味解釈や再バリデーションは行わず、そのままC4に配送 |

|

両者共通 |

トラブル発生時の報告や監査に備え、送受信ログ、ID、時刻、ファイルサイズ、エラー記録などを保持 |

将来的にPeppol Authority(PA)やOpenPeppolから報告要請があった場合、これらのログを基にしたスムーズな対応が求められます。

10. 追補 1:スキーマトロンによる検証ルールとJP PINTの課題

ペポル ネットワークで使用されるデジタルインボイスのXML文書は、CIUS(Core Invoice Usage Specification)によって定められた制約に従っている必要があります。この制約の検証には、スキーマトロンと呼ばれるルールベースの検証ファイルが用いられます。

以降では、EUのPINT(Peppol INTernational innvoice)とJP PINT(日本向け実装)におけるスキーマトロン構成とその違い、そしてJP PINTが抱える運用上の問題点について整理します。

10.1. スキーマトロンの構成:EUとJP PINTの違い

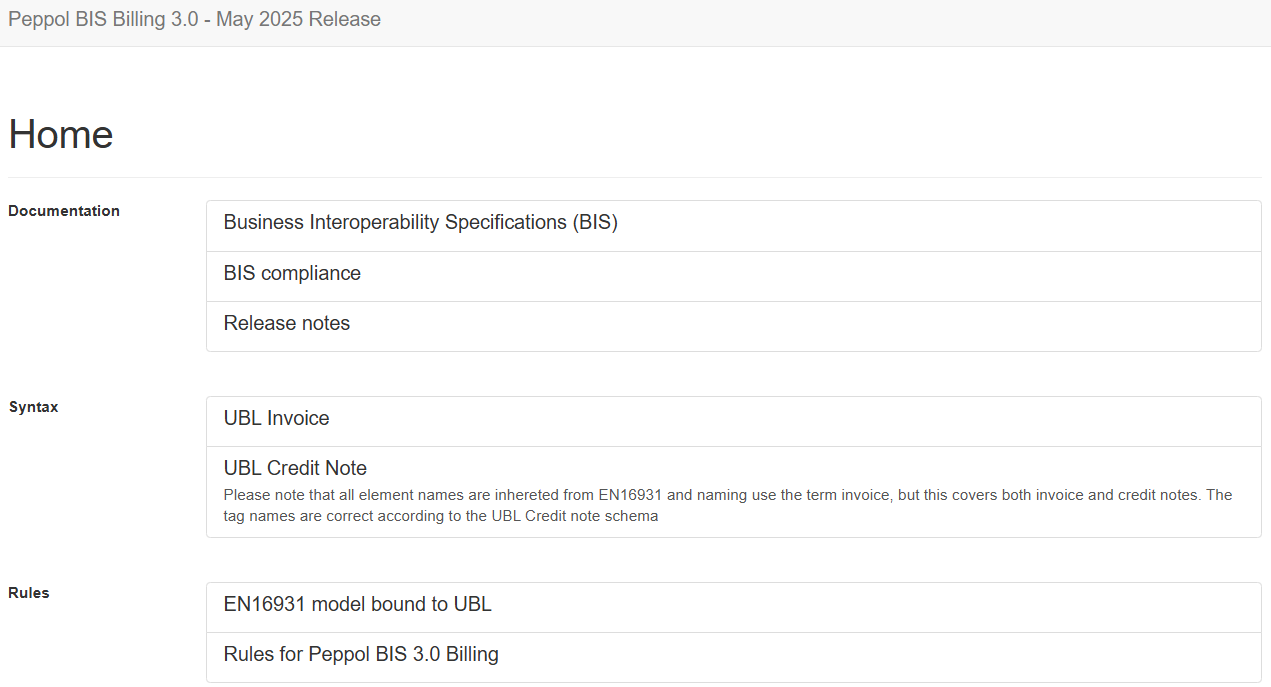

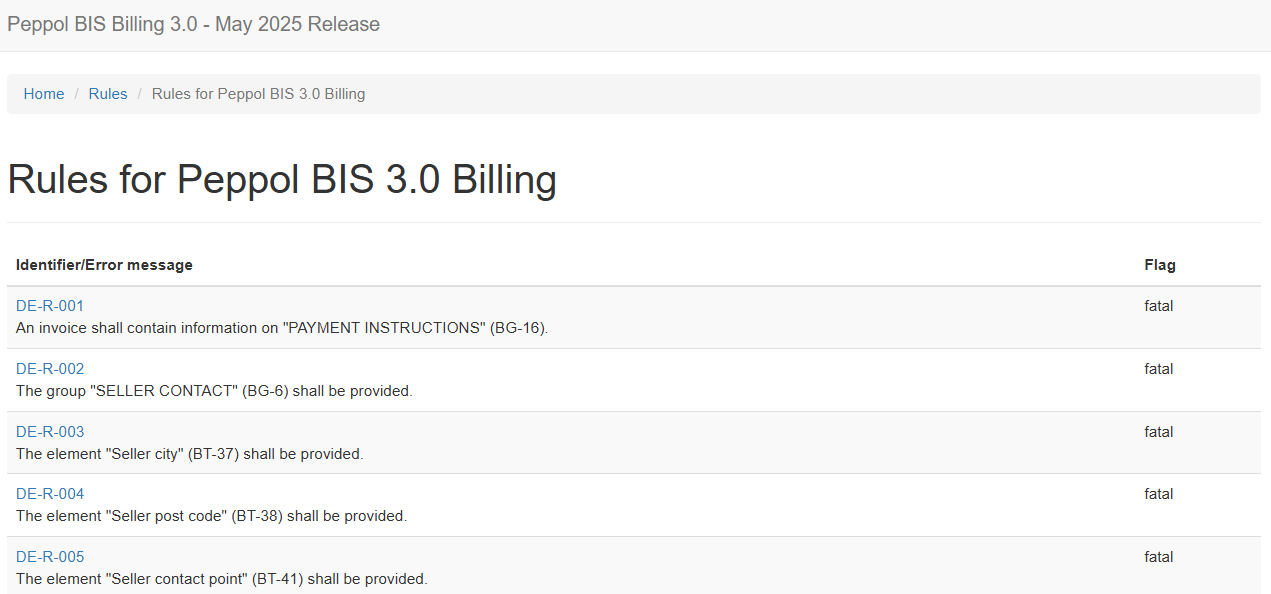

10.1.1. Peppol 3.0 BIS Billingが提供する検証ルール

Peppol 3.0 BIS Billing においては、次の2種類のスキーマトロンファイルが使用されます:

-

EN16931 model bound to UBL (CEN-EN16931-UBL.sch):

EN 16931のCEN標準に準拠した基本-Basic-ルールを提供し、特にCIUS未定義要素の使用を警告または禁止するルールが含まれる。

EN16931 model bound to UBL -

Rules for Peppol BIS 3.0 Billing (PEPPOL-EN16931-UBL.sch):

Peppol仕様に基づいた国/地域別の拡張(例:税制・記述表現等)を含む詳細なペポルBISルール。

Rules for Peppol BIS 3.0 Billing

この2つは併用されることを前提としており、仕様整合性と拡張表現を両立する設計です。

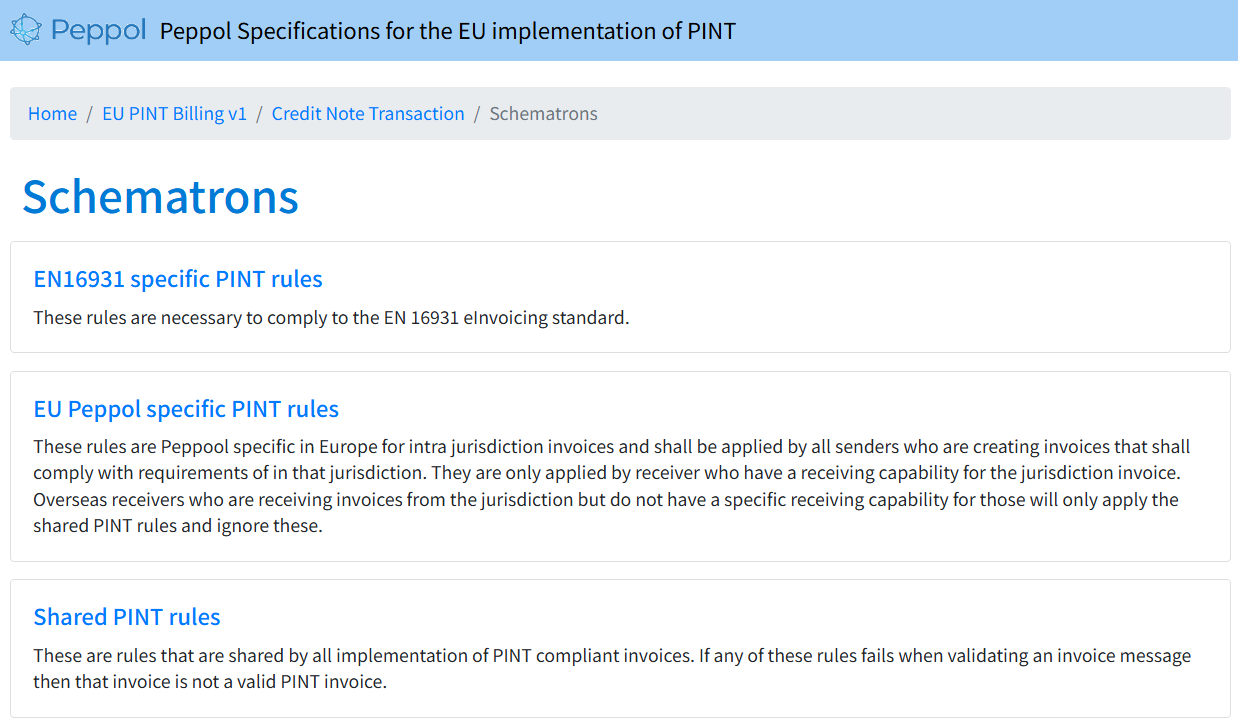

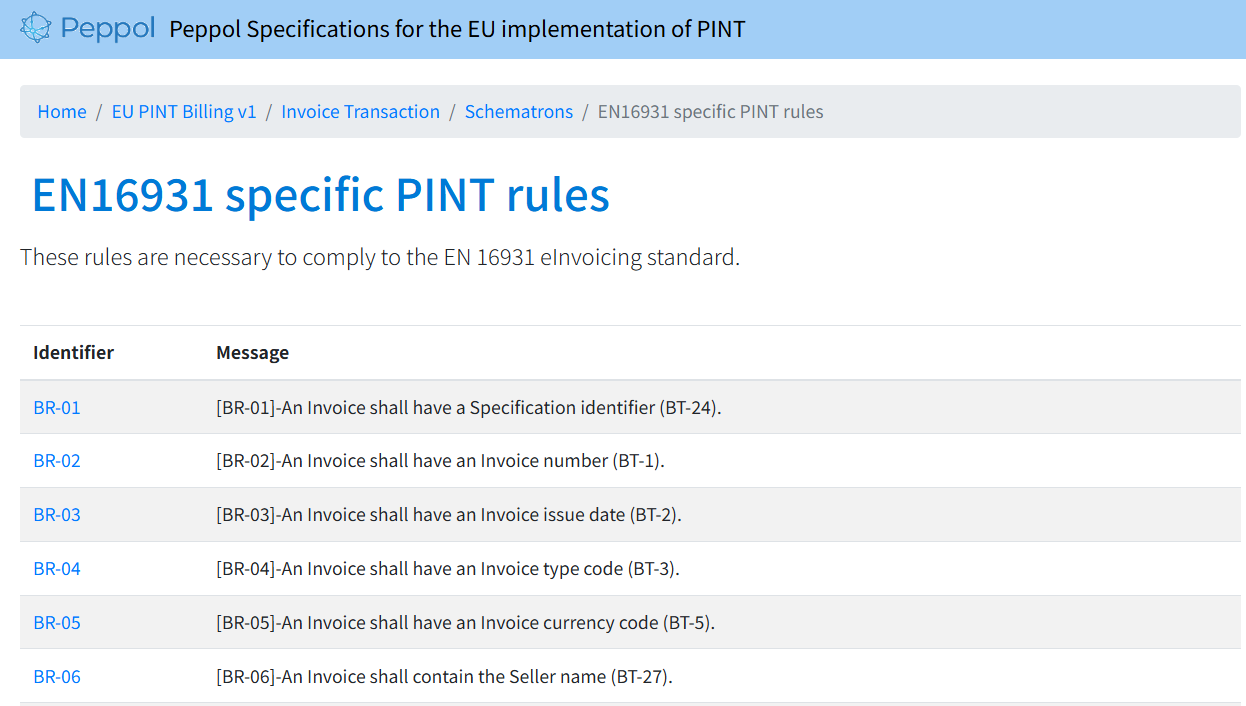

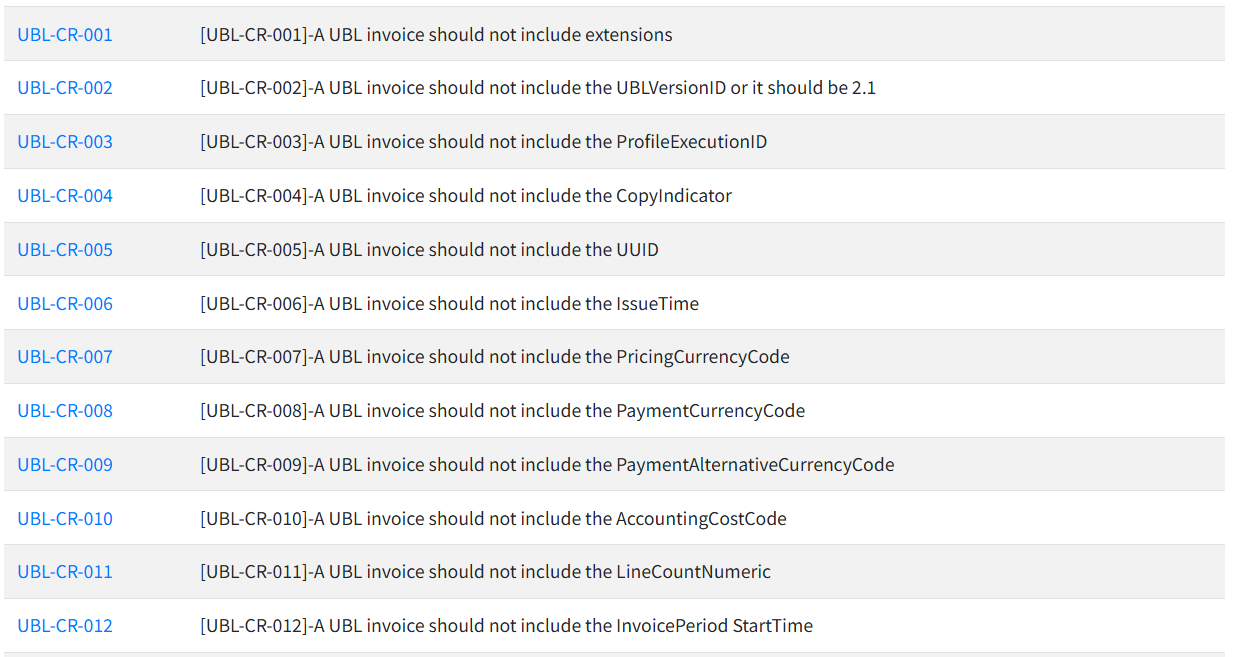

10.1.2. PINT-EUが提供する検証ルール

PINT-EUもPINTのEN 16931に対応する国別の拡張として定義されるので、Peppol 3.0 BIS Billing の2種類のスキーマトロンファイルは、次のように3種類に分けて提供されます。

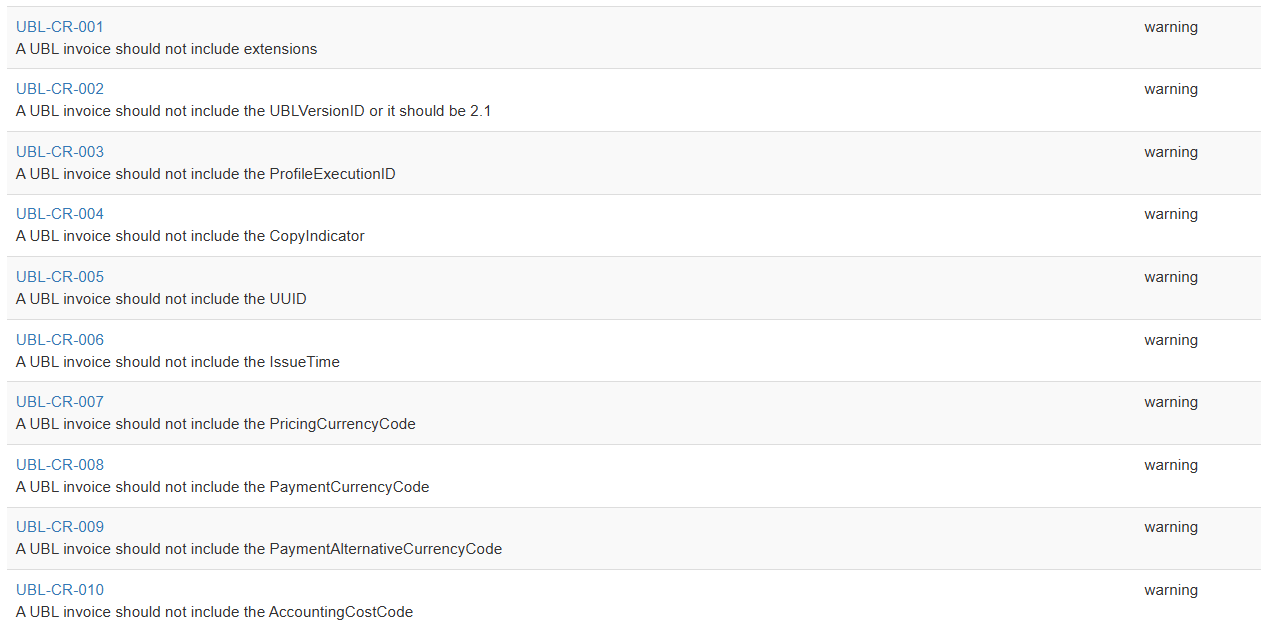

EN16931 specific PINT rules として、EN16931 model bound to UBL に相当する基本-Basic-ルールのスキーマトロン(PINT-EN16931-aligned-rules.sch)が提供されています。

基本-Basic-ルール

https://test-docs.peppol.eu/pint/pint-eu/pint-eu/trn-creditnote/rule/PINT-EN16931-aligned-rules/

[UBL-CR-nnn]-A UBL invoice should not include the … が、基本-Basic-ルールです。

ペポルBISルールRules for Peppol BIS 3.0 Billing は、共通-Shared-ルール(PINT-UBL-validation-preprocessed.sch)と国/地域別の拡張-Aligned-ルール(PINT-jurisdiction-aligned-rules.sch)の2つのスキーマトロンに分けて提供されています。

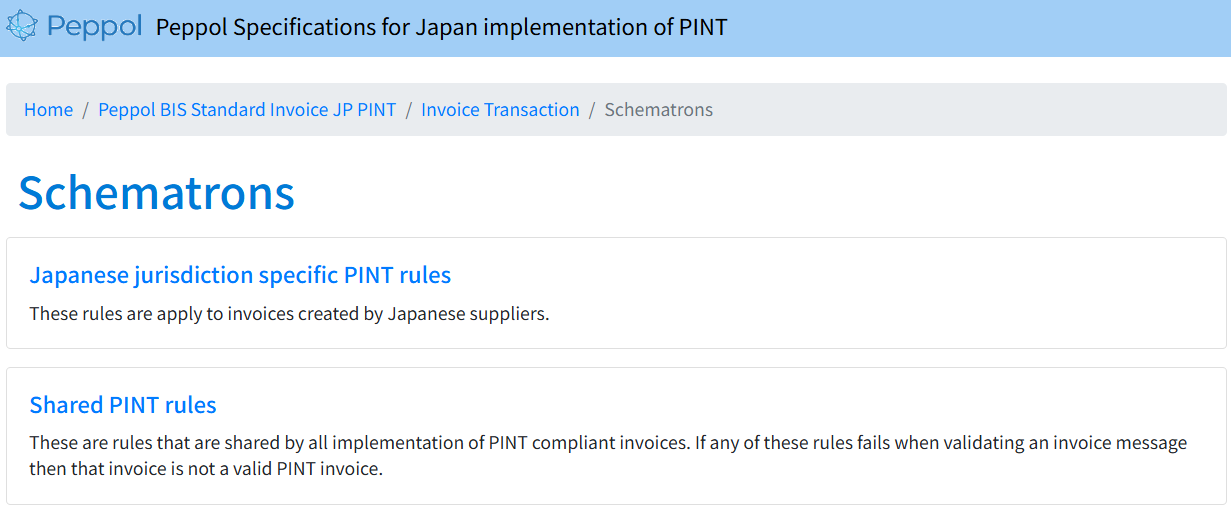

10.1.3. JP PINT構成

現在、JP PINTで提供されているスキーマトロンは次の2つです:

-

共通-Shared-ルール:Shared PINT Rules (PINT-UBL-validation-preprocessed.sch):共通-Shared-ルール(EN 16931に準拠) -

国/地域別の拡張-Aligned-ルール:Japanese jurisdiction specific PINT rules (PINT-jurisdiction-aligned-rules.sch)

注:基本-Basic-ルール`EN16931 specific PINT rules (PINT-EN16931-aligned-rules.sch)`に対応する`Japanese jurisdiction specific PINT rules (PINT-EN16931-aligned-rules.sch)`は提供されていません。

この構成では、以下のような課題が発生します。

10.2. JP PINTにおけるCIUS未定義要素と基本-Basic-ルールの課題

ペポル ネットワークで使用される電子インボイスは、CIUS(Core Invoice Usage Specification)に基づき、スキーマトロンによる構文・要件チェックを受けることで、互換性と整合性が担保されます。

PINT EUでは、CIUSに定義されていないUBL要素の使用を警告する `基本-Basic-ルール:PINT-EN16931-aligned-rules.sch`が提供されており、正しい仕様に準拠した文書の送信が可能です。

2022年当時、JP PINT導入に際しても「PINTとして基本-Basic-ルールを提供すべきである」と提言していましたが、OpenPeppol側からは次のような回答がでした。

BIS Billing 3.0 では基本-Basic-ルールを提供していたが、PINTでは提供しない方針である。

PINTでは、導入地域に応じた Aligned 拡張の自由度を認めているため、共通の基本-Basic-ルールを維持することが困難であるという理由でした。確かに、この理由は理解できる面もあります。

しかしながら、EUのようにCIUS未定義要素の検出を行う「国/地域別の拡張に対応した基本-Basic-ルール」の検討は、ペポルオーソリティ(PA)とEIPAの共同検討チームにおいても必要だったと考えます。

JP PINTではこの基本-Basic-ルールに相当するスキーマトロンが提供されておらず、次のような問題が生じています。

10.3. JP PINTにおけるPINT準拠責任の所在と検証体制の課題

ペポル ネットワークでは、電子インボイスのPINT準拠(Compliance to PINT)は、次のような責任分担のもとに成立しています。

10.3.1. 準拠責任の構造

| 役割 | 準拠責任 | 補足 |

|---|---|---|

|

C1(売り手) |

|

スキーマトロンによる事前検証が前提 |

|

C2(送信アクセスポイント) |

Peppolサービスプロバイダ契約に従い文書を送信 |

内容の妥当性には責任を負わない |

|

C3(受信アクセスポイント) |

Peppol契約に基づき文書を転送 |

スキーマトロン検証は必須でない(実施は任意) |

|

C4(買い手) |

登録済み受信Capabilityに基づき文書を処理 |

|

10.3.2. JP PINTにおける問題点

JP PINTでは、PINT EUで提供されている `基本-Basic-ルール:PINT-EN16931-aligned-rules.sch`に相当する CIUS未定義要素の使用検出ルールが未整備です。

このため:

-

CIUSに定義されていないUBL要素が含まれていても スキーマトロンでは検出不可

-

JP PINTが禁止している例(例:

/Invoice/cac:InvoiceLine/cac:TaxTotal/cbc:TaxAmount)も未検出 -

C1が準拠責任を負うにもかかわらず、準拠性を確認する手段が不十分

-

結果として、責任がC1へ一方的に偏重する不健全な構造

10.3.3. 想定されるリスク

-

C1が気付かずに未定義要素を送信 → C3やC4で処理エラー

-

C2/C3が受信時に警告ログや受け渡し拒否 → トラブルシュートが発生

-

CIUS改訂時に既存実装に影響 → 保守コスト増加

10.3.4. C2の責務と限界

-

C2はSMP/SMLを用いてC3の受信Capabilityを確認し、スキーマトロンを適用する責務を持つ

-

しかし、PA提供のスキーマトロンにCIUS未定義要素チェックがなければ、それ以上の検証責務はない

-

処理エラーがC4で発生しても、C2の責任とはできない

10.3.5. 現状の代替と限界

一部のC2/C3は 基本-Basic-ルール:CEN-EN16931-UBL.sch を併用し、未定義要素の検出を行っているかもしれませんが:

-

JP PINTの国/地域別の拡張に対応しておらず、誤検出または見逃しが発生

-

民間事業者による独自調整が必要 → 技術的・運用的負担が過大

-

本来は デジ庁ペポルオーソリティ(PA)が公式に整備・配布すべき責務

10.3.6. EUでの整備状況

PINT EUでは次のような整備が行われています:

-

PINT-EN16931-aligned-rules.schにより、CIUS未定義要素をwarningまたはerrorとして検出 -

C1が送信前に準拠性を検証可能 → 責任分離が成立

-

C2/C3は中立的な通信者として明確に位置づけ

10.3.7. 提言:デジ庁ペポルオーソリティ(PA)によるルール整備の必要性

JP PINTでも、次のような整備が不可欠です:

-

JP PINTの日本向けの拡張を考慮した

基本-Basic-ルール:PINT-EN16931-aligned-rules.schをPAが策定・提供する。 -

EU版スキーマトロンをベースに、

-

明示的に許容された要素を除外

-

それ以外の未定義UBL要素は

warningまたはerrorにて検出

-

-

デジ庁ペポルオーソリティ(PA)が公式に提供・バージョン管理し、C2/C3が共通に使用できる体制を構築

10.3.8. 結論

JP PINTにおける CIUS準拠性の基本-Basic-ルールの不備は、C1の責任偏重とネットワーク全体の不整合を招きます。

デジ庁ペポルオーソリティ(PA)が基本-Basic-ルールのスキーマトロンを公式整備・提供することが、ペポルネットワークの信頼性・相互運用性向上の鍵です。

11. 追補 2:スキーマトロンの検証ルール

次の検証ルールがどのスキーマトロンで定義されているか確認します。

| No. | チェック内容 | 主な確認観点 |

|---|---|---|

|

1 |

明細行金額と 計算値 = 単価 × 数量 – 返金 + 追加請求 の一致 |

計算ロジックの有無(各明細金額の計算)、誤差許容範囲、計算関数使用の有無 |

|

2 |

明細行合計金額の計算値と cbc:LineExtensionAmount の一致 |

計算ロジックの有無(各明細金額の加算)、誤差許容範囲、計算関数使用の有無 |

|

3 |

明細行における税額(cac:InvoiceLine/cac:TaxTotal/cbc:TaxAmount)に関係する検証の有無とその取扱 |

禁止、必須、または存在時の制限(例えば行レベル税額記載の可否) |

|

4 |

消費税率別の請求書税額小計と合計税額の提供 |

TaxTotal/TaxSubtotal の使用、TaxCategory/Percent による区分と TaxAmount の正当性 |

|

5 |

TaxAmount × 税率 = TaxAmount が正しく成立しているか |

TaxableAmount × Percent = TaxAmount が正しいかどうかのチェックと関数定義の有無 |

11.1. BIS Billing 3.0スキーマトロン検証ルール対応表

| No. | 対象 | 基本-Basic-ルール / ペポルBISルール の定義状況 |

|---|---|---|

|

1 |

明細行金額の計算 |

ペポルBISルール の PEPPOL-EN16931-R120 |

|

2 |

明細行合計金額とLineExtensionAmountの一致 |

※ 該当ルール無し |

|

3 |

明細行における税額記載の有無 |

基本-Basic-ルール の UBL-CR-561 |

|

4 |

消費税率別のTaxSubtotalとTaxTotalの整合性 |

ペポルBISルール の PEPPOL-EN16931-R053, R054 |

|

5 |

課税金額×税率=税額かの確認 |

※ 基本-Basic-ルール の BR-S-08:下記の標準税率の例を参照 |

11.1.1. 【BR-S-08】標準税率(Standard rate)VATの課税対象額の基本的な計算方法

BR-S-08: 標準税率の明細行の請求金額の計算検証

このルールは、VATカテゴリーが「S(Standard rated)」である場合に、以下の算出式により TaxableAmount(課税対象額)が正しく計算されていることを要求します。

検証対象

-

TaxSubtotal要素内のcbc:TaxableAmount -

TaxCategoryのcbc:ID = 'S'(Standard rated) -

TaxSchemeのcbc:ID = 'VAT'

基本計算式

以下の合計値が TaxableAmount に一致しているかを検証します。

| 項目 | 説明 |

|---|---|

|

1. 明細行小計合計 |

InvoiceLine の |

|

2. 文書レベル加算合計 |

Charge ( |

|

3. 文書レベル値引合計 |

Allowance ( |

|

計算式 |

明細行小計合計 + 文書レベル加算合計 − 文書レベル値引合計 |

この合計値が cbc:TaxableAmount に±1ユニット未満の誤差範囲で一致していなければなりません。

備考

-

加算・値引の金額を除く基本構成では、明細行金額(LineExtensionAmount)の合計が課税対象額となります。

-

本ルールは、各異なる税率(cbc:Percent)ごとに個別に適用されます。

11.2. PINT EUスキーマトロン検証ルール対応表

| No. | 対象 | 基本-Basic-ルール / PINT EUルール の定義状況 |

|---|---|---|

|

1 |

明細行金額の計算(数量 × 単価) |

PEPPOL-EN16931-R120 (国/地域別の拡張-Aligned-ルール) 以下に詳細解説を記載 |

|

2 |

明細行合計金額(ibt-106)の検算 |

ibr-co-10(共通-Shared-ルール) |

|

3 |

明細行における税額記載の有無 |

UBL-CR-561(基本-Basic-ルール) |

|

4 |

消費税率別のTaxSubtotalとTaxTotalの整合性 |

ibr-co-13 & ibr-co-14(共通-Shared-ルール) |

|

5 |

課税金額×税率=税額かの確認 |

BR-S-08(基本-Basic-ルール) |

11.2.1. 国/地域別の拡張-Aligned-ルール[PEPPOL-EN16931-R120] 明細行金額(Line Extension Amount)の検算ルール

| 項目 | 内容 |

|---|---|

|

ルールID |

PEPPOL-EN16931-R120 |

|

重要度 |

致命的(flag=”fatal”) |

|

対象 |

cac:InvoiceLine または cac:CreditNoteLine |

|

目的 |

各明細行の小計金額(cbc:LineExtensionAmount)が、以下の式で計算される期待値と 誤差±0.02以内 で一致することを検証する。 |

|

使用変数 |

quantity: |

|

期待される計算式(概念) |

LineExtensionAmount ≒ quantity × (priceAmount ÷ baseQuantity) + chargesTotal − allowancesTotal |

|

検証ロジック |

u:slack($lineExtensionAmount, ($quantity * ($priceAmount div $baseQuantity)) + $chargesTotal – $allowancesTotal, 0.02) |

|

備考 |

u:slack() は、誤差許容関数であり、SchXslt拡張として定義されていることが多い。 |

|

違反時のエラーメッセージ(例) |

Invoice line net amount MUST equal (Invoiced quantity * (Item net price/item price base quantity) + Sum of invoice line charge amount – sum of invoice line allowance amount |

11.2.2. 基本-Basic-ルール[BR-S-01] 標準税率(Standard rated)の使用に関する整合性チェック

| 項目 | 内容 |

|---|---|

|

ルールID |

BR-S-01 |

|

重要度 |

致命的( |

|

検証対象 |

請求書内に「標準税率(S: Standard rated)」が使用されている場合、 |

|

検証内容 |

次の条件のいずれかを満たす必要があります: |

|

該当BTコード |

* |

|

目的 |

「標準税率」で課税されている明細・値引・課金が存在する場合、必ずVAT分類の内訳(BG-23)にも「標準税率」が含まれていなければならない。整合しない場合は、集計と明細での不一致となり、税額計算の根拠に不備があることになる。 |

|

備考 |

このルールは、明細とTaxTotalが連動していることを保証し、明細の税カテゴリがVAT Breakdownと一致することを強制します。 |

11.2.3. 共通-Shared-ルール[ibr-co-13]税抜合計金額(TaxExclusiveAmount)の整合性チェック

| 項目 | 内容 |

|---|---|

|

ルールID |

|

|

重要度 |

致命的( |

|

目的 |

請求書の |

|

検証式の分岐 |

ルールは以下の条件分岐で構成される: |

|

計算式(簡易) |

以下は概念式です(小数第2位で四捨五入): |

|

該当BTコード |

ibt-109:TaxExclusiveAmount |

|

目的 |

税抜合計金額が、明細金額合計(ibt-131)を基準として、文書レベルの課金・値引を反映して正しく計算されていることを検証する。 |

11.2.4. 共通-Shared-ルール[ibr-co-14]税額合計の整合性チェック:

| 項目 | 内容 |

|---|---|

|

ルールID |

|

|

重要度 |

致命的( |

|

対象要素 |

|

|

検証内容 |

請求書または貸方票全体の`税額合計(cbc:TaxAmount)`が、明細的に分類された`各税分類小計(cac:TaxSubtotal/cbc:TaxAmount)`の合計と一致することを検証。 |

|

計算方法 |

|

|

該当BTコード |

* |

|

目的 |

請求書全体に記載された税額が、すべての税率ごとの小計の合計と一致することを確認し、整合性と信頼性を担保する。 |

|

備考 |

|

11.2.5. 基本-Basic-ルール[BR-CO-17]VAT 税額 (TaxAmount) の計算ルール

概要

本ルールは、VAT税額(BT-117)が、次の計算式に基づいて正しく算出されていることを検証します:

TaxAmount = TaxableAmount × (Rate ÷ 100)

この計算結果は「小数第3位を四捨五入して小数第2位まで」とし、誤差±1(1最小通貨単位以内)に収まっていることを許容します。

検証対象項目

| 項目 | 説明 |

|---|---|

|

|

課税対象額(BT-116) |

|

|

VAT率(BT-119) |

|

|

VAT税額(BT-117) |

判定条件

| 状況 | 判定条件 |

|---|---|

|

税率が0 |

税額も0であること |

|

税率が非0 |

税額 = 課税対象額 × 税率 / 100(±1誤差以内) |

|

税率未指定 |

税額 = 0 |

計算例

例1:標準税率10%、課税対象額が ¥12,000 の場合:

税額 = 12,000 × 10 / 100 = 1,200.00

→ cbc:TaxAmount は 1,200.00 であるべき

例2:免税(税率0%)の場合:

税率 = 0 → 税額も 0

小数処理の注意

-

計算結果は「小数第3位を四捨五入して小数第2位まで」に丸める必要があります。

-

例:税額 1,234.567 → 1,234.57

-

検証ではこの丸め済み値との比較で±1(例:1,234 または 1,236)は誤差として許容されます。

備考

-

このルールは、VAT以外(例:関税やその他の税)には適用されません。

-

TaxCategory要素内のTaxScheme/cbc:IDが `VAT’ に該当するものが対象です。

11.3. JP PINTスキーマトロン検証ルール対応表

| No. | 対象 | 基本-Basic-ルール / PINT EUルール の定義状況 |

|---|---|---|

|

1 |

明細行金額の計算(数量 × 単価) |

基本-Basic-ルールが定義されていないので未定義 |

|

2 |

明細行合計金額(ibt-106)の検算 |

ibr-co-10(共通-Shared-ルール)PINT EUと同じ |

|

3 |

明細行における税額記載の有無 |

基本-Basic-ルールが定義されていないので未定義 |

|

4 |

消費税率別のTaxSubtotalとTaxTotalの整合性 |

ibr-co-13 & ibr-co-14(共通-Shared-ルール) PINT EUと同じ |

|

5 |

課税金額×税率=税額かの確認 |

BR-S-08はEUの拡張だが日本向けの拡張-Aligned-ルールとしてaligned-ibrp-051-jpで税率ごとの税額計算金額を検証している。 |

11.3.1. aligned-ibrp-051-jp による税額検証ロジック

このルールは、TaxSubtotal における税額 (cbc:TaxAmount) が、課税対象額 (cbc:TaxableAmount) と税率 (cbc:Percent) に基づく計算結果と整合しているかをチェックするものです。

| 対象項目 | 検証ロジックの説明 |

|---|---|

|

課税対象(cbc:ID ≠ ‘O’) |

税率 (cbc:Percent) が指定されており、かつ 0% でない場合、以下の式で算出される値の範囲内に cbc:TaxAmount があることを確認: |

|

非課税・免税対象(cbc:ID = ‘O’) |

税率 (cbc:Percent) は未指定でなければならず、税額も必ず 0 であることを確認します。 |

このルールでは、税率や金額の小数誤差を吸収するために floor および ceiling 関数を使って範囲内の値を許容しています。また、文字列処理では normalize-space() や upper-case() によって表記揺れを排除し、精密な比較が可能になっています。

12. 参考:スキーマトロンファイル

12.1. Peppol BIS Billing 3.0 スキーマトロン

-

基本-Basic-ルール: EN16931 model bound to UBL (CEN-EN16931-UBL.sch)

<?xml version="1.0" encoding="UTF-8"?>

<!--

Licensed under European Union Public Licence (EUPL) version 1.2.

-->

<!--Schematron version 1.3.14.1 - Last update: 2025-04-22--><schema xmlns="http://purl.oclc.org/dsdl/schematron" queryBinding="xslt2">

<title>EN16931 model bound to UBL</title>

<ns prefix="ext" uri="urn:oasis:names:specification:ubl:schema:xsd:CommonExtensionComponents-2" />

<ns prefix="cbc" uri="urn:oasis:names:specification:ubl:schema:xsd:CommonBasicComponents-2" />

<ns prefix="cac" uri="urn:oasis:names:specification:ubl:schema:xsd:CommonAggregateComponents-2" />

<ns prefix="qdt" uri="urn:oasis:names:specification:ubl:schema:xsd:QualifiedDataTypes-2" />

<ns prefix="udt" uri="urn:oasis:names:specification:ubl:schema:xsd:UnqualifiedDataTypes-2" />

<ns prefix="cn" uri="urn:oasis:names:specification:ubl:schema:xsd:CreditNote-2" />

<ns prefix="ubl" uri="urn:oasis:names:specification:ubl:schema:xsd:Invoice-2" />

<ns prefix="xs" uri="http://www.w3.org/2001/XMLSchema" />

<phase id="EN16931model_phase">

<active pattern="UBL-model" />

</phase>

<phase id="codelist_phase">

<active pattern="Codesmodel" />

</phase>

<pattern id="UBL-model">

<rule context="cac:AdditionalDocumentReference">

<assert id="BR-52" flag="fatal" test="normalize-space(cbc:ID) != ''">[BR-52]-Each Additional supporting document (BG-24) shall contain a Supporting document reference (BT-122).</assert>

</rule>

<rule context="/ubl:Invoice/cac:LegalMonetaryTotal/cbc:PayableAmount">

<assert id="BR-CO-25" flag="fatal" test="((. > 0) and (exists(//cbc:DueDate) or exists(//cac:PaymentTerms/cbc:Note))) or (. <= 0)">[BR-CO-25]-In case the Amount due for payment (BT-115) is positive, either the Payment due date (BT-9) or the Payment terms (BT-20) shall be present.</assert>

</rule>

<rule context="cac:AccountingCustomerParty/cac:Party/cbc:EndpointID">

<assert id="BR-63" flag="fatal" test="exists(@schemeID)">[BR-63]-The Buyer electronic address (BT-49) shall have a Scheme identifier.</assert>

</rule>

<rule context="cac:AccountingCustomerParty/cac:Party/cac:PostalAddress">

<assert id="BR-11" flag="fatal" test="normalize-space(cac:Country/cbc:IdentificationCode) != ''">[BR-11]-The Buyer postal address shall contain a Buyer country code (BT-55).</assert>

</rule>

<rule context="cac:PaymentMeans/cac:CardAccount/cbc:PrimaryAccountNumberID">

<assert id="BR-51" flag="warning" test="string-length(normalize-space(.))<=10">[BR-51]-In accordance with card payments security standards an invoice should never include a full card primary account number (BT-87). At the moment PCI Security Standards Council has defined that the first 6 digits and last 4 digits are the maximum number of digits to be shown.</assert>

</rule>

<rule context="cac:Delivery/cac:DeliveryLocation/cac:Address">

<assert id="BR-57" flag="fatal" test="exists(cac:Country/cbc:IdentificationCode)">[BR-57]-Each Deliver to address (BG-15) shall contain a Deliver to country code (BT-80).</assert>

</rule>

<rule context="/ubl:Invoice/cac:AllowanceCharge[cbc:ChargeIndicator = false()] | /cn:CreditNote/cac:AllowanceCharge[cbc:ChargeIndicator = false()]">

<assert id="BR-31" flag="fatal" test="exists(cbc:Amount)">[BR-31]-Each Document level allowance (BG-20) shall have a Document level allowance amount (BT-92).</assert>

<assert id="BR-32" flag="fatal" test="exists(cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID)">[BR-32]-Each Document level allowance (BG-20) shall have a Document level allowance VAT category code (BT-95).</assert>

<assert id="BR-33" flag="fatal" test="exists(cbc:AllowanceChargeReason) or exists(cbc:AllowanceChargeReasonCode)">[BR-33]-Each Document level allowance (BG-20) shall have a Document level allowance reason (BT-97) or a Document level allowance reason code (BT-98).</assert>

<assert id="BR-CO-05" flag="fatal" test="true()">[BR-CO-05]-Document level allowance reason code (BT-98) and Document level allowance reason (BT-97) shall indicate the same type of allowance.</assert>

<assert id="BR-CO-21" flag="fatal" test="exists(cbc:AllowanceChargeReason) or exists(cbc:AllowanceChargeReasonCode)">[BR-CO-21]-Each Document level allowance (BG-20) shall contain a Document level allowance reason (BT-97) or a Document level allowance reason code (BT-98), or both.</assert>

<assert id="BR-DEC-01" flag="fatal" test="string-length(substring-after(cbc:Amount,'.'))<=2">[BR-DEC-01]-The allowed maximum number of decimals for the Document level allowance amount (BT-92) is 2.</assert>

<assert id="BR-DEC-02" flag="fatal" test="string-length(substring-after(cbc:BaseAmount,'.'))<=2">[BR-DEC-02]-The allowed maximum number of decimals for the Document level allowance base amount (BT-93) is 2.</assert>

</rule>

<rule context="/ubl:Invoice/cac:AllowanceCharge[cbc:ChargeIndicator = true()] | /cn:CreditNote/cac:AllowanceCharge[cbc:ChargeIndicator = true()]">

<assert id="BR-36" flag="fatal" test="exists(cbc:Amount)">[BR-36]-Each Document level charge (BG-21) shall have a Document level charge amount (BT-99).</assert>

<assert id="BR-37" flag="fatal" test="exists(cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID)">[BR-37]-Each Document level charge (BG-21) shall have a Document level charge VAT category code (BT-102).</assert>

<assert id="BR-38" flag="fatal" test="exists(cbc:AllowanceChargeReason) or exists(cbc:AllowanceChargeReasonCode)">[BR-38]-Each Document level charge (BG-21) shall have a Document level charge reason (BT-104) or a Document level charge reason code (BT-105).</assert>

<assert id="BR-CO-06" flag="fatal" test="true()">[BR-CO-06]-Document level charge reason code (BT-105) and Document level charge reason (BT-104) shall indicate the same type of charge.</assert>

<assert id="BR-CO-22" flag="fatal" test="exists(cbc:AllowanceChargeReason) or exists(cbc:AllowanceChargeReasonCode)">[BR-CO-22]-Each Document level charge (BG-21) shall contain a Document level charge reason (BT-104) or a Document level charge reason code (BT-105), or both.</assert>

<assert id="BR-DEC-05" flag="fatal" test="string-length(substring-after(cbc:Amount,'.'))<=2">[BR-DEC-05]-The allowed maximum number of decimals for the Document level charge amount (BT-99) is 2.</assert>

<assert id="BR-DEC-06" flag="fatal" test="string-length(substring-after(cbc:BaseAmount,'.'))<=2">[BR-DEC-06]-The allowed maximum number of decimals for the Document level charge base amount (BT-100) is 2.</assert>

</rule>

<rule context="cac:LegalMonetaryTotal">

<assert id="BR-12" flag="fatal" test="exists(cbc:LineExtensionAmount)">[BR-12]-An Invoice shall have the Sum of Invoice line net amount (BT-106).</assert>

<assert id="BR-13" flag="fatal" test="exists(cbc:TaxExclusiveAmount)">[BR-13]-An Invoice shall have the Invoice total amount without VAT (BT-109).</assert>

<assert id="BR-14" flag="fatal" test="exists(cbc:TaxInclusiveAmount)">[BR-14]-An Invoice shall have the Invoice total amount with VAT (BT-112).</assert>

<assert id="BR-15" flag="fatal" test="exists(cbc:PayableAmount)">[BR-15]-An Invoice shall have the Amount due for payment (BT-115).</assert>

<assert id="BR-CO-10" flag="fatal" test="(xs:decimal(cbc:LineExtensionAmount) = xs:decimal(round(sum(//(cac:InvoiceLine|cac:CreditNoteLine)/xs:decimal(cbc:LineExtensionAmount)) * 10 * 10) div 100))">[BR-CO-10]-Sum of Invoice line net amount (BT-106) = Σ Invoice line net amount (BT-131).</assert>

<assert id="BR-CO-11" flag="fatal" test="xs:decimal(cbc:AllowanceTotalAmount) = (round(sum(../cac:AllowanceCharge[cbc:ChargeIndicator=false()]/xs:decimal(cbc:Amount)) * 10 * 10) div 100) or (not(cbc:AllowanceTotalAmount) and not(../cac:AllowanceCharge[cbc:ChargeIndicator=false()]))">[BR-CO-11]-Sum of allowances on document level (BT-107) = Σ Document level allowance amount (BT-92).</assert>

<assert id="BR-CO-12" flag="fatal" test="xs:decimal(cbc:ChargeTotalAmount) = (round(sum(../cac:AllowanceCharge[cbc:ChargeIndicator=true()]/xs:decimal(cbc:Amount)) * 10 * 10) div 100) or (not(cbc:ChargeTotalAmount) and not(../cac:AllowanceCharge[cbc:ChargeIndicator=true()]))">[BR-CO-12]-Sum of charges on document level (BT-108) = Σ Document level charge amount (BT-99).</assert>

<assert id="BR-CO-13" flag="fatal" test="((cbc:ChargeTotalAmount) and (cbc:AllowanceTotalAmount) and (xs:decimal(cbc:TaxExclusiveAmount) = round((xs:decimal(cbc:LineExtensionAmount) + xs:decimal(cbc:ChargeTotalAmount) - xs:decimal(cbc:AllowanceTotalAmount)) * 10 * 10) div 100 )) or (not(cbc:ChargeTotalAmount) and (cbc:AllowanceTotalAmount) and (xs:decimal(cbc:TaxExclusiveAmount) = round((xs:decimal(cbc:LineExtensionAmount) - xs:decimal(cbc:AllowanceTotalAmount)) * 10 * 10 ) div 100)) or ((cbc:ChargeTotalAmount) and not(cbc:AllowanceTotalAmount) and (xs:decimal(cbc:TaxExclusiveAmount) = round((xs:decimal(cbc:LineExtensionAmount) + xs:decimal(cbc:ChargeTotalAmount)) * 10 * 10 ) div 100)) or (not(cbc:ChargeTotalAmount) and not(cbc:AllowanceTotalAmount) and (xs:decimal(cbc:TaxExclusiveAmount) = xs:decimal(cbc:LineExtensionAmount)))">[BR-CO-13]-Invoice total amount without VAT (BT-109) = Σ Invoice line net amount (BT-131) - Sum of allowances on document level (BT-107) + Sum of charges on document level (BT-108).</assert>

<assert id="BR-CO-16" flag="fatal" test="(exists(cbc:PrepaidAmount) and not(exists(cbc:PayableRoundingAmount)) and (xs:decimal(cbc:PayableAmount) = (round((xs:decimal(cbc:TaxInclusiveAmount) - xs:decimal(cbc:PrepaidAmount)) * 10 * 10) div 100))) or (not(exists(cbc:PrepaidAmount)) and not(exists(cbc:PayableRoundingAmount)) and xs:decimal(cbc:PayableAmount) = xs:decimal(cbc:TaxInclusiveAmount)) or (exists(cbc:PrepaidAmount) and exists(cbc:PayableRoundingAmount) and ((round((xs:decimal(cbc:PayableAmount) - xs:decimal(cbc:PayableRoundingAmount)) * 10 * 10) div 100) = (round((xs:decimal(cbc:TaxInclusiveAmount) - xs:decimal(cbc:PrepaidAmount)) * 10 * 10) div 100))) or (not(exists(cbc:PrepaidAmount)) and exists(cbc:PayableRoundingAmount) and ((round((xs:decimal(cbc:PayableAmount) - xs:decimal(cbc:PayableRoundingAmount)) * 10 * 10) div 100) = xs:decimal(cbc:TaxInclusiveAmount)))">[BR-CO-16]-Amount due for payment (BT-115) = Invoice total amount with VAT (BT-112) -Paid amount (BT-113) +Rounding amount (BT-114).</assert>

<assert id="BR-DEC-09" flag="fatal" test="string-length(substring-after(cbc:LineExtensionAmount,'.'))<=2">[BR-DEC-09]-The allowed maximum number of decimals for the Sum of Invoice line net amount (BT-106) is 2.</assert>

<assert id="BR-DEC-10" flag="fatal" test="string-length(substring-after(cbc:AllowanceTotalAmount,'.'))<=2">[BR-DEC-10]-The allowed maximum number of decimals for the Sum of allowanced on document level (BT-107) is 2.</assert>

<assert id="BR-DEC-11" flag="fatal" test="string-length(substring-after(cbc:ChargeTotalAmount,'.'))<=2">[BR-DEC-11]-The allowed maximum number of decimals for the Sum of charges on document level (BT-108) is 2.</assert>

<assert id="BR-DEC-12" flag="fatal" test="string-length(substring-after(cbc:TaxExclusiveAmount,'.'))<=2">[BR-DEC-12]-The allowed maximum number of decimals for the Invoice total amount without VAT (BT-109) is 2.</assert>

<assert id="BR-DEC-14" flag="fatal" test="string-length(substring-after(cbc:TaxInclusiveAmount,'.'))<=2">[BR-DEC-14]-The allowed maximum number of decimals for the Invoice total amount with VAT (BT-112) is 2.</assert>

<assert id="BR-DEC-16" flag="fatal" test="string-length(substring-after(cbc:PrepaidAmount,'.'))<=2">[BR-DEC-16]-The allowed maximum number of decimals for the Paid amount (BT-113) is 2.</assert>

<assert id="BR-DEC-17" flag="fatal" test="string-length(substring-after(cbc:PayableRoundingAmount,'.'))<=2">[BR-DEC-17]-The allowed maximum number of decimals for the Rounding amount (BT-114) is 2.</assert>

<assert id="BR-DEC-18" flag="fatal" test="string-length(substring-after(cbc:PayableAmount,'.'))<=2">[BR-DEC-18]-The allowed maximum number of decimals for the Amount due for payment (BT-115) is 2. </assert>

</rule>

<rule context="/ubl:Invoice | /cn:CreditNote">

<assert id="BR-01" flag="fatal" test="normalize-space(cbc:CustomizationID) != ''">[BR-01]-An Invoice shall have a Specification identifier (BT-24). </assert>

<assert id="BR-02" flag="fatal" test="normalize-space(cbc:ID) != ''">[BR-02]-An Invoice shall have an Invoice number (BT-1).</assert>

<assert id="BR-03" flag="fatal" test="normalize-space(cbc:IssueDate) != ''">[BR-03]-An Invoice shall have an Invoice issue date (BT-2).</assert>

<assert id="BR-04" flag="fatal" test="normalize-space(cbc:InvoiceTypeCode) != '' or normalize-space(cbc:CreditNoteTypeCode) !=''">[BR-04]-An Invoice shall have an Invoice type code (BT-3).</assert>

<assert id="BR-05" flag="fatal" test="normalize-space(cbc:DocumentCurrencyCode) != ''">[BR-05]-An Invoice shall have an Invoice currency code (BT-5).</assert>

<assert id="BR-06" flag="fatal" test="normalize-space(cac:AccountingSupplierParty/cac:Party/cac:PartyLegalEntity/cbc:RegistrationName) != ''">[BR-06]-An Invoice shall contain the Seller name (BT-27).</assert>

<assert id="BR-07" flag="fatal" test="normalize-space(cac:AccountingCustomerParty/cac:Party/cac:PartyLegalEntity/cbc:RegistrationName) != ''">[BR-07]-An Invoice shall contain the Buyer name (BT-44).</assert>

<assert id="BR-08" flag="fatal" test="exists(cac:AccountingSupplierParty/cac:Party/cac:PostalAddress)">[BR-08]-An Invoice shall contain the Seller postal address. </assert>

<assert id="BR-10" flag="fatal" test="exists(cac:AccountingCustomerParty/cac:Party/cac:PostalAddress)">[BR-10]-An Invoice shall contain the Buyer postal address (BG-8).</assert>

<assert id="BR-16" flag="fatal" test="exists(cac:InvoiceLine) or exists(cac:CreditNoteLine)">[BR-16]-An Invoice shall have at least one Invoice line (BG-25)</assert>

<assert id="BR-53" flag="fatal" test="every $taxcurrency in cbc:TaxCurrencyCode satisfies exists(//cac:TaxTotal/cbc:TaxAmount[@currencyID=$taxcurrency])">[BR-53]-If the VAT accounting currency code (BT-6) is present, then the Invoice total VAT amount in accounting currency (BT-111) shall be provided.</assert>

<assert id="BR-66" flag="fatal" test="count(cac:PaymentMeans/cac:CardAccount) <= 1">[BR-66]-An Invoice shall contain maximum one Payment Card account (BG-18).</assert>

<assert id="BR-67" flag="fatal" test="count(cac:PaymentMeans/cac:PaymentMandate) <= 1">[BR-67]-An Invoice shall contain maximum one Payment Mandate (BG-19).</assert>

<assert id="BR-AE-01" flag="fatal" test="((exists(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'AE']) or exists(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'AE'])) and (count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'AE']) = 1)) or (not(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'AE']) and not(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'AE']))">[BR-AE-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Reverse charge" shall contain in the VAT Breakdown (BG-23) exactly one VAT category code (BT-118) equal with "VAT reverse charge".</assert>

<assert id="BR-AE-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'AE'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID)) and (exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyLegalEntity/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'AE'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AE-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "Reverse charge" shall contain the Seller VAT Identifier (BT-31), the Seller Tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63) and the Buyer VAT identifier (BT-48) and/or the Buyer legal registration identifier (BT-47).</assert>

<assert id="BR-AE-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'AE'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID)) and (exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyLegalEntity/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'AE'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AE-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Reverse charge" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63) and the Buyer VAT identifier (BT-48) and/or the Buyer legal registration identifier (BT-47).</assert>

<assert id="BR-AE-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'AE'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID)) and (exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyLegalEntity/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'AE'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AE-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "Reverse charge" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63) and the Buyer VAT identifier (BT-48) and/or the Buyer legal registration identifier (BT-47).</assert>

<assert id="BR-CO-03" flag="fatal" test="(exists(cbc:TaxPointDate) and not(cac:InvoicePeriod/cbc:DescriptionCode)) or (not(cbc:TaxPointDate) and exists(cac:InvoicePeriod/cbc:DescriptionCode)) or (not(cbc:TaxPointDate) and not(cac:InvoicePeriod/cbc:DescriptionCode))">[BR-CO-03]-Value added tax point date (BT-7) and Value added tax point date code (BT-8) are mutually exclusive.</assert>

<assert id="BR-CO-15" flag="fatal" test="every $Currency in cbc:DocumentCurrencyCode satisfies (count(cac:TaxTotal/xs:decimal(cbc:TaxAmount[@currencyID=$Currency])) eq 1) and (cac:LegalMonetaryTotal/xs:decimal(cbc:TaxInclusiveAmount) = round( (cac:LegalMonetaryTotal/xs:decimal(cbc:TaxExclusiveAmount) + cac:TaxTotal/xs:decimal(cbc:TaxAmount[@currencyID=$Currency])) * 10 * 10) div 100)">[BR-CO-15]-Invoice total amount with VAT (BT-112) = Invoice total amount without VAT (BT-109) + Invoice total VAT amount (BT-110).</assert>

<assert id="BR-CO-18" flag="fatal" test="exists(cac:TaxTotal/cac:TaxSubtotal)">[BR-CO-18]-An Invoice shall at least have one VAT breakdown group (BG-23).</assert>

<assert id="BR-DEC-13" flag="fatal" test="(//cac:TaxTotal/cbc:TaxAmount[@currencyID = cbc:DocumentCurrencyCode] and (string-length(substring-after(//cac:TaxTotal/cbc:TaxAmount[@currencyID = cbc:DocumentCurrencyCode],'.'))<=2)) or (not(//cac:TaxTotal/cbc:TaxAmount[@currencyID = cbc:DocumentCurrencyCode]))">[BR-DEC-13]-The allowed maximum number of decimals for the Invoice total VAT amount (BT-110) is 2.</assert>

<assert id="BR-DEC-15" flag="fatal" test="(//cac:TaxTotal/cbc:TaxAmount[@currencyID = cbc:TaxCurrencyCode] and (string-length(substring-after(//cac:TaxTotal/cbc:TaxAmount[@currencyID = cbc:TaxCurrencyCode],'.'))<=2)) or (not(//cac:TaxTotal/cbc:TaxAmount[@currencyID = cbc:TaxCurrencyCode]))">[BR-DEC-15]-The allowed maximum number of decimals for the Invoice total VAT amount in accounting currency (BT-111) is 2.</assert>

<assert id="BR-E-01" flag="fatal" test="((exists(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'E']) or exists(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'E'])) and (count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'E']) = 1)) or (not(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'E']) and not(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'E']))">[BR-E-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Exempt from VAT" shall contain exactly one VAT breakdown (BG-23) with the VAT category code (BT-118) equal to "Exempt from VAT".</assert>

<assert id="BR-E-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'E'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'E'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-E-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "Exempt from VAT" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-E-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='E'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='E'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-E-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Exempt from VAT" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-E-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='E'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='E'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-E-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "Exempt from VAT" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-G-01" flag="fatal" test="((exists(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'G']) or exists(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'G'])) and (count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'G']) = 1)) or (not(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'G']) and not(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'G']))">[BR-G-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Export outside the EU" shall contain in the VAT breakdown (BG-23) exactly one VAT category code (BT-118) equal with "Export outside the EU".</assert>

<assert id="BR-G-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'G'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'G'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-G-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "Export outside the EU" shall contain the Seller VAT Identifier (BT-31) or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-G-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='G']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='G'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-G-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Export outside the EU" shall contain the Seller VAT Identifier (BT-31) or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-G-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='G']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='G'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-G-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "Export outside the EU" shall contain the Seller VAT Identifier (BT-31) or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-IC-01" flag="fatal" test="((exists(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']) or exists(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K'])) and (count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']) = 1)) or (not(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']) and not(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']))">[BR-IC-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Intra-community supply" shall contain in the VAT breakdown (BG-23) exactly one VAT category code (BT-118) equal with "Intra-community supply".</assert>

<assert id="BR-IC-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'K'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID)) and (exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'K'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT'])">[BR-IC-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "Intra-community supply" shall contain the Seller VAT Identifier (BT-31) or the Seller tax representative VAT identifier (BT-63) and the Buyer VAT identifier (BT-48).</assert>

<assert id="BR-IC-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'K'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID)) and (exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'K'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-IC-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Intra-community supply" shall contain the Seller VAT Identifier (BT-31) or the Seller tax representative VAT identifier (BT-63) and the Buyer VAT identifier (BT-48).</assert>

<assert id="BR-IC-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'K'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID)) and (exists(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'K'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-IC-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "Intra-community supply" shall contain the Seller VAT Identifier (BT-31) or the Seller tax representative VAT identifier (BT-63) and the Buyer VAT identifier (BT-48).</assert>

<assert id="BR-IC-11" flag="fatal" test="(exists(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']) and (string-length(cac:Delivery/cbc:ActualDeliveryDate) > 1 or (cac:InvoicePeriod/*))) or (not(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']))">[BR-IC-11]-In an Invoice with a VAT breakdown (BG-23) where the VAT category code (BT-118) is "Intra-community supply" the Actual delivery date (BT-72) or the Invoicing period (BG-14) shall not be blank.</assert>

<assert id="BR-IC-12" flag="fatal" test="(exists(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']) and (string-length(cac:Delivery/cac:DeliveryLocation/cac:Address/cac:Country/cbc:IdentificationCode) >1)) or (not(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'K']))">[BR-IC-12]-In an Invoice with a VAT breakdown (BG-23) where the VAT category code (BT-118) is "Intra-community supply" the Deliver to country code (BT-80) shall not be blank.</assert>

<assert id="BR-AF-01" flag="fatal" test="((count(//cac:AllowanceCharge/cac:TaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) + count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT'])) > 0 and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cbc:ID = 'L']) > 0) or ((count(//cac:AllowanceCharge/cac:TaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) + count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT'])) = 0 and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) = 0)">[BR-AF-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "IGIC" shall contain in the VAT breakdown (BG-23) at least one VAT category code (BT-118) equal with "IGIC".</assert>

<assert id="BR-AF-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AF-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "IGIC" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-AF-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AF-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "IGIC" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-AF-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[cbc:ID='L'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AF-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "IGIC" shall contain the Seller VAT Identifier (BT-31), the Seller Tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-AG-01" flag="fatal" test="((count(//cac:AllowanceCharge/cac:TaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) + count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT'])) > 0 and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cbc:ID = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) > 0) or ((count(//cac:AllowanceCharge/cac:TaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) + count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT'])) = 0 and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) = 0)">[BR-AG-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "IPSI" shall contain in the VAT breakdown (BG-23) at least one VAT category code (BT-118) equal with "IPSI".</assert>

<assert id="BR-AG-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AG-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "IPSI" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-AG-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AG-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "IPSI" shall contain the Seller VAT Identifier (BT-31), the Seller Tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-AG-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='M'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-AG-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "IPSI" shall contain the Seller VAT Identifier (BT-31), the Seller Tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-O-01" flag="fatal" test="((exists(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) or exists(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O'])) and (count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) = 1)) or (not(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) and not(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']))">[BR-O-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Not subject to VAT" shall contain exactly one VAT breakdown group (BG-23) with the VAT category code (BT-118) equal to "Not subject to VAT".</assert>

<assert id="BR-O-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (not(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) and not(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) and not(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT'])">[BR-O-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "Not subject to VAT" shall not contain the Seller VAT identifier (BT-31), the Seller tax representative VAT identifier (BT-63) or the Buyer VAT identifier (BT-48).</assert>

<assert id="BR-O-03" flag="fatal" test="(exists((/ubl:Invoice|/cn:CreditNote)/cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (not(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) and not(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) and not(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists((/ubl:Invoice|/cn:CreditNote)/cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-O-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Not subject to VAT" shall not contain the Seller VAT identifier (BT-31), the Seller tax representative VAT identifier (BT-63) or the Buyer VAT identifier (BT-48).</assert>

<assert id="BR-O-04" flag="fatal" test="(exists((/ubl:Invoice|/cn:CreditNote)/cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (not(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) and not(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID) and not(//cac:AccountingCustomerParty/cac:Party/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists((/ubl:Invoice|/cn:CreditNote)/cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-O-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "Not subject to VAT" shall not contain the Seller VAT identifier (BT-31), the Seller tax representative VAT identifier (BT-63) or the Buyer VAT identifier (BT-48).</assert>

<assert id="BR-O-11" flag="fatal" test="(exists(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[normalize-space(cbc:ID) != 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) = 0) or not(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O'])">[BR-O-11]-An Invoice that contains a VAT breakdown group (BG-23) with a VAT category code (BT-118) "Not subject to VAT" shall not contain other VAT breakdown groups (BG-23).</assert>

<assert id="BR-O-12" flag="fatal" test="(exists(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) and count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) != 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) = 0) or not(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O'])">[BR-O-12]-An Invoice that contains a VAT breakdown group (BG-23) with a VAT category code (BT-118) "Not subject to VAT" shall not contain an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is not "Not subject to VAT".</assert>

<assert id="BR-O-13" flag="fatal" test="(exists(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) and count(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) != 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) = 0) or not(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O'])">[BR-O-13]-An Invoice that contains a VAT breakdown group (BG-23) with a VAT category code (BT-118) "Not subject to VAT" shall not contain Document level allowances (BG-20) where Document level allowance VAT category code (BT-95) is not "Not subject to VAT".</assert>

<assert id="BR-O-14" flag="fatal" test="(exists(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O']) and count(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) != 'O'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) = 0) or not(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'O'])">[BR-O-14]-An Invoice that contains a VAT breakdown group (BG-23) with a VAT category code (BT-118) "Not subject to VAT" shall not contain Document level charges (BG-21) where Document level charge VAT category code (BT-102) is not "Not subject to VAT".</assert>

<assert id="BR-S-01" flag="fatal" test="((count(//cac:AllowanceCharge/cac:TaxCategory[normalize-space(cbc:ID) = 'S']) + count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'S'])) > 0 and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[normalize-space(cbc:ID) = 'S']) > 0) or ((count(//cac:AllowanceCharge/cac:TaxCategory[normalize-space(cbc:ID) = 'S']) + count(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'S'])) = 0 and count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[normalize-space(cbc:ID) = 'S']) = 0)">[BR-S-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Standard rated" shall contain in the VAT breakdown (BG-23) at least one VAT category code (BT-118) equal with "Standard rated".</assert>

<assert id="BR-S-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'S'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'S']))">[BR-S-02]-An Invoice that contains an Invoice line (BG-25) where the Invoiced item VAT category code (BT-151) is "Standard rated" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-S-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='S'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='S'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-S-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Standard rated" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-S-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='S'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='S'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-S-04]-An Invoice that contains a Document level charge (BG-21) where the Document level charge VAT category code (BT-102) is "Standard rated" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-Z-01" flag="fatal" test="((exists(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'Z']) or exists(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'Z'])) and (count(cac:TaxTotal/cac:TaxSubtotal/cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'Z']) = 1)) or (not(//cac:TaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'Z']) and not(//cac:ClassifiedTaxCategory[cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']/cbc:ID[normalize-space(.) = 'Z']))">[BR-Z-01]-An Invoice that contains an Invoice line (BG-25), a Document level allowance (BG-20) or a Document level charge (BG-21) where the VAT category code (BT-151, BT-95 or BT-102) is "Zero rated" shall contain in the VAT breakdown (BG-23) exactly one VAT category code (BT-118) equal with "Zero rated".</assert>

<assert id="BR-Z-02" flag="fatal" test="(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'Z'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:ClassifiedTaxCategory[normalize-space(cbc:ID) = 'Z'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-Z-02]-An Invoice that contains an Invoice line where the Invoiced item VAT category code (BT-151) is "Zero rated" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-Z-03" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID)='Z'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID) or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=false()]/cac:TaxCategory[normalize-space(cbc:ID) = 'Z'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-Z-03]-An Invoice that contains a Document level allowance (BG-20) where the Document level allowance VAT category code (BT-95) is "Zero rated" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-Z-04" flag="fatal" test="(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID)='Z'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']) and (exists(//cac:AccountingSupplierParty/cac:Party/cac:PartyTaxScheme/cbc:CompanyID)or exists(//cac:TaxRepresentativeParty/cac:PartyTaxScheme[cac:TaxScheme/(normalize-space(upper-case(cbc:ID)) = 'VAT')]/cbc:CompanyID))) or not(exists(//cac:AllowanceCharge[cbc:ChargeIndicator=true()]/cac:TaxCategory[normalize-space(cbc:ID) = 'Z'][cac:TaxScheme/normalize-space(upper-case(cbc:ID))='VAT']))">[BR-Z-04]-An Invoice that contains a Document level charge where the Document level charge VAT category code (BT-102) is "Zero rated" shall contain the Seller VAT Identifier (BT-31), the Seller tax registration identifier (BT-32) and/or the Seller tax representative VAT identifier (BT-63).</assert>

<assert id="BR-B-01" flag="fatal" test="(not(//cbc:IdentificationCode != 'IT') and (//cac:TaxCategory/cbc:ID ='B' or //cac:ClassifiedTaxCategory/cbc:ID = 'B')) or (not(//cac:TaxCategory/cbc:ID ='B' or //cac:ClassifiedTaxCategory/cbc:ID = 'B'))">[BR-B-01]-An Invoice where the VAT category code (BT-151, BT-95 or BT-102) is “Split payment” shall be a domestic Italian invoice.</assert>